Markets | NGI All News Access | NGI The Weekly Gas Market Report

BofA Merrill Lynch Running with Gas Bulls Through 2017

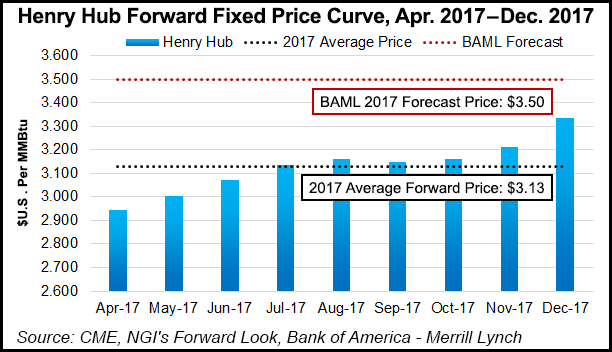

A warm winter and supple supply may have paused the U.S. natural gas price recovery, but BofA Merrill Lynch Global Research is keeping unchanged its 2017 average price forecast from April through December at $3.50/MMBtu, 37 cents above NGI’s Forward Look’s calculated forward curve as of March 20.

The forecast is contrary to one issued by the Energy Information Administration earlier this month, which reduced its 2017 spot price to $3.03/MMBtu, 12% lower than the February outlook. Barclays last week also reduced its 2017 gas price forecast to $3.02 from $3.38.

While BofA Merrill Lynch kept its forecast intact for 2Q2017 through 4Q2017, the 1Q2017 assumption was cut by 35 cents on realized weather, which in turn reduced its full-year average forecast to $3.40 from $3.50.

“With unfavorable seasonals fading, we find the constructive fundamentals still stand: we expect strong structural demand growth to outpace a slow production recovery in 2017, necessitating a coal-to-gas switch in the power sector,” said senior director Sabine Schels. “This switch will only occur at higher prices, so we see prices at the prompt moving up in the second quarter and spreads tightening.

“We reiterate our mid-year target of $3.40/MMBtu, and introduce a year-end target of $4.00/MMBtu.”

Schels’ team expects inventories to finish the winter at 2.3 Tcf, which would be the third highest ever recorded and 0.5 Tcf above the five-year average.

“Naturally the warm winter has depressed prices relative to our expectations in 1Q2017,” Schels said. “Yet as the winter is now fading seasonally, the structural story of a tightening balance — as strong as ever — should take over. We therefore see more upside to forward natural gas prices.”

The firm’s view of U.S. gas hasn’t changed much despite weak prices. To balance the market in 2017 and 2018, some gas demand has to be rationed in the power sector, Schels said.

Coal-to-gas switching levels now sit in a $3.50-4.50/MMBtu range, she said, offering “plenty of upside” for domestic gas prices to move higher.

“We see the need for gas demand destruction of 3.8 Bcf/d year/year on average during the injection season (April-Oct.), which would be equivalent to the second-biggest demand loss in the last 10 years. As weather risks from the winter fade, we expect May-October timespreads to rise on a tightening supply demand balance over the coming months.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |