Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

CPP or Not, NatGas Seen as Critical in Power Generation Future, Study Finds

Natural gas has played and will continue to play a critical role in power generation within the United States, regardless of what the Trump administration does with the Clean Power Plan (CPP), according to a new study conducted by Pace Global and commissioned by the Natural Gas Supply Association (NGSA).

The report found that current market conditions have driven the increase in low-emission generating sources, such as natural gas, noting that the share of natural gas as a fuel in the U.S. power stack has grown from 18% in 2005 to more than 33% in 2015.

“This market trend is driven by favorable long-term fundamental economics and is likely to continue into the foreseeable future, regardless of the presence or absence of additional regulation to expressly limit emissions,” Pace Global said in the report. “The cost competitiveness and reliability of natural gas generation makes it a critical component of a low-carbon energy future.”

Speaking at a rollout of the report in Washington, DC, on Thursday, Melissa Haugh, executive director at Pace Global and author of the study, said U.S. power markets are currently undergoing a rapid transformation. “There are three key elements that are driving that from our perspective. The current market is challenging our large fleet of baseload coal-fired generation, and some nuclear generators as well are challenged to remain economic in certain markets. Coal traditionally has been about 60% of the generation mix, but in 2016 that was down to about 30%.”

Haugh added that the report took into account the significant amounts of renewable sources, such as wind and solar, coming into the market as costs are coming down. But economic electricity battery storage technology is not there yet and the sun does not always shine and the wind does not always blow.

The company found that the growth in market share for natural gas — which is expected to continue — was triggered by competitive natural gas prices as a result of the shale gas revolution, citing the Energy Information Administration (EIA). Natural gas is also expected to remain affordable for the foreseeable future. “The EIA projection in their last outlook expects natural gas prices to remain at or below the $5/MMBtu level through 2030, and a lot of other forecasts including our own are even lower than that,” Haugh told the audience. “So the long-term consensus view is for sustained lower prices of natural gas.”

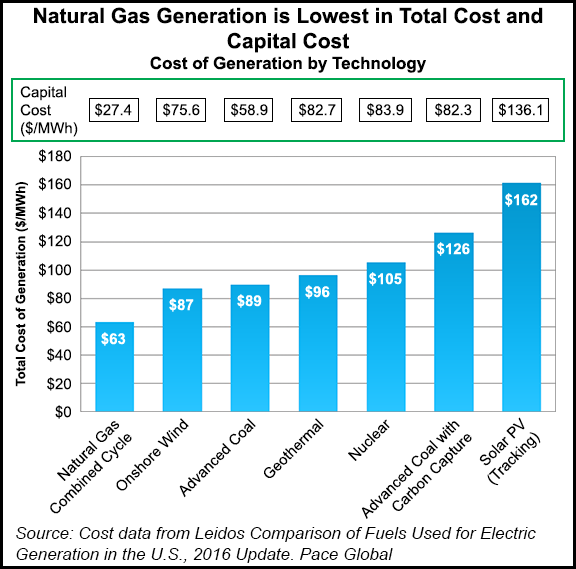

In addition to low commodity costs, the report found that gas-fired combined-cycle generation facilities provide the lowest total cost per megawatt hour (MWh) of any fuel. Looking at data from 2016, Pace pegged the total MWh cost of a gas-fired combined cycle power plant at $63/MWh, which compares to $87/MWh for onshore wind, $89/MWh for advanced coal, $105/MWh for nuclear, $126/MWh for advanced coal with carbon capture and $162/MWh for solar photovoltaic (tracking).

“The Pace Global report’s findings validate what we already suspected: electric utilities and generators have increased their use of natural gas because of its cost, reliable performance and environmental savings,” said NGSA CEO Dena E. Wiggins. “Those factors will continue to fuel the power sector’s embrace of natural gas, with or without federal low-carbon regulations.

“Greater use of natural gas already has been a major cause of the energy sector’s cuts in carbon emissions. In 2016, the energy sector used natural gas to generate electricity at the highest levels on records, and at the same time achieved the lowest carbon emissions in almost 25 years,” Wiggins added.

CPP a Deal-breaker?

Since the election of President Trump, the future of the CPP is very much in question as the new administration continues to slash regulations that it feels are harming business. If the CPP were to go away, Wiggins does not see it as a blow to natural gas in the power stack. “Then we compete on price,” Wiggins told the audience. “There are a number of coal plants that are currently struggling in the marketplace. They are operating solely so that they do not have large piles of coal sitting on their lands [due] to the take-or-pay contracts that they have.”

The Obama administration unveiled the final version of the CPP in August 2015. The plan, which embraces renewables, solar and wind powers, calls for states to reduce emissions by 32% below 2005 levels by 2030. The CPP would require that states develop and implement plans to ensure power plants in their state — either as single plants or as a collective group — achieve goals for reducing carbon dioxide (CO2) emissions between 2022 and 2029, and final CO2 emission performance rates by 2030. The CPP gave states the option of choosing between either an emissions standards plan or a state measures plan to reduce emissions. They also had the option of trading emissions rate credits with other states.

Infrastructure Opposition Reaching a Fever Pitch

Addressing the pushback from environmental and anti-fossil fuel contingents to natural gas infrastructure development, Wiggins said the industry needs to do a better job of educating the public. But she allowed that a subsection of the opposition have their minds made up and are not interested in listening to reason.

“I think if you ask the people at Constitution Pipeline, they would say things are worse [in terms of anti-fossil fuel opposition],” Wiggins said. “So far, although I think they have been drug out perhaps longer than what we would normally in the past expect a certificate process to take, but at the end of the day, most of these pipeline projects are getting approved, eventually. They might have to go to the courts or [work through] FERC,” but eventually they are making it through. “We are just going to have to keep at it. I just don’t think we can as a country lose the benefit of this valuable natural resource.” Wiggins added that NGSA is “standing shoulder to shoulder” with the Interstate Natural Gas Association of America, which includes involvement in some of the court cases.

Wiggins said the water court case in New York against the proposed Constitution Pipeline is a big case for the industry. “Hopefully the second circuit [court] will rule the right way. I’m not a Clean Water Act lawyer, I understand there is a state’s rights tension here, but whatever rights and responsibilities that New York has under the Clean Water Act, it just can’t be a veto power,” she said. “It just can’t mean that New York can effectively veto a federally approved certificate. It can’t mean that New York can stop New England from getting gas supply through a pipeline that goes through their state.”

Next Steps

NGSA made the following policy recommendations in tandem with the report’s release:

NGSA said it commissioned the study to document the importance of natural gas to clean air policy goals and the organization plans to use the report to help educate policymakers at the federal and state levels.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |