E&P | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

E&Ps Lured to Deepwater, with BOEM Auction Drawing Two Bids Above $20M, Four at $10M-Plus

The Gulf of Mexico oil and natural gas auction held Wednesday attracted two high bids for more than $20 million and four others for $10 million-plus, a sure sign that the energy industry is suiting up for a dive back into the offshore.

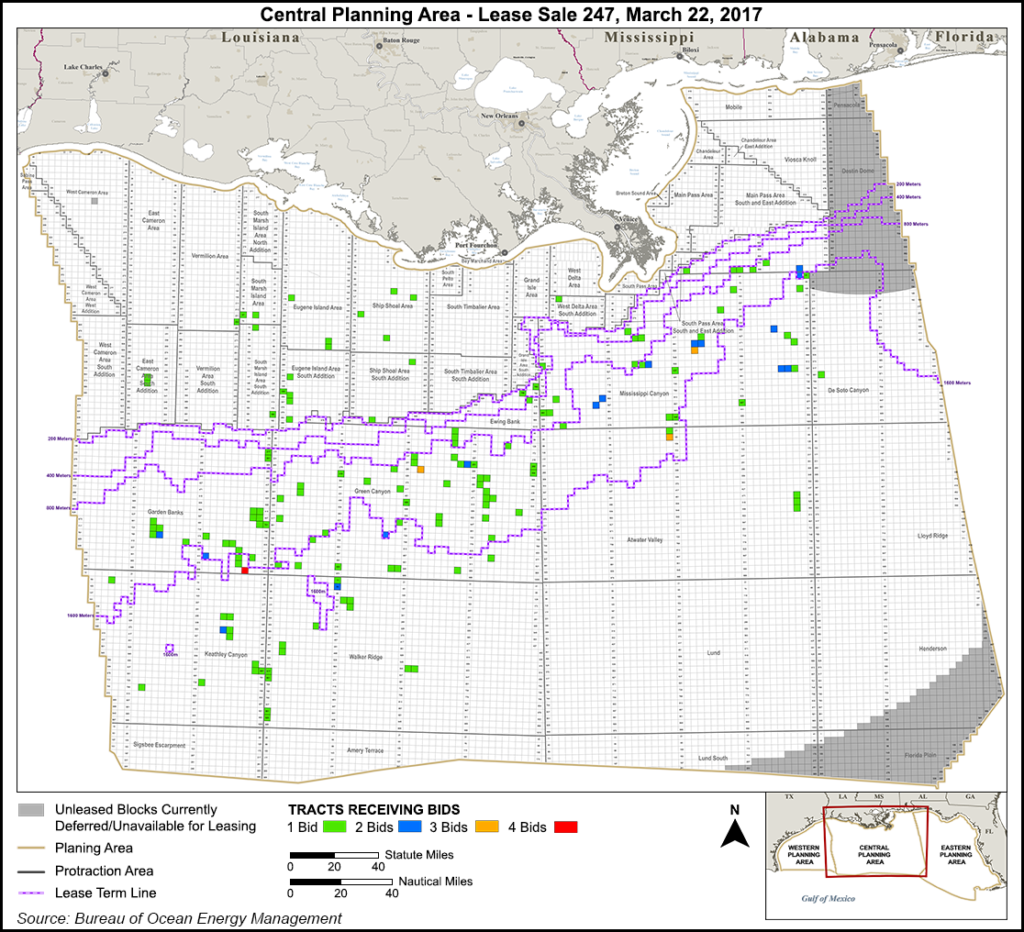

A total of 28 producers bid for the opportunity to explore offshore Louisiana, Mississippi and Alabama in the 12th and final Outer Continental Shelf lease sale of the 2012-2017 program. The Department of Interior’s Bureau of Ocean Energy Management (BOEM) conducted Central Planning Area (CPA) Lease Sale 247 via webcast from New Orleans.

A total of $274.797 million in high bids was offered, with total bids amounting to nearly $315.304 million. The sale, which covered 48 million acres, all unleased and nonprotected areas, drew 189 bids on 163 blocks covering 913,542 acres, said BOEM’s Michael Celata, who directs the GOM Region.

Shell Offshore Inc. topped all bidders with close to $24.1 million for Atwater Valley Block 64, an active deepwater area, Celata said during a conference call to discuss the results.

The strong bids overall “reflect an upswing from last year,” he said. In March 2016, CPA Lease Sale 241 drew 30 producers with total bids of close to $179.2 million.

This year’s auction “shows a continued interest in the Gulf of Mexico, especially deepwater,” Celata said. Most of the bids were for blocks in water depths of at least 400 meters. “That’s been the trend over the last few years.”

The “sizes of the bids show some pretty good prospects,” and the high bids prove “the continued viability of the Gulf of Mexico for oil and gas.”

While Shell’s bid for the Atwater Valley block topped all others, the deepwater Garden Banks (GB) Block 1006 drew the most interest with five bids. Total E&P USA Inc. was high bidder at close to $12.6 million.

The other top bidders, blocks and water depths were:

â— Statoil Gulf of Mexico LLC, $21.238 million, Walker Ridge (WR) 55 in 1,600-plus feet.

â— Hess Corp., $18.328 million, Green Canyon (GC) 287 in 800-1,599 feet.

â— Chevron U.S.A. Inc., $11.308 million, GC 642 in 800-1,599 feet.

â— Statoil Gulf of Mexico, $11.125 million, WR 189 in 1,600-plus feet.

â— Hess, GC 72, $6.834 million in 400-799 feet.

â— ExxonMobil, GC 250, $5.275 million in 800-1,599 feet.

â— Anadarko US Offshore LLC, Mississippi Canyon (MC) 41, $5,134 million in 1,600-plus feet.

â— Shell, MC 845, $5,057 million in 800-1,599 feet.

Shell Offshore led all participants with 20 high bids worth $55.856 million. The other high bidders were Chevron, 20 at $35.566 million; ExxonMobil , 19 at $21.910 million; Anadarko, 16 at $18.942 million; Statoil, 13 at $44.501 million; Hess, 12 at $43.874 million; Houston Energy LP, nine at $2.082 million; Ridgewood Energy Corp., eight at $4.774 million; Talos Energy Offshore LLC, six at $2.319 million; and Red Willow Offshore LLC, six at $1.489 million.

Prior to the sale, BOEM had estimated that if all of the blocks had been awarded bids, the lease sale could result in production totals of 1.9-3.9 Tcf of natural gas and 460-890 million bbl of oil. The sale had offered 9,118 tracts from 3-230 miles offshore in water depths of 9-11,115-plus feet (3-3,400 meters).

BOEM plans to evaluate the bids for fair market value for the next three months, with awards posted on the website as they are completed.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |