Infrastructure | NGI All News Access

OGE Energy Looks to Organic Utility Growth; Unsure of CenterPoint’s Future in Midstream MLP

Oklahoma City-based OGE Energy Corp. will look to organic utility opportunities as opposed to acquisition for its future growth, and is unsure what its 50% general partner in a midstream master limited partnership (MLP) intends to do regarding a possible sale, CEO Sean Trauschke told analysts during an earnings conference call Thursday.

While the combination utility is confident it has a lot of investment opportunities around its electric utility grid, Trauschke also talked bullishly about the oil/natural gas midstream MLP, Enable Midstream Partners LP. General partner CenterPoint Energy Inc. has extended its option to sell its 50% interest until June 15, he said. Under the partnership agreement, CenterPoint has 120 days to find a better offer than the one from OGE and its partner, and if it does not, the sales process starts over again, Trauschke said.

OGE and an unnamed partner have offered to buy CenterPoint’s interest. CenterPoint has until June 15 to top that offer by 105%. Whatever happens with the interest, OGE is expecting future distributions from the MLP to increase, Trauschke said.

In regard to future growth plans for the utility and Enable, Trauschke said OGE is basically “a utility company that happens to own a piece of a midstream company in our service territory, but who we are and what we are is still a utility company, and all of our investments will be focused around utility type regulated assets.”

Last year, CenterPoint said it was considering selling its share of Enable. CenterPoint owns a 50% general partner interest and a 55.4% limited partner interest in Enable, which is a publicly traded MLP.

Enable recently reported net income attributable to its units in 4Q2016 was $59 million (14 cents/unit), compared to $65 million (15 cents) for 4Q2015. For all of 2016, profits were $290 million (68 cents), compared to a loss of $752 million (minus $1.78) for all of 2015.

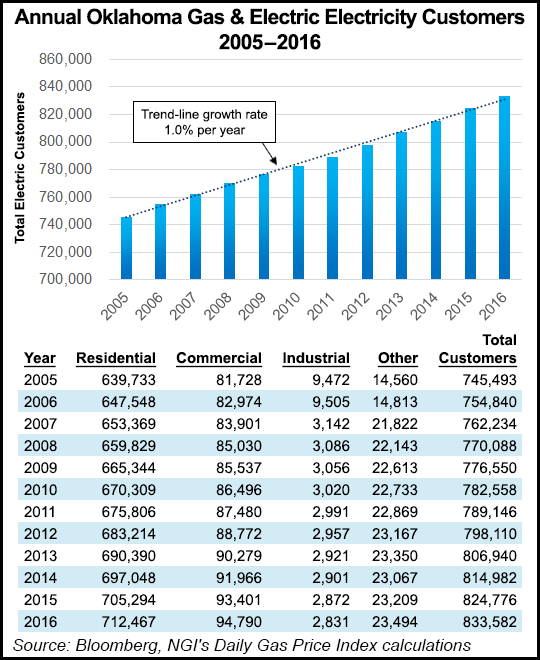

The results were reflective of a rebound in the oil/gas midstream sector last year, and Trauschke reported that the OGE utility experienced a similar boost, with 141 new utility customers for its oilfield load.

In 4Q2016, OGE net income was $57.9 million (29 cents/share), compared to $29.4 million (15 cents) for the same period a year earlier, and for all of 2016, net income was $338.2 million ($1.69), compared to $271.3 million ($1.36) for all of 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |