Late-Winter Cold Blast Lifts Weekly NatGas Prices At All Points; Futures Crack $3

Prompted by weather forecasts through the week of cooler temperatures to come, weekly natgas prices posted healthy gains. Severe storms and cold were forecast to pummel the Northeast, and many market points in New England made gains close to $1.

The NGI Weekly Spot Gas Index added 28 cents to $2.78, and the individual point showing the greatest advance was Algonquin Citygate with a rise of 92 cents to average $4.33. Gas priced at the SoCal Citygate was the week’s laggard with a gain of just a nickel to $2.83.

Regionally the Northeast was the week’s biggest mover with a rise of 76 cents to $3.65,and California points moved the least, advancing 11 cents to $2.76.

The Rocky Mountains didn’t do much better than California and rose 14 cents to average $2.51, and three regions, the Midwest, South Louisiana, and Midcontinent all added 19 cents to $2.80, $2.70, and $2.62, respectively.

East Texas and South Texas were both higher by 22 cents to $2.73 and $2.72, respectively and Appalachia rose 27 cents to $2.46. The Southeast came in 32 cents higher to average $2.90.

April futures for the week ventured just north of the psychological $3 mark by adding 18.1 cents and finishing at $3.008.

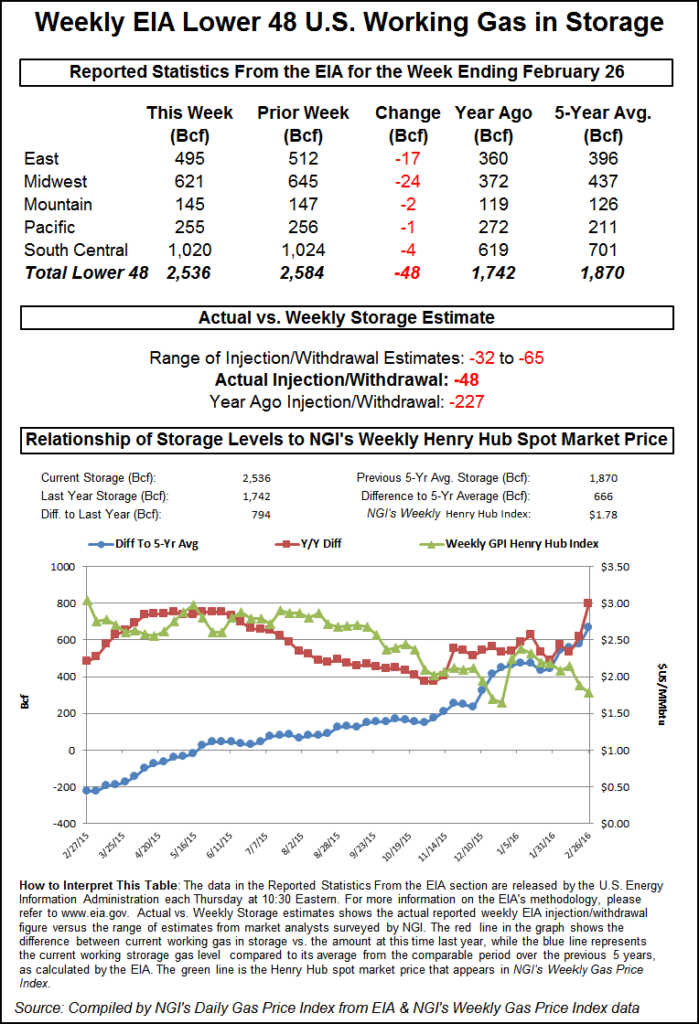

Thursday saw the Energy Information Administration (EIA) report a 68 Bcf storage withdrawal for the week ending March 3 in its 10:30 a.m. EST release, but 4 Bcf of that represented a reclassification of working gas to base case. The implied flow, however, of 64 Bcf was still about 3 Bcf greater than industry estimates.

Prior to the report, Ritterbusch and Associates was looking for a 54 Bcf withdrawal. A Reuters survey of 18 traders and analysts showed an average 61 Bcf pull with a range of -51 Bcf to -77 Bcf. Last year 63 Bcf was withdrawn and the five-year pace is for a 136 Bcf pull.

“It looks like the market has the potential to test the $3.01 level, and the possibility to ‘pop the top’ [$3.01] is there,” said a New York floor trader. “If it does that, I have a feeling it will be a bull trap. If it breaks back over $2.95, I think it tests the $3.01 area.”

“The 64 Bcf ‘implied flow’ figure was slightly more than the expected draw for last week, but the combined 68 Bcf reduction in total storage looks like somewhat more of a bullish surprise,” said Tim Evans of Citi Futures Perspective. “While much more supportive than last week’s 7 Bcf build, this report was still bearish compared with the five-year average 132 Bcf draw for the date.”

BMO Capital Markets Analyst Randy Ollenberger also saw the storage withdrawal as somewhat bullish.

“We believe the storage report will be viewed as slightly positive,” he said. “Storage is trending below last year’s levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 summer injection season, assuming normal weather.”

In spite of the draw being well below the five-year average, others also see a positive tone to the market as long as weather behaves itself.

“The EIA reported a storage draw of 68 Bcf, leaving storage about 360 Bcf (about 19%) above average, and providing a shift back towards normal a week after the first ever February injection,” said Jefferies analyst Zach Parham in a note to clients. “Last week, we reduced our 2017 natural gas price forecast to $3.15/MMBtu (from $3.50/MMBtu) as warm weather in January/February pushed storage levels above average. We remain bullish longer term ($3.50/MMBtu 2018-plus forecast) on tighter supply/demand balances (excluding weather).”

Inventories now stand at 2,295 Bcf and are 192 Bcf less than last year and 363 Bcf greater than the five-year average. In the East Region 18 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 29 Bcf. Stocks in the Mountain Region fell 7 Bcf, and the Pacific Region was down 4 Bcf. The South Central Region dropped 10 Bcf.

In Friday’s trading buyers for weekend and Monday natural gas were taking no chances as forecasts of cold and snow across the Upper Great Lakes and New England as far south as Philadelphia brought buyers off the bench.

Gains east of the Continental Divide were hefty and widespread, and only a few points traded in negative territory. Prompted by multi-dollar gains in New England, the NGI National Spot Gas Average jumped 36 cents on Friday to $3.25.

Gains in the futures arena were far less exuberant, but spot futures managed to build on opening strength Friday and finish just over $3. At settlement, April was up 3.4 cents to $3.008 and May had risen 2.8 cents to $3.074. April crude oil continued its losing ways, falling another 79 cents to $48.49/bbl.

The forecast cold was expected to hit Chicago and points east to New York and New England. Forecaster Wunderground.com predicted that the high Friday in Chicago of 31 degrees would ease to 30 by Saturday before rising to 34 on Monday, 10 degrees below normal. Pittsburgh’s Friday peak of 33 was anticipated to slide to 28 by Saturday before recovering to 42 Monday, still 6 degrees below normal. New York City was forecast to see its 46 high on Friday drop to 29 by Saturday and work back to 32 on Monday, 16 degrees below its seasonal norm.

Gas at the Algonquin Citygate Friday vaulted $1.98 to $7.92, and gas on Iroquois, Waddington jumped $2.33 to $6.32. Deliveries to Tenn Zone 6 200L soared $2.06 to $7.62.

Not to be outdone, gas bound for New York City on Transco Zone 6 added $2.79 to $5.93, and packages on Tetco M-3 Delivery were quoted at $4.04, up $1.20.

[ Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes ]

“A pattern change will cause a temperature shift late this week and into the weekend,” said Wunderground.com meteorologist Linda Lam. “This shift will allow arctic cold to return to parts of the Midwest and Northeast and will bring warmer temperatures to the Southwest. This change is due to the jet stream. A southward dip in the jet stream, or upper-level trough, is expected to develop over parts of the East. This will allow colder temperatures to slide southward into portions of the Midwest and East.”

Other market centers firmed Friday, but gains were far less than those in the Northeast. Gas for weekend and Monday delivery at the Chicago Citygate rose 4 cents to $2.95, and deliveries to the Henry Hub added 15 cents to $2.98. Packages at Opal changed hands 8 cents higher at $2.66, and gas delivered to the PG&E Citygate fetched $3.22, up 6 cents.

U.S. operators went pedal-to-the medal and added 12 rigs for the week, but in Canada not so much. The United States added nine land-based rigs along with one in the inland waters and two in the offshore to make for a net U.S. gain of one-dozen rigs, according to Baker Hughes Inc. (BHI) in its report for the week ending March 10.

The U.S. gain was more than undone by the loss of 20 rigs in Canada, causing North America to end the week with eight fewer rigs than the previous week.

Eight U.S. oil rigs came back, accompanied by five natural gas rigs; one “miscellaneous” rig left action. Six of the 12 returning U.S. rigs were horizontal units and six were verticals

Short-term traders like the market. “We’ve got some cold weather coming in, and it might get up to $3.15 to $3.18. Maybe $3.25,” said a New York floor trader.

“I like the market as a short-term ‘buy.’ I would buy it here for a move to $3.15 to $3.18. At $3.15 I would take my profits, but not necessarily go short. I think it’s a nice short-term rally and can sustain itself as long as there is some cold weather around.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |