E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Exco to Sell South Texas Properties to KKR Affiliate for $300 Million

Exco Resources Inc. announced Monday that it plans to sell its oil and natural gas properties in three counties in South Texas to an affiliate of Kohlberg Kravis Roberts & Co. LP (KKR) for $300 million.

In a statement Monday, the Dallas-based exploration and production (E&P) company said it had executed a definitive agreement with a subsidiary of Venado Oil and Gas LLC for Exco’s interest in oil and gas properties and surface acreage in Dimmit, Frio and Zavala counties. The properties produced approximately 4,100 boe/d in December 2016, with more than 90% oil.

Exco said it expects the transaction, which is subject to customary closing conditions and adjustments, to close in June.

“Exco’s planned divestiture of the South Texas oil and natural gas properties represents an important step in its portfolio optimization initiative and will improve its financial flexibility,” the E&P said, adding that it “intends to use the proceeds [from the sale] to fund drilling and development of its core Haynesville and Bossier shale assets in North Louisiana and East Texas, and for other general corporate purposes.”

According to Exco, the borrowing base under its revolving credit facility will be $100 million after the transaction closes. The company’s next borrowing base redetermination is scheduled for November.

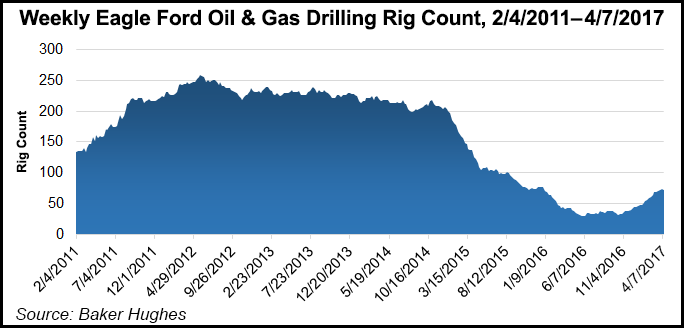

Last May, Exco sold some of its non-core undeveloped acreage, as well as interests in four producing wells, for $12 million. Two months earlier, the E&P slashed its capital expenditures budget for 2016 by more than two-thirds, while also announcing plans to spud and complete a handful of wells in the Haynesville and Bossier shale. Exco shut down its drilling program in the Eagle Ford Shale and the Appalachian Basin in November 2015.

According to Exco’s 10-K filing with the U.S. Securities and Exchange Commission (SEC) on March 16, the company said it holds 82,100 net acres in East Texas and North Louisiana prospective to the Haynesville and Bossier shales. It also told the SEC that it has 49,300 net acres in South Texas prospective to the Eagle Ford.

In the Appalachian Basin, Exco reported that it holds 127,000 net acres prospective for the Marcellus Shale and 40,000 net acres in the Utica Shale, predominantly in the play’s dry gas window.

KKR and Austin-based Venado formed a partnership, funded by a growth fund from the former, to consolidate proven assets in the Eagle Ford Shale in South Texas last September.

The New York-based equity firm has a long history of energy investments dating back to 2009, when it invested $350 million in privately-held East Resources Inc. (ERI). The next year, a unit of Royal Dutch Shell plc purchased nearly all of ERI’s assets, including KKR’s interest, for $4.7 billion.

KKR formed separate joint ventures (JV) with RPM Energy LLC,Hilcorp Energy Co. and El Paso Midstream Group Inc. in 2010. The firm acquired assets from ConocoPhillips,Carrizo Oil & Gas Inc. and Samson Investment Co. and formed a midstream services agreement with Quicksilver Resources Inc. in separate deals in 2011. KKR also acquired assets from Chesapeake Energy Corp. and WPX Energy, and forged a JV with Comstock Resources Inc., in 2012.

In 2014, KKR partnered with Riverstone Holdings, another equity giant, to form Trinity River Energy LLC, with E&P focused on the Barnett Shale. The next year, it partnered with Fleur de Lis Energy LLC to purchase assets from Anadarko Petroleum Corp., and formed a JV in Mexico with Monterra Energy.

Veresen Midstream, a 50/50 partnership of Calgary-based Veresen Inc. and KKR, said it would fund 55-60% of the construction costs of the proposed $715 million Tower rich natural gas processing plant in the Montney Shale in December 2015.

Last March, SM Energy Co. closed on an $800 million gross sale of its non-operated assets in the Eagle Ford, including an ownership interest in associated midstream infrastructure, to Venado EF LP, a unit of Venado.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |