Markets | NGI All News Access | NGI Data

April NatGas Futures Waffle Lower Following On-Target Storage Stats

Natural gas futures were tentative Thursday immediately after the Energy Information Administration (EIA) reported a storage withdrawal that was what the market was expecting.

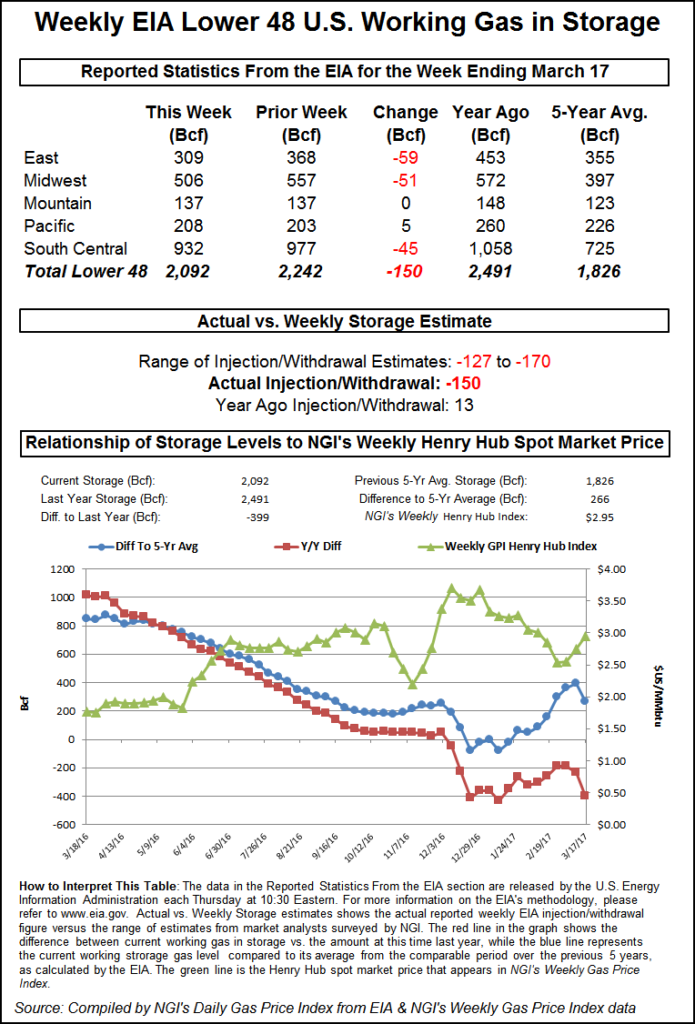

EIA reported a 150 Bcf storage withdrawal, which was in line with industry estimates, in its 10:30 a..m. EDT release. April futures were trading at $3.051 to $3.010 before the number came out. After the number’s release, they stayed within that range for a good 10 minutes, but broke down to the day’s low at $2.986 shortly thereafter. At 10:45 a.m., April was trading at $2.995, down 1.6 cents from Wednesday’s settlement.

Before the report, Raymond James and Associates was looking for a 138 Bcf withdrawal, and analysts at Wells Fargo calculated a 156 Bcf decline. A Reuters survey of 26 traders and analysts showed an average 150 Bcf pull with a range of -127 Bcf to -170 Bcf. Last year 13 Bcf was injected and the five-year pace is for a 21 Bcf pull.

“$3 was a good level of support, but it broke through, so I’m thinking there is no support at $3 in here,” said a New York floor trader. “Support would be at $2.85 and $2.75 below that.”

The report wasn’t much of a surprise to analysts.

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger, an analyst with BMO Capital Markets. “Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at or above five-year averages assuming normal weather.”

Tim Evans of Citi Futures Perspective said the number was “slightly less than other measures such as a Bloomberg survey for 153 Bcf in net withdrawals. The data was bullish compared with the 21 Bcf five-year average for the date, but this was not a surprise. We see the swing to warmer than normal temperatures over the next two weeks as leaving the market without a further fundamental reason to explore the upside.”

Inventories now stand at 2,092 Bcf and are 399 Bcf less than last year and 266 Bcf greater than the five-year average. In the East Region 59 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 51 Bcf. Stocks in the Mountain Region were unchanged, and the Pacific Region was up 5 Bcf. The South Central Region dropped 45 Bcf.

Salt Cavern storage was down 30 Bcf at 295 Bcf and non-salt storage was lower by 16 Bcf to 637 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |