Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Weather On-Target Storage Data; March Adds 2 Cents

For the most part, traders of physical gas for Friday delivery elected to get deals done before the release of the often volatility-inducing Energy Information Administration (EIA) storage report.

Outside the Northeast prices moved within a few pennies of unchanged, and even with stout double-digit gains in New England the NGI National Spot Gas Average added just 6 cents to $3.13.

Volatility was not in the mix when the EIA announced a withdrawal of 152 Bcf in its weekly storage report, almost exactly what the market was expecting, and the total range on March futures was a miserly 7.9 cents. At the close, March had added 1.5 cents to $3.141 and April gained 1.3 cents to $3.209. March crude oil climbed 66 cents to $53.00/bbl.

Next-day gas along the Atlantic Seaboard jumped as forecasters predicted a one-day shot of cooler, messy weather. Wunderground.com forecast that the high Thursday in Boston of 39 degrees would drop to 21 Friday before bouncing back to 35 Saturday, 3 degrees below the seasonal norm. New York City’s 43 Thursday high was expected to fall to 29 before rising back to 40 on Saturday, the normal high.

Gas at the Algonquin Citygate gained 28 cents to $5.79, and deliveries to Iroquois, Waddington jumped 41 cents to $4.62. Packages on Tenn Zone 6 200L were quoted 35 cents higher at $6.03.

Gas bound for New York City on Transco Zone 6 added 44 cents to $4.94, yet gas on Texas Eastern M-3, Delivery fell 11 cents to $3.11.

The National Weather Service in southeast Massachusetts forecast that “a major winter storm will bring heavy snow to the entire region with blizzard conditions across southeast Massachusetts [Thursday]. High pressure builds in with drier colder air tonight through Friday night [and] two weather systems then affect U.S. over the weekend, bringing a chance of snow Saturday and rain or snow Sunday.”

Price changes at other market hubs were more subdued. Deliveries to the Chicago Citygate shed 2 cents to $3.00, and packages at the Henry Hub changed hands at $3.10, a nickel higher. In the nation’s heartland, gas on Panhandle Eastern added 5 cents to $2.83, and gas on Kern Receipt rose 9 cents to $2.86. Gas at the SoCal Citygate jumped 16 cents to $3.22.

Bulls take heart. Just because, from a market perspective, recent winter temperatures have basically fallen flat on their face, winter is far from over, at least in the Northeast, according to AccuWeather.com.

While the 2016-2017 winter to date has been largelythe winter that wasn’t for much of the country, cold weather is expected to grab hold of the northern tier of the United States well into spring.

Northeast population centers can expect rain and snow through mid-March, and that will keep a lid on temperatures, according to Paul Pastelok, AccuWeather.com lead long-range forecaster.

“As far as a significant warmup goes in the Northeast, I think you have to hold off until late April and May,” Pastelok said.

The March natural gas futures contract lost a portion of its opening strength Thursday morning after EIA reported a storage withdrawal that was about in line with what traders were expecting.

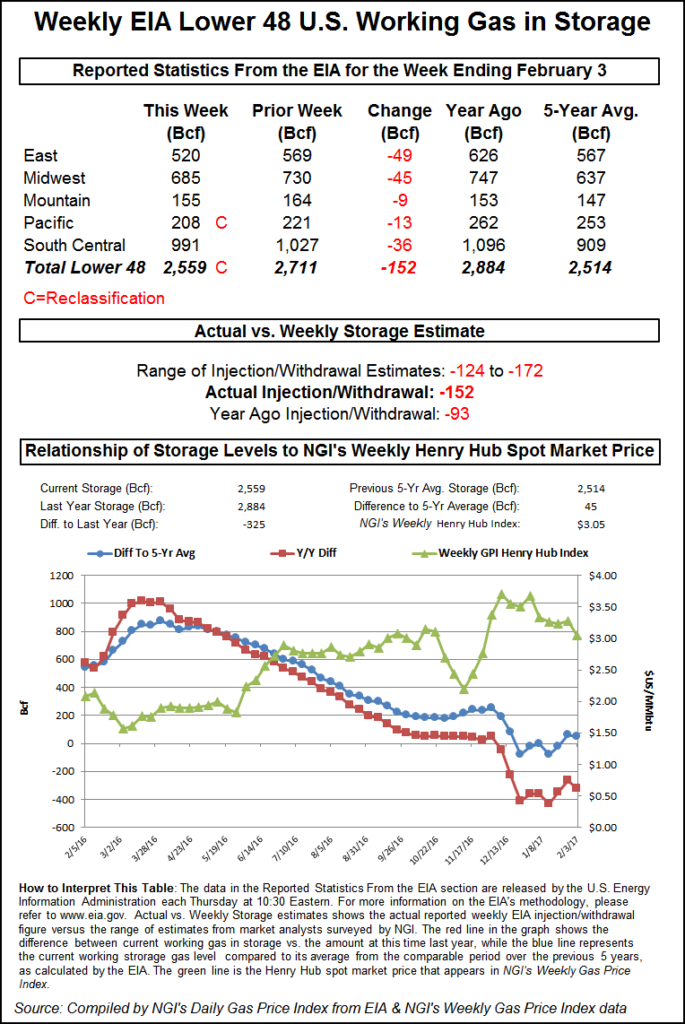

EIA reported a 152 Bcf storage withdrawal in its 10:30 a.m. EST release, but 5 Bcf of that represented a reclassification of working gas to base gas, thereby reducing actual flows to 147 Bcf. Traders had been expecting a pull of about 153 Bcf. March futures were trading about 5 cents higher prior to the release of the figures, but after the number was reported, March fell to $3.130, and by 10:45 a.m. March was trading at $3.146, up 2.0 cents from Wednesday’s settlement.

Last year 93 Bcf was withdrawn for the week, and the five-year pace stands at a 138 Bcf decline.

“I think the market is in kind of grey area,” said a New York floor trader. “The market has to hold here, but right now it looks like a weak hold. I think the market will work its way lower.”

“The 152 Bcf net withdrawal from storage for last week was right in line with market expectations and so neither a bullish nor bearish surprise,” said Tim Evans of Citi Futures Perspective. However, we note that the report included a 5 Bcf reclassification of working gas as base gas, with the implied flow out of storage at a weaker 147 Bcf rate.

“While the data for last week looks moderately supportive compared with the 138 Bcf five-year average draw, we note that the market lacks a follow-up support, with the warming trend that followed last week’s cool temperatures likely to translate into weaker storage withdrawals and weaker comparisons over the next few reports.”

Inventories now stand at 2,559 Bcf and are 325 Bcf less than last year and 45 Bcf greater than the five-year average. In the East Region 49 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 45 Bcf. Stocks in the Mountain Region fell 9 Bcf, and the Pacific Region was down 13 Bcf. The South Central Region dropped 36 Bcf.

The AccuWeather.com forecast notwithstanding, traders don’t see a lot of market upside. “We remain unenthusiastic about being a buyer in the market at the present time,” said Al Levine, principal at Powerhouse LLC, a Washington DC-based trading and risk management firm.

“We don’t think there is much likelihood of the market advancing, and the pattern of low heating degree days has really made a difference. With the return of even warmer weather the likelihood is that we will break down under $3.20 and test down to $3, and in general continue to move lower. The only bullish factor is the expansion of LNG exports.”

Market technicians are in the same boat. In spite of being able to hold $3 technical support, analysts versed in Elliott Wave and retracement see the market heading lower. “Bullish case, $3.006 marked the end of (C) in an ABC pattern down from the $3.994 high,” said Brian LaRose, an analyst with United ICAP. “Bearish case, this low merely represents the end of wave ”1’ of (C). At this time we are inclined to favor the latter. So for now at least, we will be labeling any sideways to higher prices as corrective in nature. To indicate something more bullish is taking hold would require a breach of $3.383-3.390.”

Longer term, forecasters are predicting a slight cooling trend but heating requirements remain less than average. “[Thursday’s] six-10 day period forecast is on average cooler than yesterday’s forecast over the eastern half of the U.S.,” said WSI Corp. in a Thursday morning report to clients. “CONUS GWHDDs are up 3.2 to 121.6 for the period, [but] these are 14.3 below average.

WSI said confidence in the forecast was average as the medium-term models were in good agreement, but “A potential amplified flow and PNA [Pacific North America] correlations offer a warmer risk over the West and Front Range, but a colder risk over the southern and eastern U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |