E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton’s U.S. Land Revenue Climbs 30%, with Newbuild Demand Escalating

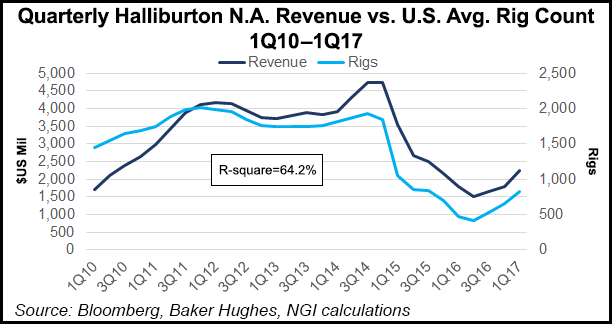

Halliburton Co.’s North American revenue jumped 24% sequentially in the first three months of the year, with U.S. land outperforming the domestic rig count with an increase of almost 30%.

The No. 1 pressure pumper in North America delivered, said President Jeff Miller during a Monday morning conference call. CEO Dave Lesar was not on the call as he had long-standing business commitments.

Last month, Halliburton telegraphed its strong progress, with U.S. pressure pumping capacity coming back at double the rate anticipated, and crews being added in the U.S. onshore as quickly as was possible.

Miller solidified that view during the conference call. “In North America the momentum is building, and we only see it getting better,” he said.

North American revenue climbed from a year ago to $2.23 billion from $1.79 billion and from revenue of $1.80 billion during 4Q2016. For comparison, Schlumberger Ltd., which reported its results last Friday, said North American revenue only rose 6% sequentially.

Halliburton’s U.S. land revenue growth alone was up nearly 30% from the fourth quarter, above the average domestic land rig count growth of 27%, primarily driven by increased activity in pressure pumping and well construction product service lines.

“The quarter wrapped in line with what we expected,” in a continuing “tale of two cycles,” Miller said. “North America activity increased rapidly, but not without growing pains, while activity in the rest of the world declined due to typical seasonal pressures that were exacerbated by current cyclical headwinds.”

The first quarter brought a lot of change in North America, both to strategy and customers’ views of the market.

“I love the way the market is shaping up. I’m excited because customers are investing to meet production targets, pricing is moving, supply-versus-demand dynamics are tight, our reactivated equipment is going to work at leading-edge pricing, and we are working to manage our input costs.”

Halliburton expected to “outgrow” the U.S. land market, and it delivered. And the reactivation program is continuing, with Halliburton able to secure higher rates for its services, estimated to be as much as 25% more than before.

North America incremental margins improved through the quarter, despite transitory inflation costs, reactivation costs and typical seasonal declines in the Gulf of Mexico (GOM). In short, Miller said, “our first quarter results reflect that we are not chasing market share at the cost of pricing.” The “path” to normalized margins is in sight, and management plans to “invest now to maintain hard-earned market share so that when we earn normalized margins, it will be on a bigger base of business. We still think this is the smart choice and the right choice.”

The pace of activity may moderate in the second half of the year, especially if accelerated North American oil and gas production escalates and pressures pricing. However, management still sees “sufficient demand for the equipment we’re bringing into the market,” Miller said. “As we look at the second half of the year, we’ll assess our options for continued redeployment beyond our current plans, but have made no decisions.”

Because Halliburton builds its equipment, it has the luxury of waiting longer than some competitors to make newbuild decisions. The active fleet of pumping equipment now is “fully utilized, and we know from our own experience, as we get near the bottom of the stacked equipment pile, it will be progressively harder and more expensive for the industry to reactivate equipment.”

Once the stacked equipment is nearly gone, there’s always been a “flight to quality” because operators want to build better wells and reduce their costs per boe.

“Let me reiterate: we foresee increased demand for newbuild equipment, but will not consider responding to this demand until the economics make sense,” Miller said. There are “multiple paths” to normalized margins, and the plan is to “travel the path that gets us there the fastest with the highest market share.”

Market dynamics “continue to make forecasting a challenge,” CFO Robb Voyles said in presenting the near-term outlook. However, Halliburton expects the drilling and evaluation division to see a second quarter rebound “from typical seasonal weather disruptions in drilling activity, such that sequential revenue will experience a mid-single-digit increase compared to first quarter levels, with margins increasing 75-125 basis points. In our completion and production division, we believe that revenues will increase in the upper teens, while margins will increase by 275-325 basis points.

“As for our regional outlook, as in the first quarter, we expect our revenue growth in North America to outperform the average U.S. land rig count growth, which is already up significantly for the second quarter. In Latin America, we anticipate revenues will increase sequentially by mid-single digits. We expect Europe, Africa CIS revenues to increase by low double digits as a result of increased activity after the winter months. And we believe Middle East, Asia revenue will remain relatively flat sequentially.”

Halliburton reported a loss from continuing operations of $32 million (minus 4 cents/share) in 1Q2017, versus a sequential loss of $149 million (minus 17 cents) and a year-ago loss of $2.4 billion (minus $2.81). Revenue improved 6% sequentially to nearly $4.3 billion, with operating income of $203 million. Cash losses totaled $32 million net, down from losses a year ago of nearly $2.42 billion. Total cash flow provided by operating activities was $5 million in the first quarter, versus a loss of $171 million in 1Q2016.

Completion and production revenue was $2.6 billion, a sequential increase of 15%, while operating income was up 73% to $147 million. Improvements primarily followed improved pressure pumping pricing and utilization in the U.S. land market, partially offset by a decline of completion tool sales in the GOM.

Drilling and evaluation revenue fell 4% sequentially to $1.7 billion, while operating income fell by half from the fourth quarter to $122 million, mostly because of lower software sales across all regions, as well as decreased pricing/fluid sales in the Middle East. The decreases were partially offset by improved fluid sales and project management activity in Mexico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |