Markets | NGI All News Access | NGI Data

$3 Within Sight as Bulls Relish Supportive NatGas Storage Stats

Natural gas futures scooted higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what the market was expecting.

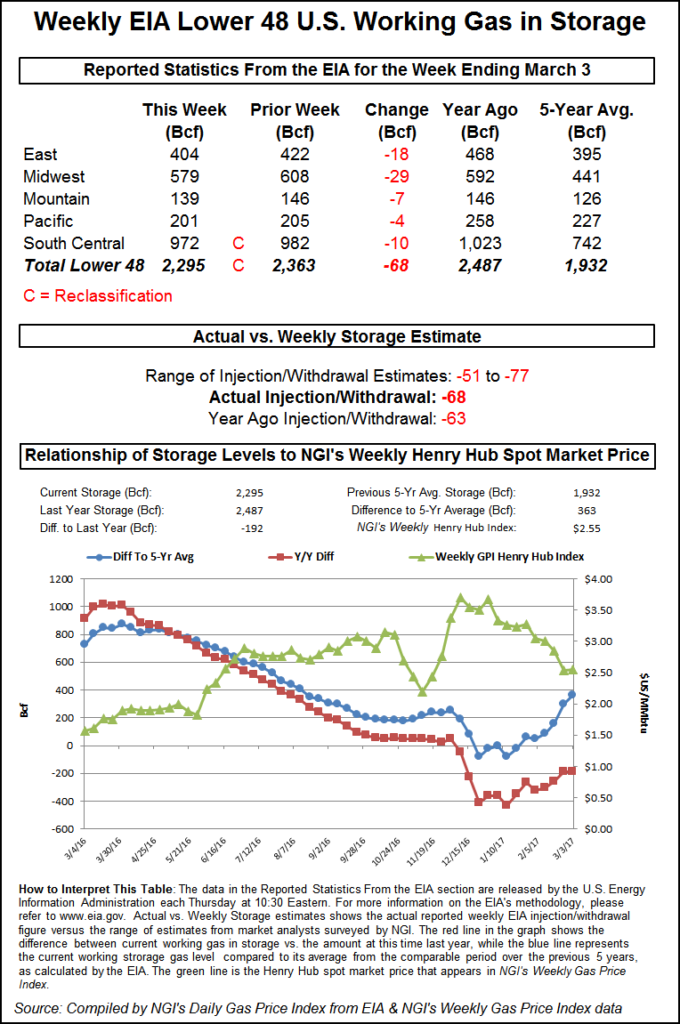

EIA reported a 68 Bcf storage withdrawal for the week ending March 3 in its 10:30 a.m. EST release, but 4 Bcf of that represented a reclassification of working gas to base case, thus making the actual flow 4 Bcf less. The implied flow, however, of 64 Bcf was still about 3 Bcf greater than industry estimates. March futures rose to $2.976, and by 10:45 a.m. March was trading at $2.949, up 4.8 cents from Wednesday’s settlement.

Prior to the report, Ritterbusch and Associates was looking for a 54 Bcf withdrawal. A Reuters survey of 18 traders and analysts showed an average 61 Bcf pull with a range of -51 Bcf to -77 Bcf. Last year 63 Bcf was withdrawn and the five-year pace is for a 136 Bcf pull.

“It looks like the market has the potential to test the $3.01 level, and the possibility to ‘pop the top’ [$3.01] is there,” said a New York floor trader.

“If it does that, I have a feeling it will be a bull trap. If it breaks back over $2.95, I think it tests the $3.01 area.”

“The 64 Bcf ‘implied flow’ figure was slightly more than the expected draw for last week, but the combined 68 Bcf reduction in total storage looks like somewhat more of a bullish surprise,” said Tim Evans of Citi Futures Perspective. “While much more supportive than last week’s 7 Bcf build, this report was still bearish compared with the five-year average 132-Bcf draw for the date.”

BMO Capital Markets Analyst Randy Ollenberger also saw the storage withdrawal as somewhat bullish.

“We believe the storage report will be viewed as slightly positive,” he said. “Storage is trending below last year’s levels and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 summer injection season, assuming normal weather.”

Inventories now stand at 2,295 Bcf and are 192 Bcf less than last year and 363 Bcf greater than the five-year average. In the East Region 18 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 29 Bcf. Stocks in the Mountain Region fell 7 Bcf, and the Pacific Region was down 4 Bcf. The South Central Region dropped 10 Bcf.

Salt Cavern storage was down 7 Bcf at 326 Bcf and non-salt storage was lower by 3 Bcf to 646 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |