E&P | NGI The Weekly Gas Market Report

Permian Leads Rig Gains; Haynesville Production Comeback Seen

Texas and Oklahoma led the states in active drilling rig gains during the week ending Friday, according to Baker Hughes Inc. Texas raised its tally by eight, and Oklahoma added seven.

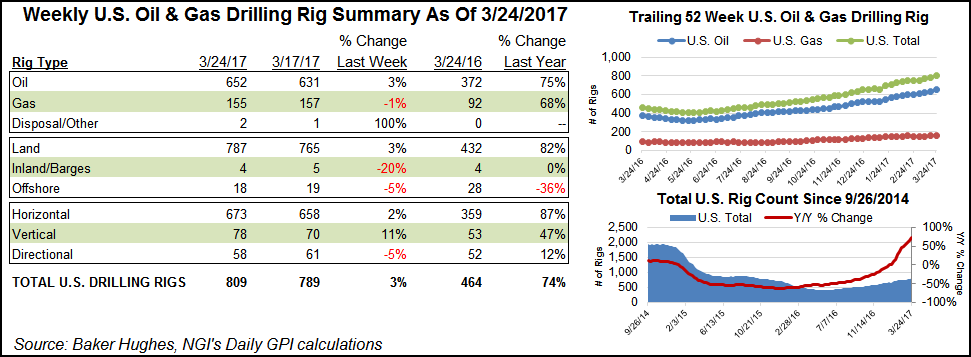

The U.S. land rig count overall gained 22 units to end the week at 787. One rig left the inland waters along with one departing the offshore to make for a net gain of 20 rigs to end the week with 809 active in the United States overall.

Twenty-one oil rigs returned along with one miscellaneous unit, offset by the departure of two natural gas rigs. Fifteen horizontal rigs came back, as did eight vertical units; three directional rigs left the game.

Among U.S. plays, the Permian Basin was the biggest gainer, adding seven rigs to end the week at 315 running. The Permian gain was composed of four rigs in the Delaware subbasin and three in the Midland.

It’s still easier to find a home near the popular oil patch than it was during the boom days, but the Permian Basin housing market is tightening, the Federal Reserve Bank of Dallas said in a recent note. “The rising rig count and optimism of Dallas Fed district energy companies could be tailwinds for the Permian Basin housing market,” it said.

In Canada spring breakup continued with the departure of 79 oil rigs and 11 natural gas units as well as one miscellaneous rig. There were 70 oil rigs and 114 gas rigs running at week’s end, which is up from the respective year-ago tallies of 11 and 44. Alberta drilling dropped by 24% during the week, while British Columbia was down by 6%, Saskatchewan was off by 82%, and Manitoba saw a decline of 80%.

While no rigs were added in the Haynesville Shale during the week, the play has made a strong comeback over the last 12 months, resting at 37 active rigs, up from just 14 one year ago.

“Having been completely stagnant last year, production in the play formed a trough early this year and has started to rise, partly on the frack log and partly on new drilling given the increase in prices,” analysts at Bank of America Merrill Lynch said in a recent note. “Many producers are also focused on employing new and more efficient drilling technologies, such as increasing lateral lengths, tighter cluster spacing, pad drilling or higher proppant loadings, all of which are reducing drilling and completion times and delivering promising gains in well productivity…

“We see average Haynesville production increasing by 0.3 Bcf/d this year and 0.9 Bcf/d next year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |