Traders Mull Increasing Production; Physical NatGas Eases, March Adds 3 Cents

Physical natural gas for Thursday delivery took a minor loss while March futures took a minor gain in trading Wednesday. Temperature forecasts continued on the mild side, leaving little incentive for buyers to purchase incremental volumes, and in the same vein, futures traders saw little reason to pursue a bullish position with the market on the downside of the temperature demand slope.

The NGI National Spot Gas Average fell 4 cents to $2.38 as plump losses in the East were able to dominate points showing modest gains in the Midwest and Gulf. Futures for the moment are holding $2.55 support. At the close, March had risen 2.8 cents to $2.592, and April had gained 1.0 cents to $2.701. April crude oil shed 74 cents to $53.59/bbl.

As if market bulls didn’t have enough to deal with in the form of quickly evaporating heating degree days (HDD), analysts expect natural gas production to start increasing and build through the summer.

“Come this summer we expect to see higher volumes coming in,” said Genscape Inc. analyst Rick Margolin. He said he expected increases to start showing up within the next couple of weeks but there would be some seasonality in play, and the increase would be gradual.

“Our Spring Rock number for Tuesday [was] topping 72 Bcf/d, which is the first time we were at this level since early September,” he said. “This is fairly in line with what we were expecting. Month-to-date production is just under 71.5 Bcf/d, and November through January averaged 70.8 Bcf/d.

“We are already starting to see those numbers come back as we expected. We expect a rebound somewhere around the March-April time frame, although you have to be careful with maintenance season rubbing some of those volumes out.”

Gas production from the active oil plays in the Permian Basin is also expected to show increases.

“The rebound in crude prices helps Permian production, and from a gas perspective we are looking for Permian gas production this summer to come in nearly half a Bcf higher than last summer,” Margolin said. “There’s a pretty good amount of associated gas that can come out of that area. That should get us up to 6.2 Bcf/d for that whole summer strip.”

Tuesday overnight weather models showed a small loss in heating load.

“The forecast trends warmer along the northern tier and in the West while the South is mixed,” leading to a small loss in national gas-weighted HDDs when compared to Tuesday’s outlook, said MDA Weather Services in its Wednesday morning six- to 10-day outlook.

“The period averages with much above normal temperatures across the South, the southern Midwest and in the East, with strong ‘above’ peaks coming out ahead of low pressure on day seven in the Midwest and at mid-period along the East Coast. In an amplified pattern setup, troughing looks to continue providing a coverage of below normal temperatures in the West, where models are mixed on the cold’s intensity.

“Still warmer risks exist along the East Coast around mid-period and based on an increase in westerly flow ahead of low pressure. Risks remain mixed in the West.”

With March’s 27-cent nosedive on Tuesday, Tim Evans of Citi Futures Perspective saw the market “plumbing the lowest level for a nearby futures contract since November as the temperature forecast for the next two weeks trended warmer, further undercutting expected heating demand.”

The ongoing mild temperature forecasts have prompted estimates of decreased heating load in major market zones. The National Weather Service for the week ending Saturday (Feb. 25) has predicted triple-digit variances from normal for the East and Midwest.

New England is expected to see 154 HDDs, or 100 fewer than normal, and the Mid-Atlantic is anticipated to have 118 HDDs, or 117 fewer than its norm. The greater Midwest from Ohio to Wisconsin is forecast to have 105 HDDs, or 145 fewer than normal.

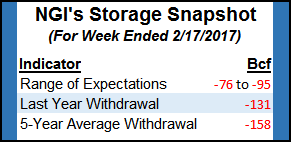

The year-ago Energy Information Administration storage report corresponding with this week’s showed that 131 Bcf was withdrawn, and the five-year average decline is 158 Bcf. This week’s report is expected to come in at about half the five-year pace.

IAF Advisors is calculating a pull of 80 Bcf, and ICAP Energy is looking for a withdrawal of 81 Bcf. A Reuters survey of 20 traders and analysts showed an average of an 85 Bcf decline, with a range of -76 Bcf to -95 Bcf.

Moderating temperature forecasts kept physical buyers sidelined. Wunderground.com forecast Wednesday’s high in Boston of 61 degrees would hold Thursday before sliding to 56 Friday, 16 degrees above normal. Chicago’s 60 max Wednesday was expected to slide to 46 Thursday before bouncing back to 58 Friday. The normal high in the Windy City this time of year is 38.

Gas at the Algonquin Citygate tumbled 48 cents to $2.19, and deliveries to Iroquois, Waddington skidded 13 cents to $2.60. Gas on Tennessee Zone 6 200 L was quoted 30 cents lower at $2.33.

Packages on Texas Eastern M-3, Delivery fell 20 cents to $2.10, and gas bound for New York City on Transco Zone 6 changed hands 22 cents lower at $2.10.

At the Chicago Citygates, next-day deliveries rose 2 cents to $2.59, and gas at the Henry Hub rose a penny to $2.53. Gas on El Paso Permian came in 7 cents lower at $2.24, and packages priced at the SoCal Citygate lost a penny to $2.82.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |