E&P | NGI All News Access | NGI The Weekly Gas Market Report

Gastar Stacking It Higher in The STACK

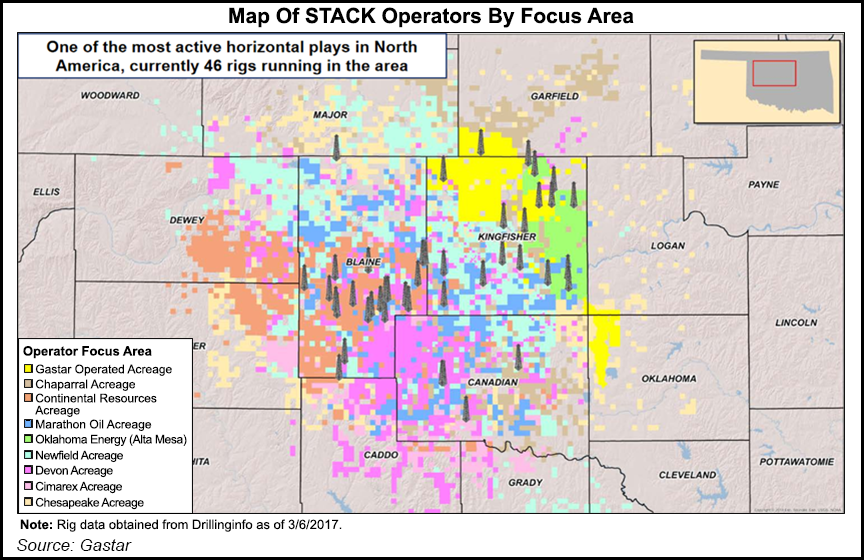

Gastar Exploration Inc. has acquired additional working and net revenue interests in 66 gross (9.5 net) producing wells and 5,670 net acres of additional STACK oil and gas leasehold in Kingfisher County, OK.

Before the acquisition, Gastar held an interest in the majority of the acquired producing wells and leasehold. Current net production associated with the acquired well interests is 330 boe/d (49% oil), and 57% of the acreage is currently held-by-production. The acquisition price of $51.4 million has an effective date of March 1, 2017 and is subject to customary adjustments.

STACK stands for Sooner Trend of the Anadarko Basin in Canadian and Kingfisher counties.

“This acquisition further increases Gastar’s position in the STACK Play to a total of 62,370 net surface acres, excluding 27,100 net acres in the WEHLU and surrounding area,” said CEO J. Russell Porter. “Acquiring additional working interest within our core STACK position in leases that Gastar currently owns and operates is an attractive approach to creating additional value.

“Approximately 48% of the additional interest is in leases that are within our joint development agreement area and as a result, Gastar will earn a 10% drilling promote on those additional interests that are drilled within the joint venture.”

Gastar paid about $6,700 per net acre assuming a value of $40,000 per flowing boe, Wells Fargo Securities LLC analyst Gordon Douthat said in a note Thursday.

“With investors more focused on execution/well performance of the company’s current assets as well as balance sheet restructuring, we expect a mixed reaction to the deal at the [market] open today,” Douthat wrote. Gastar shares were up more than 2% in early trading Thursday.

Gabriele Sorbara, an analyst with The Williams Capital Group, wrote, “After ascribing a value to the acquired production, we arrive to a valuation of about $7,600 per undeveloped acre, which is at a discount to recent transactions in the region.”

The deal was paid for with funds managed by Ares Management LP through an additional $75 million principal amount, priced at par, of Gastar’s previously issued convertible notes due 2022, which increases the convertible notes issued to funds managed by Ares to $200 million, the company said. At a special shareholders meeting May 2, shareholders are expected to vote on the conversion rights of the convertible notes.

“Through our planned 2017 capital program, a large majority of the acquired leases will be held by production under our current drilling plan,” Porter said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |