Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Noble Energy Targets DJ, Permian, Eagle Ford as U.S. Onshore Spending Increases by 90%

Noble Energy Inc. has raised its U.S. onshore organic investments for 2017 by 90% year/year, in a bid to raise drilling and completion activity in Colorado and Texas, the Houston-based super independent said Tuesday.

Oil and natural gas volumes, led by Colorado’s Denver-Julesburg (DJ) Basin, the Permian Basin’s Delaware sub-basin and the Eagle Ford Shale, are expected to be 5% higher in 2017. U.S. onshore oil volumes alone are forecast to jump nearly 30%.

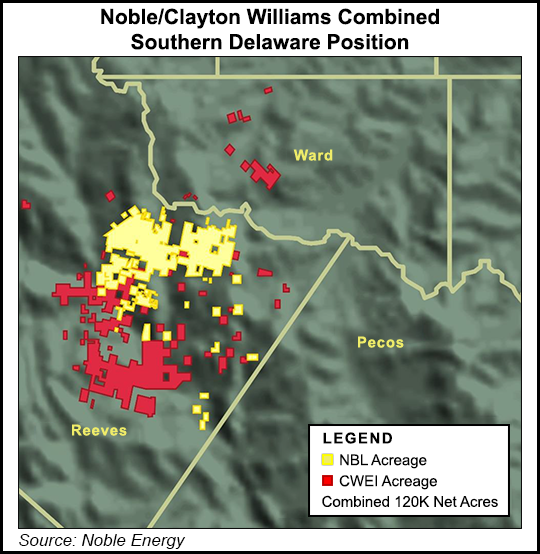

Adjusting for 2016 divestments and including volumes from the soon-to-be-completed $2.7 billion takeover of Clayton Williams Energy Inc., 2017 volumes are expected to be 415,000-425,000 boe/d, with oil volumes rising 9%.

Increased capital spending this year reflects rig additions in the DJ and Delaware, along with “higher intensity completions” in the two basins, CEO Dave Stover said during a conference call to discuss results.

Nearly 75% of this year’s capital expenditures (capex), about $1.8 billion are being allocated to U.S. onshore development — the DJ ($850 million), Delaware ($500 million) Eagle Ford Shale ($325 million) and Marcellus Shale ($150 million).

For the Eastern Mediterranean’s Leviathan natural gas project offshore Israel and the Gulf of Mexico, Noble is allocating 25% total, with Leviathan receiving the bulk. First gas from Leviathan is targeted for the end of 2019.

“We will continue to concentrate on long laterals and pad drilling, enhanced completions with higher proppant loadings and tighter stage and cluster spacing, as well as integrated facility design,” Stover said. “Our onshore portfolio provides some of the highest return opportunities in the U.S., and our 2017 capital plan positions us for significant value-added growth, near term and for many years to come.”

During 4Q2016, total volumes were 410,000 boe/d, 54% weighted to natural gas, 32% to crude oil and 14% natural gas liquids. Oil volumes climbed above expectations at 131,000 b/d, with the outperformance driven by the DJ and the deepwater Gulf of Mexico (GOM). U.S. sales volumes totaled 287,000 boe/d, with international sales volumes of 123,000 boe/d.

Noble ended last year with proved reserves of 1.4 billion boe, slightly higher year/year, with organic reserve replacement of “over 190% of 2016 production, for nearly 300 million boe of additions and performance revisions,” Stover said. “Even more impressive, total finding and development cost was less than $5.00/boe on an organic basis. Within the U.S. onshore, our increased activity outlook, along with performance improvements across all basins, led to an organic replacement of 280%…

“Essentially every one of our business units offset divestment impacts and price revisions” Stover said. “At the end of the day, the DJ Basin was up 13%, as was our combined Texas position.” Even in the Marcellus Shale, where Nobledissolved a joint venture with Consol Energy Inc. and divided the 669,000 acres and 1.07 Bcfe/d tied to the properties, production rose 10% from 2015.

During 4Q2016, DJ volumes averaged 112,000 boe/d, 68% weighted to liquids and 32% to natural gas. Horizontal production totaled 94,000 boe/d, with combined volumes for Wells Ranch and East Pony averaging 60,000 boe/d. Noble drilled 33 wells with average lateral lengths of 5,600-plus feet; production ramped up on 16 wells with average laterals of more than 8,400 feet. The company exited 2016 with two operated rigs and 41 drilled but uncompleted (DUC) wells.

In the Delaware, fourth quarter volumes rose 23% year/year to average 10,000 boe/d. Liquids represented 83% of volumes, with gas accounting for 17%. Four wells were drilled in the final three months with average laterals of 7,200 feet. Production ramped up on five wells with average laterals of 4,860 feet. Two rigs were added in the quarter, and there were 12 DUCs at year’s end.

Eagle Ford sales volumes averaged 46,000 boe/d in 4Q2016, weighted 59% to liquids and 41% to natural gas. Fourteen wells reached total depth in the quarter, eight in Gates Ranch with average lateral lengths of 6,400 feet. At the end of the year, two operated rigs were working and there were 30 DUCs.

Meanwhile, Marcellus Shale volumes averaged 500 MMcfe/d in the final period, 89% weighted to natural gas. And GOM volumes averaged 33,000 boe/d during 4Q2016, 46% higher year/year.

This year, Noble plans to average eight operated rigs across the U.S. onshore, exiting 2017 with nine rigs on average. A third operated rig in the DJ is to be added during 2Q2017. In Noble’s current Delaware leased area, the operated rig count was raised to three during 4Q2016 and should remain at that level through the year. Once the Clayton Williams acquisition is completed, a second operated rig is be added by midyear, with a third raised before the end of 2017.

Combined, the Delaware is expected to have six operated rigs working at year’s end. A one-rig program is planned in the Eagle Ford.

Noble expects to drill and begin production on about 225 U.S. onshore wells this year, average drilling lengths of 8,200 lateral feet. Nearly two-thirds of the planned wells would be in the DJ, more than half of those in Wells Ranch. In the Delaware, where about one-quarter of the wells are planned, most are to be drilled in the Wolfcamp A interval. Most of the Eagle Ford program is to focus on Gates Ranch wells, with “multiple” Upper Eagle Ford wells also scheduled.

The “primary focus” in 2017 is to accelerate development by improving capital efficiency gains and increasing activity, said Stover.

As production improves, the midstream business is expected to expand through majority owned Noble Midstream Partners LP, which was spun off last fall as a public entity. Noble Energy initially dedicated 300,000 net acres in the DJ to the midstream partnership, and once the Clayton Williams purchase is completed, 120,000-plus acres in West Texas would be dedicated as well.

Noble is planning its business “with a view that oil prices will remain in a range between $50 and $60/bbl for the next few years,” Stover said. “Despite the expected increase in U.S. onshore industry activity, when you step back and look at the global picture, I still see this as a reasonable range to plan our business. With this as a backdrop, I really like how we are positioned on the far left side of the cost curve in the U.S. with two huge oil plays onshore and substantial running room. Offshore are strong oil linked cash flows and huge international gas resources, which are ultimately linked to oil prices rather than U.S. gas, and provide further support.”

Noble has budgeted $120 million of its capex for midstream facility buildout, including central gathering facilities (CGF) and associated gathering lines for the DJ and Delaware.

Building out CGF in the Mustang area of the DJ is planned along with the first two CGFs in the Delaware.

Noble reported a net loss of $252 million (minus 59 cents/share) in 4Q2016, versus year-ago losses of $2.028 billion (minus $4.73). Adjusted incomewas $113 million (26 cents/share).

Fourth quarter lease operating expenses fell 9% year/year to $3.44/boe, led by lower unit costs in the DJ and GOM.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |