Bakken Shale | E&P | NGI All News Access | Regulatory

Dakota Access Will Put Williston, Permian Basins on More Level Cost Basis, Helms Says

While reporting a return to 1 million b/d oil production, North Dakota’s top oil/natural gas official also said Thursday the much maligned Dakota Access Pipeline (DAPL) should help “level the playing field” for Williston Basin supplies relative to the red hot Permian Basin where most of the U.S. exploration/production is focused currently.

The four-state, nearly 1,200-mile DAPL, carrying more than 700,000 b/d of crude to East and Gulf Coast markets will mean “lower, stable transportation costs” for Bakken producers, said Lynn Helms, North Dakota’s chief oil/gas regulator and head of its Department of Mineral Resources. “For some operators it is a little lower, and for others it is $5-6/bbl lower.

“Regardless, in every case the transportation cost is lower and more stable, so in the future, producers have a known transportation cost,” Helms said. “It is not highly variable like depending on rail transportation for a coastal market somewhere.”

Helms said the stable, lower transportation costs will affect operators’ future investment decisions, as supported by a recent conversation he had with one of the Bakken’s major producers.

“I was talking to a CEO out of Denver, and he was comparing the Permian Basin, which has been very active during the winter [with none of the weather restrictions faced by North Dakota], to the Williston Basin,” Helms said, adding that North Dakota’s production taxes are higher but the royalty requirements in Texas are much higher. “With Dakota Access, the lower transportation costs here, he believes, completely level the playing field between North Dakota and Texas.”

Helms said the major producer’s contention is that DAPL “takes the transportation costs out of the equation” and then the tax and royalty rates cancel out each other.

“In the long run, the new $3.8 billion pipeline will be very beneficial for producers because they can have a stable, confident price, and an overall transportation cost that is lower than it has been.”

Prior to DAPL, Helms said North Dakota was considered to be a high-cost oil production state, “significantly higher than the Permian.” The Denver-based Bakken producer he cited has re-looked at the relative economics with DAPL and determined things are level now.

“DAPL has lowered the transportation costs to help even everything out,” Helms said.

For February, the most recent month with complete statistics, North Dakota’s oil production returned to above the 1 million b/d mark (1.03 million b/d), compared to 981,380 b/d in January, although with three fewer days in the month overall production dropped month over month (from 30.4 million bbl to 28.9 million bbl). Similarly, overall natural gas production declined, but daily totals increased for February: 47.8 Bcf (1.75 Bcf/d), compared to 48.3 Bcf (1.56 Bcf/d) in January.

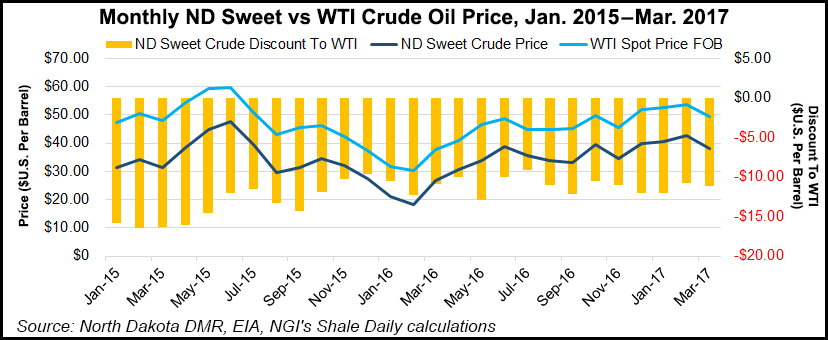

Drilling rig counts and prices are up and the numbers of drilled but uncompleted wells is down below 800 for the first time since 2014, Helms said. As of Thursday, North Dakota had 51 rigs operating, compared to 46 in March and 39 and 38 in February and January, respectively. Sweet Bakken crude oil fetched $41.75/bbl as Helms offered his monthly report via a webinar.

Flaring has stayed stable, with statewide and Bakken gas capture rates at 89% and 90%, respectively. The main concerns continue to be that the majority of the wells still flaring have takeaway pipeline access but for various reasons still are not shipping the associated natural gas rather than burning it at the wellhead.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |