E&P | Eagle Ford Shale | NGI All News Access

Penn Virginia Running Two-Rig Program in Eagle Ford This Year

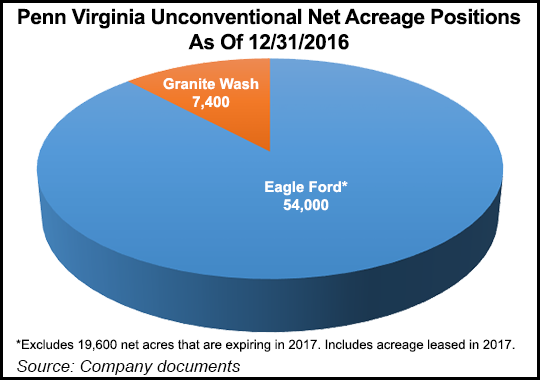

Houston-based and Eagle Ford-focused Penn Virginia Corp., which emerged from bankruptcy in September, restarted its Eagle Ford drilling program in November and has plenty of drilling locations to target with a planned two-rig program.

“Assuming an average 400 feet between laterals, we have identified approximately 525 gross lower Eagle Ford drilling locations across our approximately 54,000 net acres of core oil-rich acreage in Gonzales and Lavaca Counties [TX],” said COO and interim CEO John Brooks. “This equates to approximately 10 years of drilling inventory at our current two-rig drilling pace.

“In addition to these identified opportunities, we hope to further increase our inventory with additional down spacing, as well as future derisking of other zones, including the upper Eagle Ford and the Austin Chalk formation.”

Fourth quarter production was 857,000 boe, or 9,316 boe/d, with 68% of production composed of oil. Fourth quarter production from Eagle Ford operations was 773,000 boe, or 8,402 boe/d, and accounted for 90% of total company production. About 74% of fourth quarter Eagle Ford production was crude oil, 14% was natural gas liquids (NGL), and 12% was natural gas.

Penn Virginia’s total proved reserves as of Dec. 31 increased 13% to 49.5 million boe compared to 43.7 million reported at year-end 2015. The composition of the reserves at the end of 2016 was 74% oil, 14% NGLs and 12% natural gas, with 53% of the reserves classified as proved developed.

Production in the first quarter is expected to be 8,800-9,200 boe/d. Average daily production in the fourth quarter of 2017, or the exit rate, is anticipated to be between 11,200-12,100 boe/d, representing 20-30% growth over the fourth quarter of 2016.

The company said capital spending this year is expected to be $120 to $140 million, with about 90% directed toward drilling and completions in the Eagle Ford. The capital plan provides for drilling 41 to 44 gross wells (19 to 22 net wells) with 31 to 34 gross wells (16 to 19 net wells) turned to sales. Cash flow and credit facility borrowings are to fund the program. There is enough liquidity to accelerate activity, Penn Virginia said.

The preliminary estimate for the 2018 capital program, based on a two-rig Eagle Ford program and “Gen 3” completion design, is $125 to $145 million, with 90% being directed to Eagle Ford drilling and completions. Estimates could be revised based upon tests of the next generation of completion design and other activities. Cash flow is expected to fund the plan primarily.

Production for full year 2018 is expected to be 4.6-5.0 million boe, or 12,600-13,700 boe/d, an increase of 20-30% over the mid-point of 2017 guidance. The exit rate for 2018 is expected to be 13,500-14,500 boe/d.

Penn Virginia reported a net loss of $1.9 million for the fourth quarter, its first quarter out of bankruptcy.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |