E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Optimism Pervades OGIS, But Caveats on Permian NatGas Pricing, Takeaway, Water, Labor

U.S. oil and gas management teams — and their investors — are increasingly upbeat about the renewed state of the industry, but there are concerns about Waha natural gas basis prices, cost inflation and the lack of trained labor, executives said this week in New York City.

The Independent Petroleum Association of America’s 23rd annual Oil & Gas Investment Symposium (OGIS) brought together hundreds of executives of exploration and production (E&P) and oilfield service (OFS) companies who shared their views as the upturn gets underway.

Jefferies LLC’s Michael Hsu and Zach Parham came away “feeling encouraged by the upbeat tone and demeanor from both management and investors in attendance.” Frequent topics of discussion centered around activity in the Permian Basin, potential merger/acquisition (M&A) activity and OFS inflation.

Permian takeaway capacity and potential infrastructure constraints were big points of discussion, said Hsu and Parham.

“All Permian operators assured attendees that enough infrastructure was in place (or being built), with some noting that there is enough capacity on all fronts,” for crude and natural gas takeaway, natural gas processing and liquids takeaway, to handle the growth through 2019.

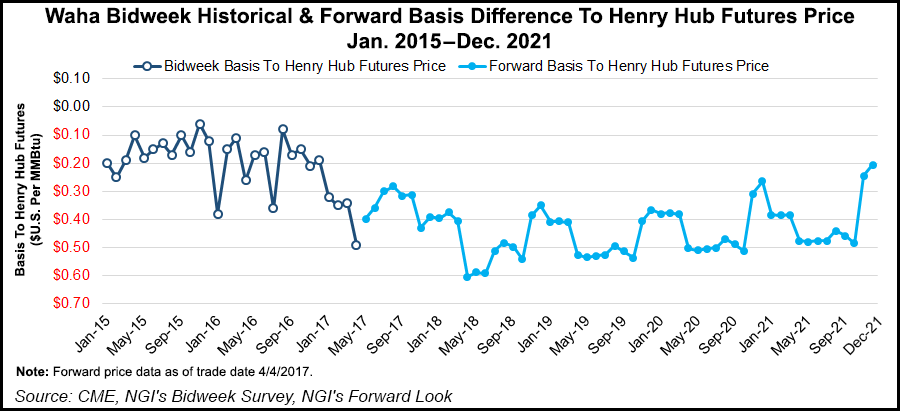

However, some operators expressed concerns about the Waha natural gas basis from West Texas beginning to trade for 40 cents/MMBtu or more below the New York Mercantile Exchange, “which could hurt natural gas realizations” for the Permian’s Delaware sub-basin operators.

Meanwhile, crude oil takeaway from the Permian isn’t expected to be an issue until at least the end of 2019.

“New projects are announced seemingly every week for additional evacuation capacity out of the Permian,” the Jefferies analysts said.

Recent announcements include Epic Pipeline Co.’s plan to construct a 730-mile 440,000 b/d crude and condensate pipeline from the Permian to Corpus Christi, TX. Two weeks ago, Phillips 66 launched an open season for a 130,000 b/d crude pipeline originating in the West Texas counties of Reeves, Loving, Winkler and Odessa, with a tentative startup in the second half of 2018.

“Assuming both pipes receive the necessary commitments to move forward, we estimate pipeline capacity could increase to 3.775 million b/d by 2019, and we do not believe the Permian will be crude takeaway constrained in the near to medium term,” said the Jefferies analysts.

One of the most heavily attended sessions at OGIS may have been by Pioneer Natural Resources Co. CEO Tim Dove, who said the company will be drilling horizontal well No. 1,000 in the Permian’s Midland sub-basin this year, “the biggest campaign of drilling of any company in the entire industry.”

Water Supply System Equal to Roman Aqueduct

Pioneer also is attempting to “stay ahead of the bottlenecks” infrastructure-wise in the Permian, where crude oil output, and to a lesser extent natural gas, is rapidly expanding. But building out isn’t only about oil and gas pipelines. Besides adding one new gas processing plant every year, Pioneer is building a “massive water system” in West Texas.

“We actually now are controlling both Midland and Odessa’s effluent water supply, which is 360,000 barrels a day,” Dove said. “Every day, we source about 350,000 barrels a day in total. Ten years from now, we’ll be needing 1.4 million barrels a day. It gives you an idea of where this is going. You better control your own water supply because it’s tantamount to success to do so at a cost that is very economic.

“For instance, after we put this water system in, something akin to the Roman aqueduct, we’ll be basically saving 500,000 barrels per well” for around 20,000 wells. That creates “$10 billion of value compared to your alternatives of trucking in water into the system, even if you could do it with the volumes we’re talking about.”

Carrizo Oil & Gas Inc. also disclosed that it is bidding on 57,000 acres adjacent to its Delaware sub-basin position. The acreage held by Riverstone Holdings LLC-backed Three Rivers III. “Carrizo believes it is the best positioned buyer,” said analyst Timothy Rezvan and James Lizzul of Mizuho Securities USA. “However, if the company is outbid, it believes it can flip its Delaware Basin position for a profit.”

Appalachian M&A also is on the table for Carrizo as it looks to build its portfolio in the Permian, said the Mizuho analysts.

Trading East for West

“Carrizo’s noncore position in the Utica and Marcellus has been assumed to be a sale candidate for some time; the only question was when the market would be ready. The company now believes the market would support a sale, given improving sentiment on in-basin gas pricing. Proceeds could help fund the Three Rivers bid.”

Chatter about other Appalachian M&A was discussed, but acreage prices may be too high.

“Producers believe that Appalachia acreage will continue to be consolidated, but current bid/ask spreads remain wide,” said Jefferies’ Hsu and Parham. “One operator commented that several recent acreage packages that had been offered for sale had been pulled when bids did not reach as high as the owners preferred. A number of operators have Marcellus/Utica assets that we believe may be potentially offered for sale in 2017…”

E&Ps still see 10-15% average well cost inflation this year, already built into their budgets. And some operators are seeing delays in getting new staff trained as activity accelerates.

“Our OFS team has noted that recent channel checks point to service companies having exhausted their ‘re-hire’ lists and are moving on to recruiting new hires,” Jefferies analysts said. “We think this will be an issue to watch out for going forward, especially for activity acceleration in more remote areas such as the Delaware Basin in West Texas. In addition to labor issues, we see the logistics of transporting large amounts of proppant to the region as another potential bottleneck.”

Wunderlich Securities Inc.’s Jason Wangler and his team also spent two days at OGIS.

“We now have all of the growth initiatives from companies, but given oil price concerns and service cost inflation, the economics of the plays remain a focus,” Wangler said. “Additionally, with many companies looking to ramp up spending due to the higher activity levels, there is a returned focus on how companies intend to finance their plans throughout the year.

“It is quite telling that we have seen investors, and frankly the companies as well, move from a focus on well results and the expansion of plays to a more measured approach of developing assets, managing the capital structure and looking at the long term.”

Wangler’s team came away “cautiously optimistic,” given continued improvements from the E&Ps, as well as the “relatively stable” outlook for oil and natural gas prices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |