Infrastructure | E&P | NGI All News Access

PennEast Pipeline Backers Undeterred by Possible PSEG Sale

New Jersey-based PSEG Power LLC’s decision to explore the sale of its minority stake in the PennEast Pipeline hasn’t discouraged the market-pull project’s other backers.

“The fact that PSEG will remain a customer reinforces that the PennEast Pipeline is a key piece of infrastructure necessary to serve area families and businesses,” said PennEast spokesperson Patricia Kornick. PSEG confirmed Thursday that it hopes to sell its 10% stake in the nearly $1 billion project to focus on its utility business.

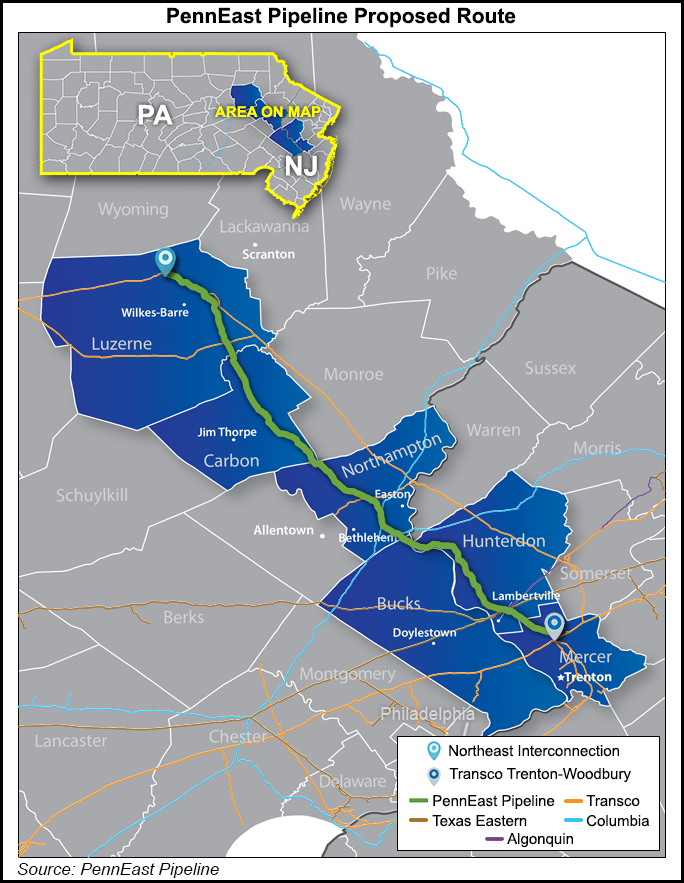

The 120-mile greenfield project would transport 1.11 million Dth/d of Marcellus Shale natural gas to markets in Pennsylvania and New Jersey. About 990,000 Dth/d of capacity has mostly been secured by utilities. PSEG has committed to 125,000 Dth/d, and company President Bill Levis said it will remain a customer.

“This project will provide PSEG customers with greater and more reliable access to affordable natural gas,” he said. “…We’ve decided to put our focus on our core business — constructing three new combined cycle plants and running our diverse fleet of generation plants.”

PennEast was announced in August 2014. The pipeline is a joint venture owned by AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); New Jersey Resources’ NJR Pipeline Co. (20%); South Jersey Industries’ SJI Midstream LLC (20%); UGI Energy Services LLC’s UGI PennEast LLC (20%); Enbridge Inc. (10%), and PSEG. The partnership is managed by UGI Energy Services.

Earlier this year, FERC said it needed more time to consider additional environmental information and pushed back the project’s final environmental impact statement from Feb. 17 to April 7. Days later, former Commissioner Norman Bay resigned and left the Federal Energy Regulatory Commission (FERC) without a quorum that could adversely impact projects with pending applications such as PennEast. It was reported this week that President Trump could nominate up to three commissioners to fill vacant seats.

Environmental groups opposed to the project hailed the news that PSEG wants to sell its stake.

“PSEG’s move to exit is significant, shows this project is in trouble and reflects the growing opposition, delays and mounting problems with the project,” said Tom Gilbert, campaign director of ReThink Energy NJ, which was launched by the New Jersey Conservation Foundation, the Stony Brook Millstone Watershed Association and the Pinelands Preservation Alliance. Those organizations oppose fossil fuels in favor of more renewable energy sources.

PennEast has grappled with opposition to the project, spending considerable time justifying it and responding to critics. Kornick said PSEG’s decision is a “relatively typical business activity across industry sectors” and said it won’t deter the project’s backers.

“PennEast remains on schedule and looks forward to receiving in April FERC’s final environmental impact statement, followed by an anticipated favorable FERC order that will enable the PennEast Pipeline to be operational in the second half of 2018,” she said. A PSEG sale would have to be approved by the PennEast board.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |