Markets | NGI All News Access | NGI Data

Weather-Driven Eastern Gains Outdo Softer West; March NatGas Futures Inch Lower

Physical natural gas traded for Thursday delivery was a split ticket Wednesday, as sharp weather-driven increases at eastern points were able to easily offset softer Midcontinent, Rockies and California prices.

The NGI National Spot Gas Average advanced a healthy 14 cents to $3.07.

Futures were far less decisive, as bullish Mexican exports, liquefied natural gas shipments overseas and increased gas usage for power generation held at bay weather forecasts calling for mild temperatures going forward.

March natural gas eased four-tenths of a cent to $3.126, and April rose four-tenths of a cent to $3.196. March crude oil tacked on 17 cents to $52.34/bbl.

Who do you love? The Energy Information Administration (EIA) in its recent Short Term Energy Outlook projected 2017 prices a touch higher than what the futures market is anticipating, but the difference becomes much more glaring in 2018.

“The EIA forecasts annualized Henry Hub spot prices to rise from $3.43 in 2017 to $3.70 in 2018,” said NGI Markets analyst Nate Harrison. “They cite increasing gas-fired electric generation as well as new export capabilities as their reason for this increase. The futures curve, however, seems to be looking more at forthcoming Marcellus takeaway capacity, which should be in place by 2018 and which should suppress prices at the Henry Hub.”

The expected 2017 average — $3.43/MMBtu — may not be as high as previously forecast, and is not far from the Jan.-Dec. 2017 futures at $3.39. That $3.70 2018 price, however, is light years ahead of the current screen, which settled at $3.11 Wednesday.

In physical trading it was a tale of two markets, with higher eastern quotes dueling with lower western pricing. AccuWeather,com forecast that Boston’s high on Wednesday of 53 degrees would plunge to 32 Thursday and 24 by Friday, 14 degrees below normal. New York City’s Wednesday peak of 60 was expected to drop to 31 Thursday and 29 Friday, 11 degrees less than normal.

Gas at the Algonquin Citygate jumped $2.14 to $5.51, and deliveries to Iroquois, Waddington added 98 cents to $4.21. Gas on Tennessee Zone 6 200 L soared $2.25 to $5.68.

Other market points outside the steep temperature drop were mixed.

Gas at the Chicago Citygate was flat at $3.02, and deliveries to the Henry Hub rose a penny to $3.05. Gas on Dominion South added 11 cents to $2.80, but packages at Opal dropped 8 cents to $2.78.

Futures traders were anticipating recent moderate weather to result in sub-par storage withdrawals beyond Thursday’s storage report.

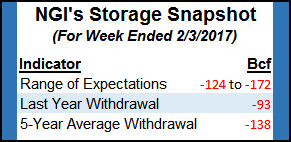

“The natural gas market is consolidating within its recent trading range having survived some early weakness off an updated weather outlook that is warmer than a day ago,” said Tim Evans of Citi Futures Perspective. Estimates for Thursday’s storage report “also look to have slipped a step toward 155 Bcf in net withdrawals, down from 160 Bcf at the start of the week. While supportive relative to the 138 Bcf five-year average for the week ended Feb. 3, this looks like it could be the last supportive comparison for a while, given the limited heating demand in the forecast.”

Tuesday overnight weather models moderated. Commodity Weather Group (CWG) noted Wednesday morning the “colder changes on the modeling (CWG stayed flat) were not carried forward overnight with general overall national demand losses,” said President Matt Rogers. “We have some colder short-term changes for the East and South with warmer adjustments in the Midwest. The six-to-10 day runs slightly warmer” than Tuesday “for the Midwest to East, is fairly flat (unchanged) in the South, and very slightly colder in the West.”

The 11-15 day forecast Wednesday was running slightly warmer than Tuesday, “as we continue to track a fairly large gradient between the American and European guidance. Despite the divergence, the American side is much warmer than yesterday with 11-15 day below normal mainly toward the East Coast.”

This week’s storage report may be the last big withdrawal for a while. Last year 91 Bcf were withdrawn and the five-year average comes in at 138 Bcf. ICAP Energy calculated a pull of 157 Bcf, and Citi Futures was figuring on a decline of 160 Bcf. A Reuters poll of 23 traders and analysts showed an average 153 Bcf with a range of -124 Bcf to -172 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |