E&P | NGI All News Access | NGI The Weekly Gas Market Report

Mexico’s Tampico-Misantla Holds Potential as Global Onshore ‘Super Basin,’ Says IHS Markit

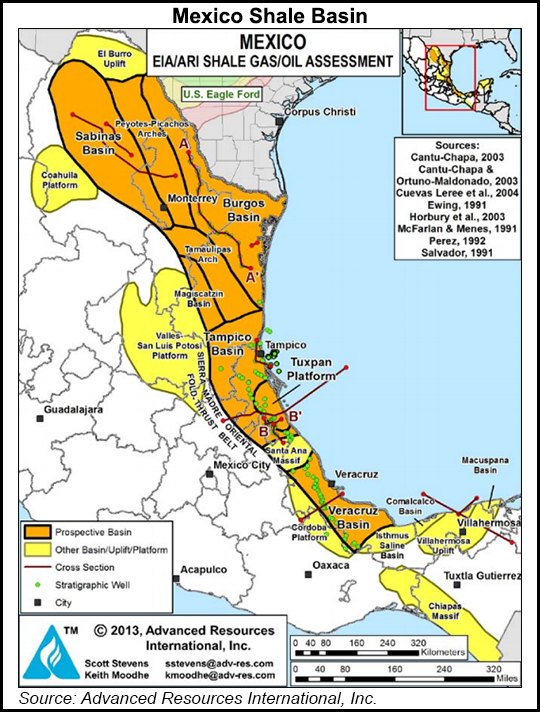

The Tampico-Misantla Basin, which extends across east-central Mexico into the shallow waters of the Gulf of Mexico, may be one of 24 global onshore “super basins,” much like the Permian Basin with its myriad reservoirs and multiple source rocks, according to IHS Markit.

In an analysis using the IHS Markit Basin Insights Service, researchers said the super basins have multiple reservoirs and source rocks, diverse play types across several geologic horizons, infrastructure with access to markets and established service sector/supply chains. The report was published last week in advance of CERAWeek by IHS Markit, which is being held in Houston this week.

“In searching for super basins, we looked for at least 5 billion boe in conventional remaining reserves in basins that had already produced at least 5 billion boe,” said IHS Markit’s Robert Fryklund, chief upstream strategist and a lead author of the report. “We did a global assessment of basins where our study criteria existed — looking for basins with multiple plays and at least two mature source rocks — basically basins that keep on giving and giving. Existing production indicates that there is extensive existing infrastructure.”

The Tampico-Misantla Basin has been producing oil since the early 1920s and it has all of the super basin characteristics, Fryklund said.

“In many ways, it may well mirror America’s model super basin — the ever-resilient Permian Basin.”

In its analysis of the Permian, the authors looked at the current view of the estimated ultimately recoverable (EUR) resources then compared the current figure with a prior estimate in 2000, about 10 years before the unconventional drilling boom in West Texas and southern New Mexico began. In 2000, the Permian’s EUR was 35 billion bbl of oil.

“Remarkably, the current view is 104 billion bbl, almost three times the previous estimate — and some put the number higher,” the authors said.

What sets the Permian apart is the ability to target smaller oil and gas horizons and attack as many as 45 stacked pay zones, which have driven significant EUR increases, the analysis said.

The three-fold uplift for the Permian prompted IHS Markit upstream specialists to look at other basins outside the United States to assess where governments could take advantage of similar basins to get more out of their existing production areas, Fryklund said.

“While IHS Markit does not expect the same dramatic increase in production in other basins as witnessed in the Permian, the Tampico-Misantla Basin fits the study’s definition of a ‘super basin.’ It has produced 7.4 billion boe (mostly oil). It still has 5.2 billion boe in discovered conventional fields, which does not take into account the basin’s unconventional potential.” Mexico’s state-owned Petroleos Mexicanos (Pemex) haseyed the basin for its unconventional potential since at least 2012.

Researchers identified 23 conventional reservoir horizons in the Tampico-Misantla, with three mature source rock formations — Agua Nueva, Huayacocotla and Pimienta. The Upper Jurassic Pimienta formation is a source rock that correlates with the Cotton Valley-Bossier-Haynesville in East Texas, Raymond James & Associates Inc. noted last September.

At least two of the Tampico-Misantla source rocks, Agua Nueva and Pimienta, are “potential shale reservoirs,” Fryklund said.

An evaluation of the Agua Nueva and Pimienta shales for shale oil resource potential resulted in an estimate of 3.8 billion boe of technically recoverable resource. The Pimienta Shale has not been tested in the Tampico-Misantla, but it has been tested in eight other wells in the Burgos and Sabinas basins, where it flowed natural gas, he said.

The Mexican basin also is under-explored, with the last discovery in 1988. Relatively few discoveries surpass 100 million boe, but there could be as much as 2.5 billion boe in the basin’s multiple unconventional fields, the authors said. Most are likely to be relatively tight reservoirs that maybe benefit from horizontal drilling.

“Between the remaining reserves in existing fields, conventional exploration potential, and opportunities in shale and other tight reservoirs, the basin offers something for everyone — a diversity of upstream opportunities for large and small companies, national oil companies and investors,” Fryklund said.

However, while the resource potential is promising, turning the Mexican formations’ oil and gas into proven reserves may be a big challenge.

“The local service sector infrastructure would need substantial investment,” Fryklund said. “We at IHS Markit believe that the investment capital is available if there is clarity around the investment opportunity.”

With a relatively high-cost structure for horizontal drilling activity, the current fiscal terms “are inadequate to offset the higher costs associated with the preliminary phases of development of tight reservoirs,” according to IHS Markit. The fiscal terms govern entitlements in the basin for Pemex, which currently is the only producer working there.

Pemex faces financial and technical challenges to develop the basin’s full potential, said IHS Markit’s Alejandra Leon, Mexico energy analyst.

“Increasing resources and capabilities beyond Pemex is critical for developing the basin,” Leon said. “The challenge is to increase the number of qualified operators investing in the basin and improve the fiscal terms. These changes could be achieved through at least two scenarios.” Mexico’s National Hydrocarbons Commission could redraw or repackage acreage and blocks “to create the scale needed” for synergies that would lead to success for this type of basin.

Mexico’s crude oil production, still the main financial vehicle for the federal budget, also continues to decline. IHS Markit’s Carlos Pascual, senior vice president for global energy one of the super basin study authors, said the country is unlikely to see 2.5 million b/d under current fiscal conditions.

“Another key factor favoring Tampico-Misantla is timing, which could be very constructive for Mexico,” Pascual said. The basin “could help offset a declining Mexican production supply profile in the near- to medium-term, much like the Permian Basin has done for the U.S. The potential to get near-term results could bring big benefits to government revenue, the local services sector and employment.”

The cycle time to generate related oil and gas volumes in Mexico’s deepwater Gulf of Mexico may not be achieved until the mid-2020s and beyond.

“Tampico-Misantla offers a near-term opportunity that could positively impact the Mexican economy in the current oil-price environment,” Pascual said. “There are other significant risks to attracting investors in Tampico-Misantla, including security and aging infrastructure, which should not be underestimated. Still, if the government takes positive steps to address the needed terms for unconventional exploration and production, the potential is significant.”

Said Fryklund, “Exploration and appraisal of unconventional and tight conventional resources is a critical component to sustaining long-term production, and the Tampico-Misantla Basin is a potential source of significant discovered resources that could make the difference for Mexico.

“While the government has several challenges to address it also has the power and authority to resolve those challenges, at least in some areas, and to chart the path for the next phase of development for this super basin.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |