Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Part Company; April Adds 4 Cents

Physical natural gas for Thursday delivery took a fall in Wednesday’s trading as forecasts called for somewhat more moderate conditions across the storm-battered Northeast — but prices still managed to hold on to lofty levels.

Most market points in the Midwest, Midcontinent, Texas and Louisiana were down by a nickel to a dime, but volatile trading in the Northeast and Southeast managed to push the NGI National Spot Gas Average 20 cents lower to $3.13.

Futures managed to recover some of Tuesday’s losses, and at the close April had risen 4.3 cents to $2.981, and May was higher by 4.7 cents to $3.040. April crude oil was able to reverse its recent losing streak and added $1.14 to $48.86/bbl.

Eastern prices fell as forecasts called for temperatures to rise as much as 10 degrees at major market points. Forecaster Wunderground.com predicted Boston’s high of 28 on Wednesday would rise to 34 Thursday and climb to 37 by Friday, 8 degrees below normal. New York City’s max on Wednesday of 25 was seen advancing to 36 Thursday and to 41 by Friday, also 8 degrees less than its seasonal norm.

Gas at the Algonquin Citygate fell but managed to hold its $7 print. Deliveries were quoted at $7.45, down 50 cents. Packages at Iroquois, Waddington changed hands at $4.05, down 78 cents and gas on Tenn Zone 6 200L slid 57 cents to $7.42.

Gas on Texas Eastern M-3, Delivery tumbled 84 cents to $3.98, but gas bound for New York City on Transco Zone 6 managed to buck the trend and rose $1.16 to $6.82.

Most major trading centers were lower. Gas at the Chicago Citygate shed 10 cents to $2.93, and deliveries to the Henry Hub fell 4 cents to $3.00. Gas on El Paso Permian shed 13 cents to $2.53, and gas priced at the PG&E Citygate fell 3 cents to $3.15.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

New England forecasters aren’t calling for a warm up anytime soon. The National Weather Service (NWS) in southeast Massachusetts said “strong low pressure over Maine will circulate much colder than normal temperatures into southern New England on blustery northwest winds for the remainder of the work week.”

A few snow showers/squalls were possible on Wednesday, but “mainly dry weather prevails into Friday. Low pressure then tracks over or near southern New England this weekend bringing the chance for snow or mix rain/snow to the area.”

NWS said dry weather likely would return next week, but “a round of rain/snow showers is possible around Tuesday ahead of an Arctic front. Unseasonably cold temperatures may return the middle of next week.”

Traders put the pencil to the variable near-term weather conditions and evidence of a production turnaround and lifted futures.

Weather models Tuesday overnight continued to show eastern cold, but also incursions of warmth. In its Wednesday morning six- to 10-day outlook, MDA Weather Services said, the forecast was undergoing a mix of changes from Tuesday, “with the most notable change being a stronger push of cold air into the eastern U.S. mid-period.

“This comes as strong high pressure over central Canada presses toward the Northeast, with models showing good general consistency with this feature although highlighting further cold risk. Meanwhile, greater warming is noted across the south-central U.S., with Texas maintaining much above normal temperatures throughout the period. The West sees a cooler/wetter trend as ridging shifts to the Midcontinent and Pacific troughing advances in.”

MDA said risks to the forecast included models highlighting additional cold risk in the Northeast, as well as model differences with regard to how far south and west the mid-period cold airmass progresses.

Analysts expect declining production to make a gradual turnaround.

“Further evidence of a gradual production rebound can be found in the slow erosion of the year-on-year production deficit,” said industry consultant Genscape Inc. Wednesday’s Spring Rock Daily Pipe Production estimate “has enabled that year-on-year deficit to drop below 1 Bcf/d for the first time since late January.”

Spring Rock’s estimate for Wednesday production was 71.7 Bcf/d. “This brings the rolling 30-day average to 71.58 Bcf/d, about 0.91 Bcf/d below last year’s average for the same 30-day period.”

In spite of increasing production analysts see a balanced market.

“If our exports of natural gas hadn’t been growing, we would have a much more serious glut of gas than we have,” said Steve Blair, vice president at Rafferty Technical Research in New York.

“For this moment in time the market is balanced. You are not seeing any huge downside moves, or are we seeing upside moves. We are looking at a market that is trading back and forth consistently.”

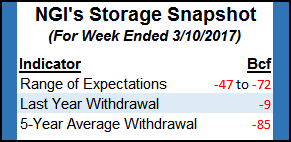

Thursday’s Energy Information Administration storage report will let traders see how balanced the market is. Last year 9 Bcf were withdrawn, and the five-year average stands at an 85 Bcf pull. This week’s estimates are falling in the middle.

Ritterbusch and Associates forecasts a 52 Bcf withdrawal, and ICAP Energy is expecting a 57 Bcf pull. A Reuters survey of 20 traders and analysts showed an average 56 Bcf with a range of -47 Bcf to -72 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |