June in the Black Thanks to Mid-Week NatGas Forwards Bounce

The front of the natural gas forward curves pulled off a surprise gain of nearly 3 cents on average between April 21 and 27 despite a multitude of headwinds facing the market, according to NGI’s Forward Look.

NGI’s Patrick Rau, director of strategy and research, characterized the small gain as more of a technical correction, as the prompt-month contract has been in a gradual decline since the first week of April. “Prompt futures entered April extremely overbought, when looking at the slow stochastics figure, but the now front month June contract is noticeably oversold,” he said.

Last Wednesday brought about a significant rally as the Nymex May futures contract rolled off the board. In fact, each month for the remainder of 2017 gained anywhere from 8-10 cents as long-term bullish sentiment appeared to outweigh near-term bearish factors.

The Nymex May futures contract jumped about 10 cents that day to expire at $3.14, although some would argue that spike was not a complete surprise given the buying interest that was seen late in last Tuesday’s session. “It is worth noting that buying interest did materialize during the final 15 minutes of the regular session when prices bounced off of the $3.022 intraday low,” analysts at Houston-based Mobius Risk Group said.

Meanwhile, U.S. Lower 48 production remains soft at around 70-71 Bcf/d, while power burn and Mexican exports were strong during the week, coming in around 23 Bcf/d and 4.1 Bcf/d, respectively. “Over the long term, I see this is a fairly tight supply/demand balance,” analysts at NatGasWeather said.

Still, the rally was short-lived as Thursday’s storage report from the U.S. Energy Information Administration (EIA) brought the market back down to reality with another cut to the year-on-year surplus. The Nymex futures strip fell about 3 cents through the remainder of the year, with June settling at $3.24 on its first day in the prompt-month position.

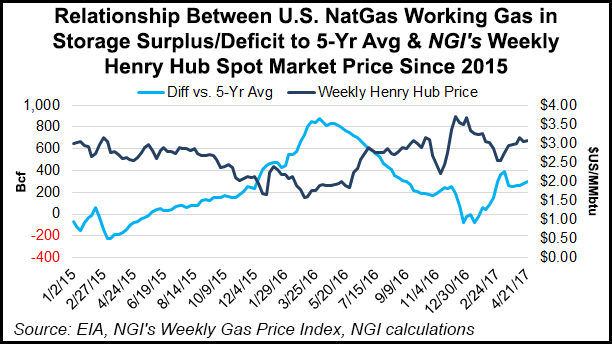

The EIA reported a 74 Bcf injection for the week ending April 21, in line with market expectations but above the 64 Bcf that was injected the same week last year and the 57 Bcf five-year average injection. Total inventories stood at 2,189 Bcf, 358 Bcf below year-ago levels but 299 Bcf above the five-year average of 1,890 Bcf.

“Just before the start of injection season, or more precisely in late March, there were many prognostications of an end-of-October storage level near 3.5 Tcf, and some as low as 3.1 Tcf. April to-date injections have caused concern for market bulls whose positions were pinned to such a path, since this would have required a flat to lower cumulative injection from April-October,” Mobius said Thursday.

Rau agreed short-term price movements historically have had a very high correlation to excess gas in storage. “I think there’s a bit of a tug of war going on as to where balances may be headed going into winter. A hot summer will obviously help keep storage balances lower, everything else being equal,” Rau said.

Absent that, relatively high gas prices could work to prevent as much coal-to-gas switching this summer as in past years, and production increases from the steady ramp in gas-focused rigs and increased drilling activity in the Permian and Eagle Ford basins should start to work its way into the fold fairly soon, he added.

In fact, Kinder Morgan CEO Steven Kean noted on KMI’s 1Q17 earnings conference call that “we’re generally seeing a leveling off of [gathering] volumes in our key basins during the first quarter.”

On the flip side, there is another 1.3 Bcf/d of additional liquefied natural gas export capacity expected to come online during the fourth quarter 2017 in the form of the fourth train at Sabine Pass and first exports from Cove Point, Rau said.

“If those don’t come online until Dec. 31, and operate at 75% of capacity between January and March 2018, that’s another 70 Bcf of gas of demand that could help draw down storage at a faster clip than this past winter. So storage may need to be a bit higher than historical levels going into November, so a lack of a hot summer or coal-to-gas switching this summer may not be as punitive on short-term gas prices as it has been in the past,” Rau said.

With weakness in the Nymex futures strip early in the week and again following the storage report, the June futures contract managed to eke out only a 4.7 increase from April 21 to 27. The July futures contract was up 5 cents during that time to $3.32, the balance of summer (July-October) futures strip was up 5 cents to $3.34 and the winter 2017-2018 futures strip was up 4 cents to $3.53.

Nationally, June forward prices rose about 3 cents during that time, as did July forward prices, while the balance of summer and the winter 2017-2018 strips each moved up an average 4 cents, Forward Look data shows.

It seems, however, that market bulls will have their work cut out for them in the near term as weather forecasts for the first 10 days of May indicate relatively neutral conditions across the Lower 48, thereby pressuring natural gas markets to the downside.

“Historically, early May is a low point for natural gas demand when temperatures are near normal. Regionally, the only significant deviations from normal are depicted along the West Coast (warmer than normal), and the extreme northern portion of the upper Midwest (colder than normal),” Mobius said.

Still, not all hope is lost that the decline in the storage surplus will soon plateau. Forecaster NatGasWeather said the coming pattern through mid-May should require just enough heating and cooling demand to result in weekly builds printing slightly lighter than five-year averages, beginning a slow and steady process of gradually reducing surpluses in supplies.

In fact, the weather forecaster said a major pattern shift will take place around May 4-5 as cool conditions pour across the east-central U.S., while warming sets up over the West. This will continue to drive stronger-than-normal national demand, as daytime temperatures over the Midwest and Northeast will only reach the 40s and 50s, well below normal for this time of year.

“With that said, it’s likely to take nearly a month to drop surpluses from current levels of +299 Bcf to +250 Bcf. Is that fast enough to satisfy the markets to keep June 2017 prices above $3.23, or will they get impatient surpluses aren’t declining quicker?” NatGasWeather said.

Forecasters at Bespoke Weather Services agreed tighter conditions will make for more supportive storage reports in the coming weeks. “Though estimates overnight turned a bit less bullish, the market remains tight, and it will be hard to see all that much of a pullback in the next couple of weeks,” Bespoke said Friday morning.

Indeed, the Nymex June futures contract traded in the black most of overnight Thursday and throughout Friday, ultimately settling at $3.276, up 3.7 cents on the day.

Bespoke attributed Friday’s strength both to some recovery following Thursday’s slide and to the upward trend in the cash market that brought Henry Hub prices to $3.07. “There remains a large cash-prompt spread which should keep too large a rally from occurring, but the buoyancy of cash prices should also keep prices from pulling back too much today,” Bespoke said.

Not all forward markets across the U.S. ended the week in the black. Several Northeast points experienced weakness for both the June and July packages, although some modest strength was seen in the balance of summer (July-October) period. Part of the weakness can be attributed to mild weather in the region, which has led to double-digit declines in regional cash markets. High temperatures have been and will continue to be in the 70s and 80s through the middle of the week.

But growing production in the region also appears to be at play in the forward market weakness seen this week. April production in the Northeast is on pace to set a monthly average of nearly 24 Bcf/d, a new record.

Indeed, the sharpest declines at the front of the forward curve were seen at Dominion, where June forward prices fell 6.8 cents between April 21 and 27 to reach $2.48, July forward prices dropped 4 cents to $2.56 and the balance of summer (July-October) inched up 2 cents to $2.60, according to Forward Look.

As mentioned a few weeks ago, the Dominion price point represents a combined price in the North and South zones. Both the Dominion North and Dominion South price points were recently added to NGI’s Forward Look product.

Meanwhile, points along the Texas Eastern Transmission pipeline also saw decreases at the front of the curve. At Texas Eastern M-2, 30 Receipt, June forward prices dropped 7.8 cents from April 21-27 to reach $2.51, July forward prices slipped 4 cents to $2.585 and the balance of summer (July-October) crept up 2 cents to $2.63, Forward Look data shows.

Cash prices at that location dropped nearly 20 cents during the same period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |