Markets | NGI All News Access | NGI Data

NatGas Futures Probe Lower Following Historic February Storage Injection

April natural gas futures posted a new low for the day Thursday morning after the Energy Information Administration (EIA) reported an unprecedented February storage build, which was greater than the small withdrawal that most in the market were expecting.

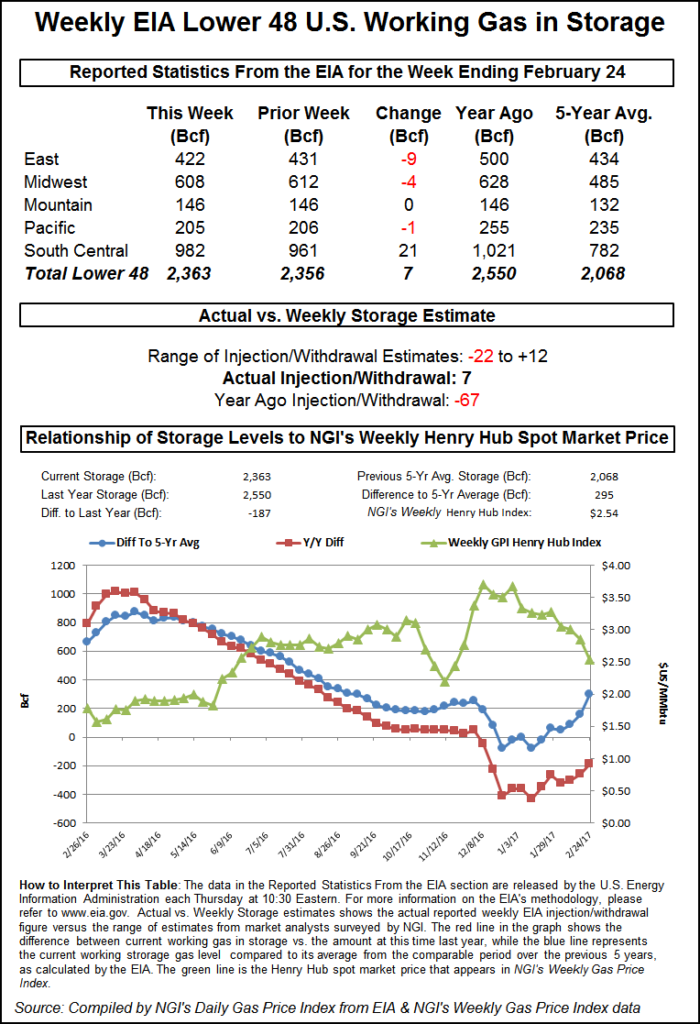

EIA reported a 7 Bcf storage injection in its 10:30 a.m. EST release for the week ending Feb. 24, about 11 Bcf greater than industry estimates. April futures fell to $2.730, and by 10:45 a.m. April was trading at $2.763, down 3.6 cents from Wednesday’s settlement.

According to EIA data, the only other time there was an injection in the months of December, January or February since 2010 was for the week ending Dec. 7, 2012, which saw an injection of 2 Bcf.

“Everybody was thinking -4 Bcf to -6 Bcf, and traders took it down and brought it right back,” a New York floor trader told NGI. “That seems to be the case most of the time. We see whether the number is off the mark, and then after 15 to 20 minutes it comes right back to where it was.”

“The 7 Bcf build in storage for last week was at the bearish end of the range of expectations and reportedly a first for February,” said Tim Evans of Citi Futures Perspective. “This was a bearish surprise that also points to some weakening in the overall supply-demand balance that may have implications for the reports to follow.”

Others see more bullish implications. “We believe the storage report will be viewed as slightly negative,” said Randy Ollenberger of BMO Capital Markets. “However, storage is trending close to five-year average levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 summer injection season, assuming normal weather.”

Heading into the report, Kyle Cooper of IAF Advisors estimated a 2 Bcf build, and ICAP Energy was expecting a withdrawal of 4 Bcf. A Reuters survey of 24 industry traders and analysts revealed an average 4 Bcf withdrawal with a range of +12 Bcf to -22 Bcf.

Inventories now stand at 2,363 Bcf and are 187 Bcf less than last year and 295 Bcf greater than the five-year average. In the East Region 9 Bcf was withdrawn and the Midwest Region saw inventories decrease by just 4 Bcf. Stocks in the Mountain Region were unchanged, and the Pacific Region down by 1 Bcf. The South Central Region grew by 21 Bcf.

Last year 67 Bcf was withdrawn and the five-year pace is for a 132 Bcf pull.

Salt Cavern storage was greater by 5 Bcf at 333 Bcf and non-salt storage was up 16 Bcf to 649 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |