Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Add A Few Pennies; EIA Stats Called Supportive

Physical natural gas traders laid low and got their deals done before the release of Energy Information Administration (EIA) storage data Thursday.

Producing Zones got ahead of Market Zones by a few pennies as near-term weather forecasts remained perched well above normal. The NGI National Spot Gas Average rose 3 cents to $2.41.

The Energy Information Administration (EIA) storage report made its typical grand entrance at 10:30 a.m. EST, and although prices staged a modest rally, they failed to breach previous highs and lows already established. At the close, March had added 2.5 cents to $2.617 and April had gained 4.8 cents to $2.749. April crude oil rose 86 cents to $54.45/bbl.

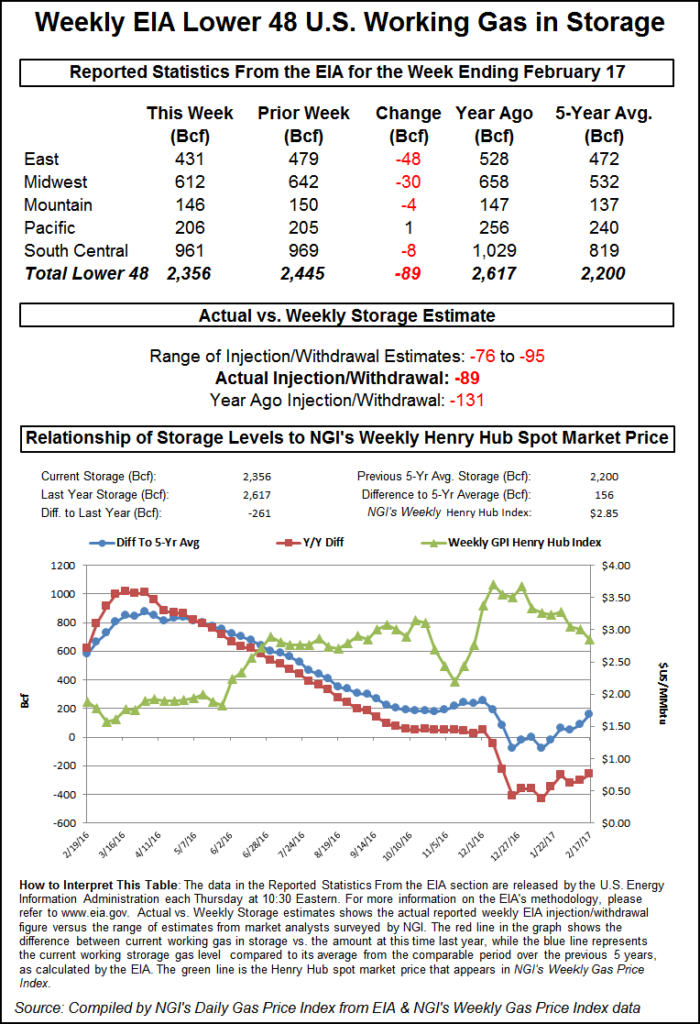

The storage figures were something of a surprise as the withdrawal was greater than what the market was expecting. EIA reported an 89 Bcf withdrawal, about 4 Bcf greater than industry estimates. March futures rose to $2.662, and by 10:45 a.m. March was trading at $2.651, up 5.9 cents from Wednesday’s settlement. March had established the session low in overnight trading at $2.569, and the session high at $2.704 before the release of the data.

“We were hearing an 88 Bcf withdrawal, but the action after the number came out was pretty uneventful,” a New York floor trader told NGI. “Things are so depressed in this market. Last week we were talking $3 holding, then $2.75, and now $2.50, and in the midst of winter.”

“The 89 Bcf figure was more than the consensus expectation for 81-85 Bcf in net withdrawals, and so supportive for prices,” said Tim Evans of Citi Futures Perspective. “At the same time, the draw was still well below the 158 Bcf five-year average, and so bearish on a seasonally adjusted basis, limiting the potential for price recovery.”

Inventories now stand at 2,356 Bcf and are 261 Bcf less than last year and 156 Bcf greater than the five-year average. In the East Region 48 Bcf was withdrawn and the Midwest Region saw inventories decrease by 30 Bcf. Stocks in the Mountain Region fell 4 Bcf, and the Pacific Region was up 1 Bcf. The South Central Region dropped 8 Bcf.

Last year 131 Bcf was withdrawn during the same week, and the five-year pace is for a 158 Bcf pull.

Wells Fargo analyst David Tameron called the report “slightly bullish [as] the 89 Bcf withdrawal was 8 Bcf above consensus, 28 Bcf below last year’s mark and 87 Bcf below the five-year average withdrawal of 176 Bcf.

“Through the first seven weeks of the year we’ve seen a cumulative withdrawal of 955 Bcf, well below last year’s 1,054 Bcf aggregate pull and the five-year average of 1,146 Bcf. Absolute storage levels are now 164 Bcf above the five-year average, as the smaller than normal cumulative withdrawal so far this year has more than erased the deficit created by a strong December.”

Randy Ollenberger with BMO Capital Markets said, “We believe the storage report will be viewed as slightly positive. Storage has dropped close to five-year average levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 summer injection season, assuming normal weather.”

Equity analysts maintained a bullish stance on tightening fundamentals, but noted weather-driven factors. “The EIA reported a storage withdrawal of 89 Bcf, well below both average and prior year levels,” said Zach Parham, an analyst with Jefferies LLC. “Year to date, dry gas production remains about 2.7 Bcf/d lower yoy and export growth (LNG, Mexico) remains strong (up about 2.5 Bcf/d). We remain bullish gas on tighter supply/demand fundamentals but acknowledge that weather headwinds have again created a storage overhang.”

Overnight weather models turned cooler. “[Thursday’s] six-10 day period forecast is colder or not as warm as yesterday’s forecast across the southern and eastern U.S.,” said forecaster WSI Corp. in a Thursday morning report to clients. “The West is warmer, especially late in the period. CONUS GWHDDs are up 1.4 to 90.6 for the period. These are [still] 32.7 below average.

“Any change with the timing and track of a storm system(s) can cause the forecast to waver. In general, the storm track offers some warmer risks across the eastern U.S. during Tuesday-Thursday. The south-central and eastern U.S. have some colder risks behind a cold front.”

For the week ending Feb. 23, there were hints of a possible injection — in February!

Preliminary Reuters figures showed an estimated range of a 7 Bcf build to a 25 Bcf withdrawal. The Desk showed a similar range, a 5 Bcf injection to a 25 Bcf pull.

In physical market trading a firm West was able to offset a weak East even though weather forecasts remained stubbornly above normal. AccuWeather.com forecast Thursday’s high in New York City of 65 degrees would rise to 66 Friday before easing to 64 on Saturday, 20 degrees above normal. Chicago’s 50 high Thursday was seen advancing to 58 Friday before plunging to 35 Saturday. The normal high in Chicago this time of year is 38.

Gas at the Chicago Citygate fell a penny to $2.58, and deliveries to the Henry Hub added 7 cents to $2.60. Gas at Northern Natural Northern Natural Demarc gained 11 cents to $2.50, and deliveries to Opal were quoted 7 cents higher at $2.40. Packages at the PG&E Citygate changed hands a nickel higher at $3.11.

Eastern points slumped. Gas at the Algonquin Citygate retreated 8 cents to $2.11 and deliveries to Iroquois, Waddington fell 15 cents to $2.45. Packages on Tenn Zone 6 200L fell 4 cents to $2.29.

Gas bound for New York City on Transco Zone 6 gave up 7 cents to $2.03, and gas priced on Texas Eastern M-3, Delivery shed 8 cents to $2.02.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |