Markets | NGI All News Access | NGI Data

NatGas Cash Lumbers Lower, But May Futures Add 4 Cents

Physical natural gas for delivery Thursday inched lower in Wednesday trading as very modest gains in the Northeast and Rockies were unable to counter broad declines of a few pennies at most major market centers.

The NGI National Spot Gas Average shed 2 cents to $2.88, and those that did trade in positive territory mostly managed to do so by just a penny or two.

Futures trading was equally lackadaisical ahead of a storage report that is expected to show a modest build. At the close, May had advanced 3.7 cents to $3.187, and June was up 3.8 cents to $3.262. May crude oil retreated from its string of six consecutive advances and dropped 29 cents to $53.11/bbl.

Forecast temperatures at major market centers, along with below normal heating loads, have kept prices under pressure. AccuWeather.com forecast that Boston’s high of 60 degrees on Wednesday would hold Thursday and dip to 59 Friday, 4 degrees above normal. Chicago’s expected high Wednesday of 51 was seen steady through Thursday before rising to 60 on Friday, 2 degrees above normal. The anticipated high in Dallas on Wednesday of 78 was predicted to hit 81 Thursday and Friday, 5 degrees above normal.

Heating loads are running well below normal. AccuWeather.com noted that with the month about half over Boston had tallied 203 heating degree days (HDD), or less than half of its normal average of 510 for April. Chicago was running a total of 156 HDDs out of a normal 449, and Dallas had accumulated only 4 HDDS out of its norm of 74.

Gas at the Algonquin Citygate shed 17 cents to $3.03, and deliveries to Iroquois, Waddington came in 2 cents lower at $3.20. Packages on Tenn Zone 6 200L, however, rose 16 cents to $3.34.

Major market centers showed only modest changes. Gas at the Chicago Citygate rose 2 cents to $2.96 and deliveries to the Henry Hub fell 9 cents to $2.99. Gas on El Paso Permian was quoted a penny lower at $2.73, deliveries to Opal came in a penny higher at $2.76 and gas at the PG&E Citygate rose a penny to $3.32.

In South Texas, maintenance on the NET Mexico Pipeline is affecting exports to Mexico from the Agua Dulce hub this week, according to natural gas analytics firm Genscape Inc.

Genscape, which has a proprietary monitor on NET, told NGI that real-time data showed the 2.3 Bcf/d pipeline flowing a little under 1 Bcf/d Wednesday. Tuesday’s flows averaged 1.017 Bcf/d, the firm said.

The maintenance, which Genscape had reported to clients last month, began impacting flows earlier this week and is expected to reduce capacity by about 570 MMcf/d through Thursday. On Friday and Saturday, the maintenance is expected to reduce capacity on NET by 1.22 Bcf/d, with about 720 MMcf/d impacted Sunday through the following Friday.

Genscape senior natural gas analyst Rick Margolin said other U.S.-to-Mexico pipeline export points have not shown an increase to offset the reductions on NET.

“The black hole becomes how gas is reacting within the Mexican market,” Margolin told NGI. “What I’ll tell you is that we’re not seeing other U.S. export points offset the losses.” Genscape had informed clients last weekend “that the opportunities for other U.S. export points to offset those losses were limited, either because they didn’t have available capacity or because they target areas of the Mexican market that weren’t impacted by this outage.”

NET is anchored by a long-term firm gas transportation agreement, for up to 2.1 Bcf/d, with MexGas Supply Ltd., a subsidiary of Petroleos Mexicanos, or Pemex, Mexico’s state-owned gas company.

Margolin said the impact of the outage on pipelines north of the border wasn’t “immediately obvious” as of Wednesday. While TGP and NGPL both deliver into NET, “those two pipes really only account for about a third of the supply that gets onto NET,” with intrastate lines and processing plants accounting for the rest, making it “hard to get a real-time estimate of how the Texas market is adjusting to this,” he said.

The South Texas Regional Average shed 5 cents in Wednesday’s trading. Tennessee Zone 0 South dropped 7 cents to $2.74, and Texas Eastern South Texas dropped 6 cents to $2.94. NGPL South Texas fell 3 cents to $2.83. No trades were reported at Agua Dulce.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

“Isolating a price impact from the maintenance on NET is difficult because Agua Dulce is currently a very illiquid point,” NGI Markets Analyst Nate Harrison said. “However, as exports to Mexico increase and associated gas production in the Eagle Ford Shale ramps back up, this point may become a better indicator of supply/demand near the border.”

Futures opened about a penny lower Wednesday at $3.15 as traders factored in moderately supportive weather with conflicting long-term price views.

Tuesday overnight weather model runs showed increased heating load. Wednesday’s “six-10 day period forecast is generally cooler” than forecast Tuesday “across the northern tier and Midwest but warmer over the southwestern U.S.,” said WSI Corp.

Gas-weighted HDDs “are up 3.2 to 43.3, which are 12.2 below average,” while continental U.S. population-weighted cooling degree days were 11.9 for the period.

“Forecast confidence is only average at the very best,” said WSI. “Medium-range models are in relatively good agreement and have shown some consistency with the general pattern, but there is spread and inherent uncertainty with an active zonal storm track.”

Current weather conditions may not be encouraging to market bulls, but Tuesday, the Energy Information Administration’s estimated 2017 average Henry Hub spot price, which had tumbled 12% in the agency’s March Short-Term Energy Outlook (STEO), would increase. The April report forecast that Henry Hub spot prices would rise to $3.10/MMBtu, a 2.2% increase compared with the previous forecast.

The 2018 Henry Hub spot price is expected to average $3.45/MMBtu, EIA said, unchanged from March’s forecast. The price increase next year is expected to come primarily from new natural gas export capabilities and growing domestic gas consumption, EIA said.

Not everyone is buying into the forecast for higher prices. Analysts with Raymond James & Associates Inc. have predicted the reverse of EIA’s forecast, with 2017 prices higher and 2018 prices lower. The group bases its downward trend on faster-than-anticipated growth in supply, along with surprising gains in renewable power generation capacity. This is expected to displace more demand than forecast only four months ago. In early January analysts had said U.S. gas prices were poised for the best prices in 2017 since 2014. Now, however, while they are maintaining their 2017 forecast of $3.25/Bcf, the 2018 estimate has been slashed to $2.75 from $3.50 and the long-term forecast reduced to $2.75 from $3.00.

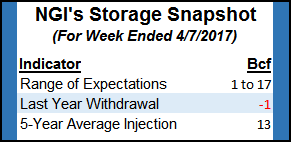

Thursday’s storage report may give some idea to what extent mild weather has prompted increased storage builds. Last year 1 Bcf was withdrawn and the five-year pace stands at a 12 Bcf injection. Analysts at ICAP Energy calculated a 7 Bcf increase. A Reuters survey of 21 traders and analysts revealed an average 9 Bcf injection with a range from +1 Bcf to +17 Bcf.

Tom Saal, vice president at FCStone Latin America in Miami, in his work with Market Profile expected the market to test Tuesday’s value area at $3.172 to $3.144. “Maybe” the market will test a second value area at $3.254 to $3.234, he said in a Wednesday report to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |