Markets | NGI All News Access | NGI Data

NatGas Futures Weaken Slightly Following EIA Storage Figures

Futures failed to take out the day’s highs or lows once the Energy Information Administration (EIA) reported a natural gas storage injection that was slightly greater than what the industry was expecting.

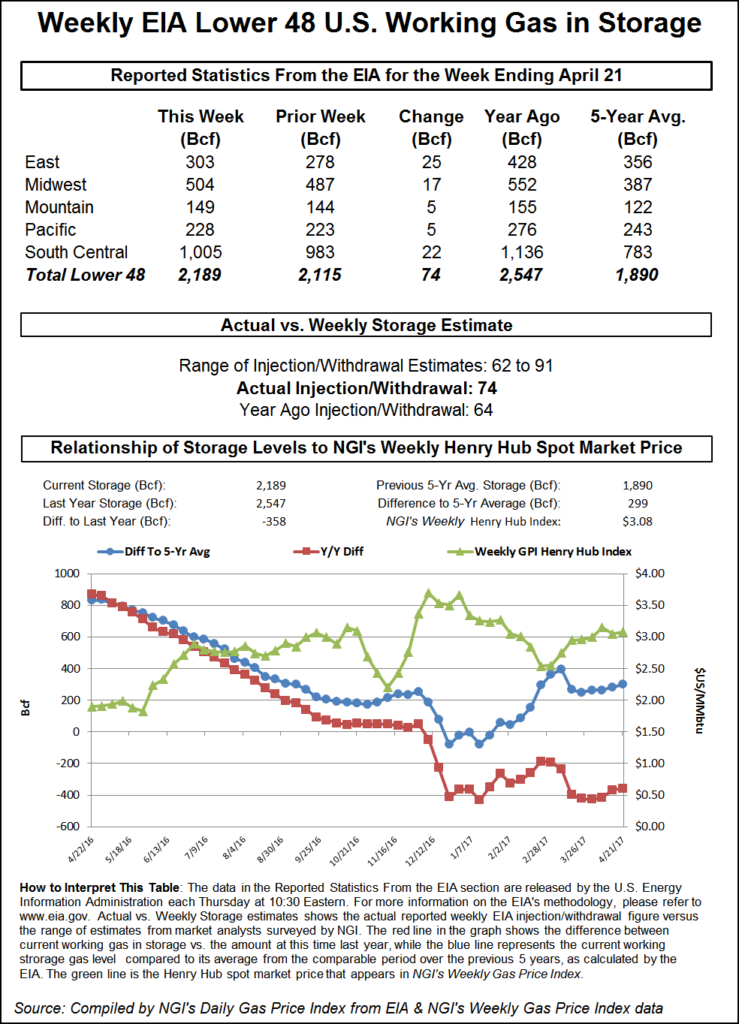

The EIA reported a storage injection of 74 Bcf, about 2 Bcf greater than consensus estimates, and prices curiously inched higher after the number was released. Once the number had made it across trading desks June futures rose to $3.245, and at 10:45 a.m. June was trading at $3.263, down 8-tenths of a cent from Wednesday’s settlement. The day’s high at that point was $3.266 and low was $3.207.

Before the number was released, Citi Futures Perspective predicted a build of 63 Bcf and Tradition Energy was expecting a 77 Bcf increase. A Reuters survey of 18 traders and analysts revealed an average 72 Bcf injection with a range of 62-91 Bcf.

In the same week last year, 64 Bcf was injected and the five-year pace is for a 57 Bcf build.

“The market didn’t move much and failed to take out the day’s highs or lows when the number was released,” said a New York floor trader. “I think you have to look at $3.15 support and $3.35 on the upside. We just rolled from May to June, so we’ll have to see if we can hold these levels.”

May futures expired Wednesday at $3.142.

Analysts see the pattern of outsized builds continuing. “The build for last week was slightly more than the 72-73 Bcf consensus view, a minor miss that doesn’t really constitute a surprise,” said Tim Evans of Citi Futures Perspective. “However, this report does nonetheless confirm that the background supply/demand balance has weakened relative to late March and early April, a bearish development in terms of our model. We’ll be looking for somewhat more robust storage injections in the weeks ahead as a result.”

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at, or above, five-year averages, assuming normal weather.”

Inventories now stand at 2,189 Bcf and are 358 Bcf less than last year and 299 Bcf greater than the five-year average. In the East Region 25 Bcf was injected, and the Midwest Region saw inventories rise by 17 Bcf. Stocks in the Mountain Region were greater by 5 Bcf and the Pacific Region was up 5 Bcf. The South Central Region increased 22 Bcf.

Salt storage rose by 7 Bcf to 321 and non-salt increased 14 Bcf to 684 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |