E&P | Mexico | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

U.S. Gas Exports to Mexico Climbed Last Year as Pemex Drilling Declined

Mexico’s Petroleos Mexicanos (Pemex) reported a smaller financial loss for 2016 than 2015. Natural gas production also declined while imports from the United States climbed.

Pemex reported a net loss of 296 billion pesos (ca. $14.3 billion) for the year, smaller than the 713 billion pesos it lost in 2015. Pemex CEO José Antonio González, appointed a year ago by president Enrique Peña, and his team have managed to slow the hemorrhage, but a lot more still needs to be done.

As concerns Pemex’s natural gas production, the decline accelerated in 2016. Production went from an average of 5.50 Bcf/d in 2015 to 4.87 Bcf/d in 2016, down 11.6%. Almost three-quarters of production, 74.3%, was associated gas.

Production during the fourth quarter of 2016 reached only 4.58 Bcf/d, due to a 10.9% decline in associated gas, and a 24.8% natural decline in non-associated gas fields in the Veracruz and Burgos basins.

The number of non-associated gas wells declined from 3,483 in the last quarter of 2015 to 3,146 for the same period in 2016, which caused the share of onshore production to shrink from 64% to 52%, year on year, while offshore increased from 36% to 48%.

Pemex’s investment in new wells reflected the company’s financial straits. For 2016, Pemex finished 149 wells, compared to 312 a year before, a 52.2% drop. The fourth quarter of 2016 saw only 25 new wells finished, compared to the 68 a year prior.

Despite the decline in production, Pemex vented more gas in 2016, 511 Mcf/d, compared to 2015 when it vented 436 Mcf/d.

An accident in the Abkatún-A platform in February was largely responsible for this increase, the company said. Yet quarterly figures show how, by the fourth quarter, venting had dropped below the level of a year prior, 420 Mcf/d vs 440 Mcf/d.

Natural gas processing saw a steep decline year over year, from 4.07 Bcf/d to 3.67 Bcf/d, on average, or a 9.9% drop. Similarly, dry gas production shrank 10.6% year on year, from 3.4 Bcf/d in 2015 to 3.05 Bcf/d in 2016, on average.

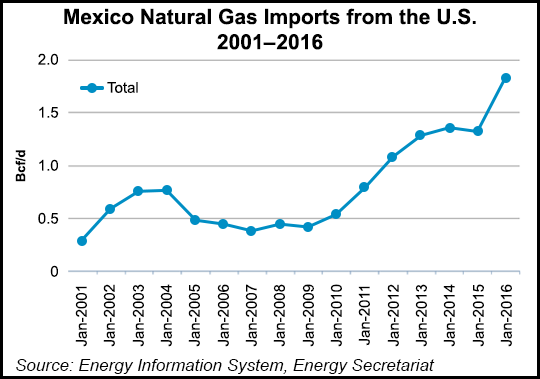

The decline in domestic production necessitates increasing imports to meet demand. Per the Energy Ministry’s energy information system, pipeline imports from the United States rose from an average of 1.33 Bcf/d in 2015 to 1.83 Bcf/d in 2016. Imports represent, then, 60% of domestic supply and just over 35% of total consumption, but they are rising fast.

For example, imports for January 2017 topped 2 Bcf/d, which represents a 35.2% increase from the previous January. Indeed, this 2 Bcf/d figure had previously been seen only during the top demand months of August, September and November of last year.

However, continued growth of natural gas imports is also predicated on the Mexican economy pulling ahead. With the Central Bank on Wednesday lowering its forecast for 2017 to 1.8% growth, even cheap natural gas from Texas will have a hard time finding eager customers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |