Baker Hughes Says U.S Rig Count Jumps By 17, While Canada Down By Two

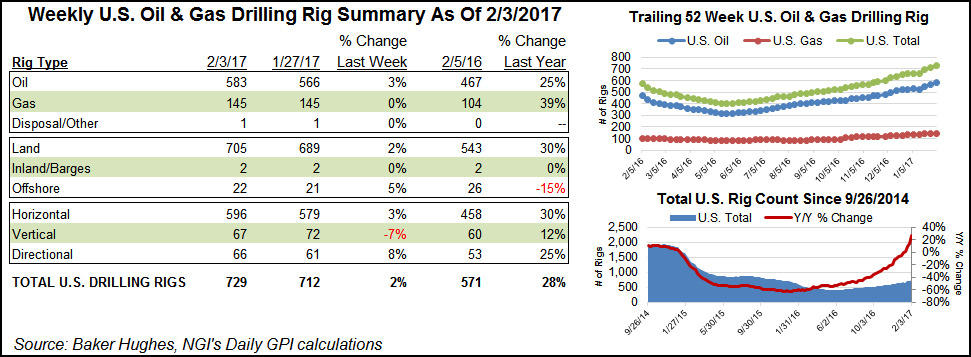

The U.S. drilling rig count jumped 17 week/week on Friday to 729, with 16 rigs raised in the onshore, all oil-directed, and one lifted in the Gulf of Mexico (GOM), Baker Hughes Inc. said Friday.

As of Friday, 705 rigs were running in the U.S. onshore, 162 more than a year ago. Two rigs also are working inland waters, up from zero a year earlier. The GOM rig count overall had fallen to 21 Friday from 26 last year.

The North American rig count stood at 1,072 as of Friday, up 15 week/week and compared with 813 a year ago.

For the week ending Friday, Canada had 343 rigs in operation, down two week/week but 101 more than a year ago, when it was running 242.

All of the new U.S. rig additions were oil-directed, Baker Hughes reported. Of the total, 583 were domestic oil rigs, versus 467 last year. Another 145 natural gas rigs were working, flat week/week, but 41 more than in the year-ago period. Canada as of Friday had 197 oil rigs in operation, down by three week/week, but it added one natural gas rig to reach 146.

Oklahoma led all U.S additions, raising six rigs, while Texas and New Mexico each raised four. One rig each was added in Alaska, Arkansas, Colorado and Wyoming, while Louisiana lost one rig. Otherwise, the count was flat week/week across the U.S. onshore.

By basin, the Cana-Woodford Shale saw the biggest jump in rig additions, with seven added overall to hit 56. Four rigs also were raised in the Permian, which brought its total count to 295, far and away leading every basin. The Eagle Ford Shale welcomed two rigs, and one rig each was added to the Barnett and Fayetteville shales. The Granite Wash lost two rigs from a week earlier, while the Haynesville Shale lost one.

More rigs mean more jobs, evidenced by data issued Friday by the Department of Labor’s U.S. Bureau of Labor Statistics (BLS). U.S. exploration and production (E&P) oil and gas extraction jobs increased by 100 to 177,400 in January, while support services jobs jumped by 600 to 195,200 in December, the second monthly increase in a row. BLS only had data for support services jobs data through December, while extraction data was available through January.

Halliburton Co. announced in late December that it would begin to staff up in the Permian Basin, while the Texas energy labor market turned positive in the final three months.

According to energy analysts that cover the North American sector, E&P capital outlays are expected to increase substantially this year, based on early earnings reports by oilfield services companies and some E&Ps. Most U.S. onshore activity continues to be directed to the Permian, which should not only lead the U.S. recovery but arguably the world, said Sanford C. Bernstein & Co. analyst Colin Davies. The massive basin that straddles West Texas and southern New Mexico is poised for a “significant uptick in well completion activity,” evidenced by results in the fourth quarter for oilfield services companies and their forecasts for 2017.

“A substantial build in drilled but uncompleted wells and increasing well pad activity are all leading indicators of accelerating growth,” Davies said. As well, the share of investments directed toward completions is rising. “Completion intensity is much higher, with more pumped per lateral foot and longer laterals,” said the Bernstein analyst.

For example, ExxonMobil Corp. has announced it will add more rigs in the Permian and drill super-laterals that extend at least two miles within the Delaware sub-basin.

“Rig rates are beginning to recover, but from very low levels, and pressure pumping will continue to face pressure in the near-term given the sheer quantity of idle equipment available reactivated at relatively low cost,” Davies said. “We believe the next round of pricing improvement will not be until later in the year as operators and service providers agree to term commitments at higher rates.”

On a trip to the Permian late last month, Evercore ISI analysts said they learned anecdotally that Helmerich & Payne was preparing to unstack 17 rigs from its Midland, TX yard, suggesting a beat in the second quarter “is already in hand.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |