Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

2016 Was Banner Year For Global LNG Trade, IGU Says

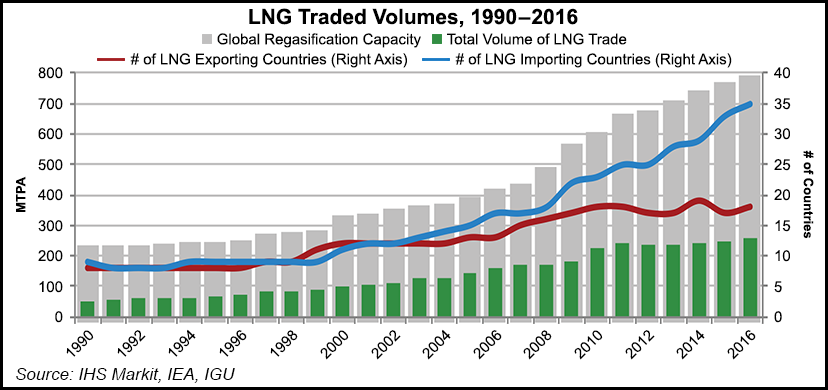

Global trade in liquefied natural gas (LNG) last year reached a record 258 million tonnes — up 5% from 2015, according to the International Gas Union (IGU). However, the LNG industry is in need of contract standardization, according to one trading house, which has introduced a proposal for a standard contract.

IGU’s 2017 World LNG Report was released at the Gastech conference in Tokyo on Wednesday. The organization said the increase in LNG trade stands out, in particular, when compared with the average growth rate of 0.5% that was seen over the previous four years.

“This jump can primarily be attributed to a significant increase in new supply, due largely to the start of exports from the U.S. Gulf of Mexico, as well as the start of commercial operations in Australia Pacific LNG, among others,” IGU said.

The group said demand for LNG also increased, particularly in Asian markets. China’s LNG consumption Increased by roughly 35% to 27 million tonnes/annum (mtpa), IGU said. However, some markets — including Japan and South Korea — have shown signs of satiation as other forms of energy have supplanted some LNG demand. “This was particularly prevalent in Brazil, where a resurgence in hydropower has reduced demand for LNG by 80%,” IGU said.

The latter half of 2016 saw Asian and spot LNG prices reach $9.95/MMBtu by February 2017 because of supply disruptions and cold weather. This followed a dip in price in the first half of 2016 to $4.05/MMBtu, primarily due to supply outstripping demand, generating an average Northeast Asian spot price for 2016 of $5.52/MMBtu. The UK National Balancing Point (NBP) finished 2016 at $5.44/MMBtu, IGU said.

Last year global LNG liquefaction capacity reached 339.7 mtpa from 301.5 mtpa in 2015. Growth came from new projects, such as Cheniere Energy’s Sabine Pass LNG in Louisiana, as well as Gorgon LNG and Australia Pacific LNG. Global liquefaction capacity is expected to grow significantly over the next few years, with 114.6 mtpa of capacity under construction as of January, IGU said.

Also announced at Gastech and indicative of the expanding LNG global trade is an initiative to encourage adopting a master sales and purchase agreement (MSPA) by the LNG industry. Commodities trader Trafigura Group Pte Ltd. is behind the effort.

“LNG, unlike other commodities, currently lacks standard terms and conditions, which has created inefficiencies, a lack of transparency and barriers to new entrants that would help increase liquidity in the industry,” said Trafigura’s Hadi Hallouche, head of LNG for the Singapore-based trader. “So we’ve proposed what we hope will be viewed as a strong starting point and very much welcome suggestions for how it can be further improved.”

Trafigura is accepting comments on the MSPA, which is available for download.

The MSPA references the Singapore International Arbitration Centre, which “…is yet another testament to Singapore as a neutral and trusted trading hub,” said Satvinder Singh, assistant CEO for International Enterprise Singapore, a unit of the Singapore government’s Ministry of Trade and Industry.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |