U.S. Shale Gale Blows Hard Across Canadian Border

U.S. natural gas merchants are catching up to the traditional Canadian champions of international trade in North American production, according to the latest trade scorecard compiled the United States Department of Energy (DOE).

U.S. exports hit 1.666 Tcf in the first nine months of 2016, or 74% of the Canadian total 2.263 Tcf, DOE said.

The agency’s 2016 third quarter report confirms a lasting trend of U.S. exports emerging as the hot growth item in North American gas trade since the onset of the “shale gale” of rising production with horizontal drilling and hydraulic fracturing.

When the new technology was just beginning to spread, Canada dominated the continental market with 2008 full-year exports of 3.8 Tcf — four times U.S. cross-border sales of 924 Bcf.

U.S. exports rose modestly to top 1 Tcf per year slightly in 2009 and 2010 then surged to 1.4 Tcf in 2011 and 1.8 Tcf as of 2015.

With three months of trade data remaining to be compiled and reported for 2016, the first three quarters of U.S. exports of 1.666 Tcf were up by 6% from 1.301 Tcf in the same period of 2015.

The Canadian pipeline exports of 2.263 Tcf during January through September last year were up by 11% from 2.034 Tcf in first three-quarters of 2015.

The U.S. pipeline export growth rate was twice as fast, with the 2016 first three quarters total of 1.557 Tcf up by 22% over 1.282 Tcf during the same period of 2015.

To pipeline deliveries into Canada and Mexico, U.S. gas merchants added dramatic results of breaking into overseas tanker exports of liquefied natural gas (LNG): 106.2 Bcf in the first three-quarters of 2016, up 672% from 13.8 Bcf a year earlier.

Canadian gas merchants have no prospect of entering the LNG trade any time soon due to fully supplied overseas markets and slow national and provincial regulatory regimes, according to a recent review of 20 Pacific Coast terminal projects by Moody’s Investor Services.

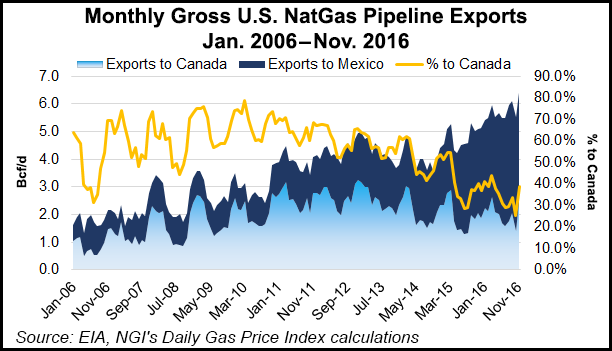

While LNG shipments only began, U.S. exports to Mexico stood out as the top volume growth item of international trade in North American gas production, jumping by 31% to 1.001 Tcf in the first three quarters of 2016 from 764.5 Bcf a year earlier.

U.S. pipeline exports to Mexico have more than doubled since 2011. Shipments to Canada have faded into a distant second-place destination for U.S. cross-border sales, at a volume of 555.9 Bcf in the first three quarters of 2016, up 7% from 517.5 Bcf in the same period of 2015.

Abundant supplies and vigorous sales competition held down average international prices in the first nine months of last year.

Canadian exports fetched US$1.94/MMBtu at the U.S. border, down 35% from US$2.98/MMBtu in first the three quarters of 2015.

U.S. exports to Canada averaged US$2.32/MMBtu in the first nine months of 2016, down 30% from US$3.30 in the same period of 2015.

U.S. LNG exports fetched a 2016 first nine-months average of US$4.61/MMBtu, down 39% from US$7.61/MMBtu a year earlier.

U.S. shipments to Mexico averaged US$2.46/MMBtu in first the three quarters of 2016, a drop of 17% from US$2.97/MMBtu a year earlier.

But the latest gas trade accounts suggest that prices are firming at least enough to slow the pronounced erosion of the traffic’s value in the first half of last year.

In the third quarter of 2016, the average price of U.S. exports, compared to the same 2015 period, dropped only 6.5% to US$2.69 in Canada and lost only 1.8% to US$2.86 in Mexico. The drop in the value of Canadian gas exports also slowed to 6.5% at a third quarter 2016 average of US$2.28/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |