E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon Raises Meramec Inventory by 40%, Showboats Leonard Shale Potential in Permian

Devon Energy Corp more than doubled its rig count in the U.S. onshore between September and December and may nearly double it again by year’s end to accelerate unconventional activity, management said Wednesday.

The Oklahoma City-based independent was running six rigs at the end of September, but over the next three months it added seven more, mostly in the Meramec formation of Oklahoma and in the Permian Basin’s Delaware, where stacked spacing tests are underway ahead of spudding the Showboat project in the Leonard Shale.

So good are the prospects in the Permian and in Oklahoma’s Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (STACK), that each play could see eight to 10 rigs working by year’s end, CEO Dave Hager said during a conference call.

The downturn was difficult, but it gave Devon experts time to hone their drilling skills.

“For Devon, 2016 was a transformational year,” Hager said. “We successfully reshaped our asset portfolio to focus on our top two franchise assets,” which together provide a “sustainable, multi-decade growth platform.”

Overall, the onshore drilling programs “generated the best well productivity in Devon’s 45-year history,” a big boast for an entrenched North American oil and natural gas leader. Hager said the company “maximized the value of every barrel produced, with cost-reduction efforts that reached $1.3 billion of annual savings.”

Point of fact, U.S. operating expenses last year fell by 42% from peak rates in 2015.

U.S. Onshore Delineation Underway

A $3.2 billion asset divestiture program completed last year cushioned “financial capacity to further accelerate investment across our best-in-class U.S. resource plays in 2017 and beyond,” Hager said. “This increased drilling activity will continue to rapidly shift our production mix to higher-margin products, positioning us to deliver peer-leading cash flow expansion at today’s market prices.”

Estimated proved reserves from the retained portfolio rose 3% from 2015 to 2.1 billion boe; proved developed reserves accounted for 80%. Lease operating expenses (LOE) fell to $367 million in 4Q2016, 4% below the guidance midpoint.

By goosing the upstream spend, domestic oil volumes this year are forecast to jump 13-17% from 4Q2016. With more rigs in place, high-margin production restarted in January in Oklahoma and the Permian, designed to increase U.S. light-oil production by 20% between now and the end of 2018.

Devon’s oil output, which accounted for 45% of volumes, averaged 244,000 b/d in 4Q2016. Companywide, production reached 537,000 boe/d, exceeding the midpoint of guidance by 2,000 boe/d, even though Devon chose to reject about 12,000 b/d of ethane in the final quarter.

U.S. onshore output averaged 396,000 boe/d in the quarter. Most of the output came from three plays: the STACK, Delaware and Eagle Ford Shale assets. Initial production (IP) rates over 90 days in the United States increased for the fourth consecutive year, advancing more than 300% from 2012.

In Canada, heavy-oil output averaged 139,000 b/d net, with oil production overall increasing 14% year/year.

Showboating In Meramec

In the myriad Oklahoma reservoirs, net production averaged 88,000 boe/d in the final quarter, while full-year output jumped 37% from 2015. Liquids production rose 56% year/year. Two operated rigs were raised in 4Q2016, bringing the total rig count to six at year’s end.

Rig acceleration led to 16 Meramec wells being drilled in the final three months, but because of completions timing, only two operated wells achieved 30-day rates, averaging 1,600 boe/d.

With three successful operated spacing tests online and several others flowing back, Devon now is incorporating the data into its initial Meramec development, the Showboat project, which is expected to spud in the second half of this year.

The parent well on the Showboat lease was drilled in 2015, achieving a 30â€day rate of 1,750 boe/d, with cumulative firstâ€year production reaching an impressive 550,000 boe. With the initial Showboat development, Devon now is evaluating 15 wells in a single drilling unit, with plans to co-develop up to three different Meramec intervals.

“Additional appraisal and infill testing that is currently ongoing could lead to spacing as high as 20-30 wells per drilling unit in the future with the coâ€development of the Meramec and Woodford formations,” Hager said. Because of the “strong and repeatable economic results delivered to date across all fluid windows, coupled with initial infill spacing success, Devon is raising its resource potential in the Meramec.

“After adjusting inventory estimates to account for the shift to 10,000-foot laterals and tighter spacing assumptions, Devon is increasing its risked inventory in the Meramec to 1,700 undrilled locations,” equivalent to 2,800 standard-length locations. “When normalized to previous disclosures of 1,600 risked locations, which were predominately standard length, this revision represents an increase of roughly 40% in risked inventory.”

Devon has identified 4,300 unrisked drilling locations in the Meramec, or more than 7,000 “normalized” sites using 5,000-foot laterals. Also underway is the five-section Hobson Row in Canadian County within the Woodford Shale, which includes 40 wells drilled with average 5,000-foot laterals. Early average well results track “at or above” the estimated ultimate recovery type curve of 1.6 million boe/well.

Leonard Shale On TRAC

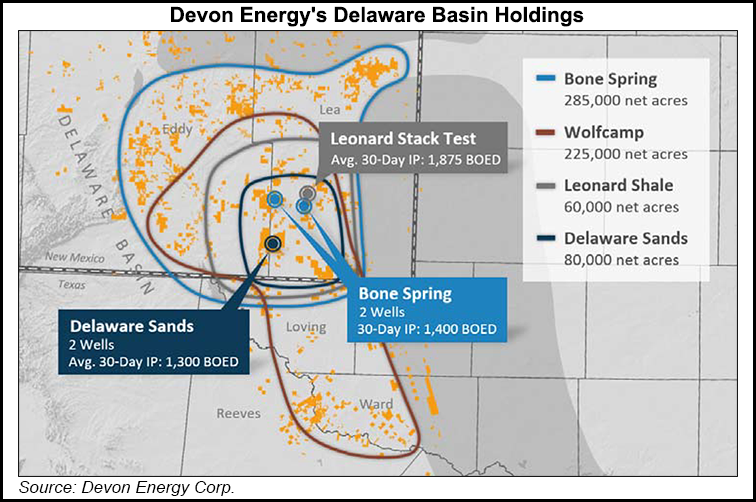

Meanwhile, net production in the Delaware averaged 54,000 boe/d in 4Q2016. To enhance cash margin, 2,000 b/d of ethane was rejected. Lease operating expenses declined to a record low of $7.42/boe, an improvement of 56% from peak rates in early 2015.

A stacked pilot in the Delaware was brought online testing 400-feet vertical spacing in the Thistle area of Lea County, NM, between Leonard Shale intervals B and C. The wells were drilled with 7,000-foot laterals and achieved peak 30-day rates averaging 1,875 boe/d at a cost of $6 million/well.

The learnings are to be applied to the initial TRAC development in 2017. Devon plans to drill a 10-well pattern across three Leonard intervals, which would test spacing of up to 19 wells per section. The risked drilling inventory has been raised to 950 gross locations, an increase of almost 20% from 2016.

Eagle Ford DUCs Falling

In the third rung of growth, the Eagle Ford, output averaged 60,000 boe/d net; 4,000 b/d of ethane also were rejected. The company brought online 35 wells, mostly tied to sales during December, with IP rates averaging 2,300 boe/d.

This year Devon and its partner plan to run as many as three rigs and invest $175 million of capital. Activity includes an initial Austin Chalk development pad in the upper part of the shale, scheduled to be online by the end of the year.

Devon exited the Eagle Ford with a drilled-but-uncompleted (DUC) well inventory of 70, which it expects to work down to 30-40 wells by December.

Besides boosting its drilling inventory and reducing costs, Devon turned around huge losses from a year ago, earning $331 million net (63 cents/share) in 4Q2016 versus a loss of $4.53 billion (minus $11.12). The company exceeded analyst consensus estimates by 20%. Operating cash flow was $536 million, and combined with proceeds received from asset sales, total cash inflows reached $1.8 billion.

The $1.1 billion sale of Access Pipeline in Canada added $28 million of incremental LOE during the quarter, while U.S. asset LOE costs improved by 42% from peak rates in early 2015, primarily driven by improved power and water-handling infrastructure, reduced labor expense and lower supply chain costs.

The company also improved general and administrative (costs with expenses down almost 40% from peak costs in late 2014. Lower overhead costs were driven by lower personnel expenses. Cost savings are expected to be “sustainable because of structural improvements and efficiency gains within its field operations and corporate support groups.”

Devon’s midstream business, operated through majority ownership (64%) EnLink Midstream, also generated $212 million of operating profit in 4Q2016. Midstream operating profits in 2017 are forecast to be $900-950 million, representing at the midpoint a 10% increase from 2016.

In 2017, with strong growth expected from EnLink, Devon projects its midstream operating profits will advance to a range of $900 million to $950 million. Based on the midpoint of guidance, this estimate represents approximately a 10 percent increase compared to 2016. EnLink’s growth is derived from an asset base that is positioned in some of the most attractive markets in North America, including the STACK, Midland Basin, Delaware Basin and an NGL business that services end-user demand along the Gulf Coast.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |