Markets | NGI All News Access | NGI Data

Little Market Response Following On-Target EIA NatGas Storage Stats

Natural gas futures moved off session lows Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was about in line with what traders were expecting.

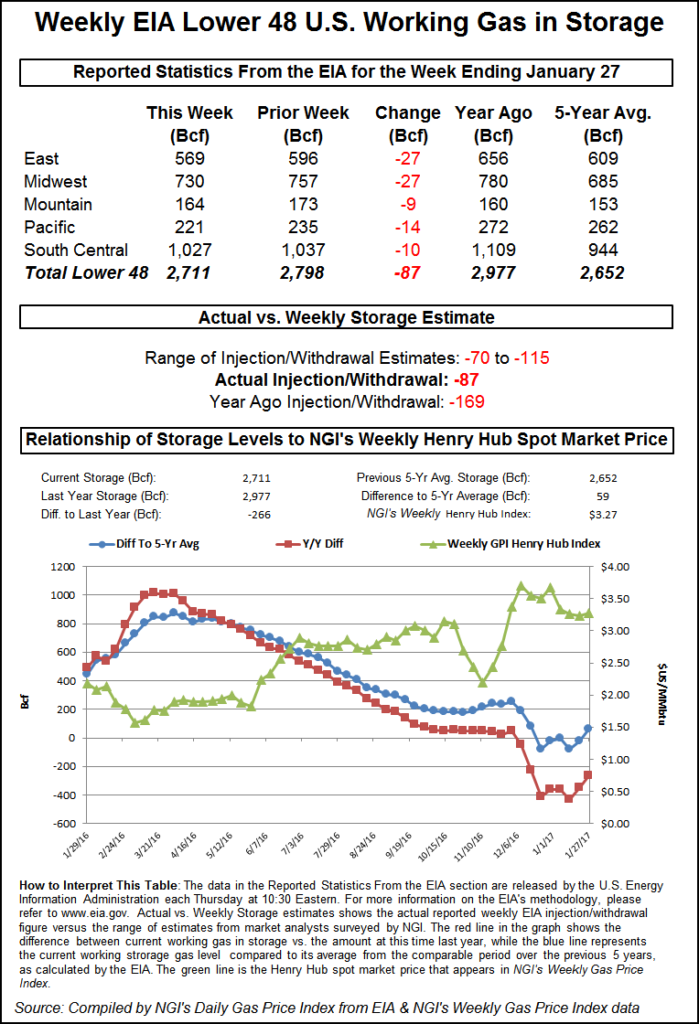

EIA reported an 87 Bcf storage withdrawal in its 10:30 a.m. EST release, whereas traders were expecting a pull of only about 1 Bcf more.

March futures were trading about 4 cents lower prior to the release, but after the statistics were released, March rose to $3.154. By 10:45 a.m. March was trading at $3.162, down six-tenths from Wednesday’s settlement.

“The natural gas market largely saw this report coming,” said Tim Evans of Citi Futures Perspective. Citi analysts still “view this as confirmation that storage fell far less than the five-year average in the week ended Jan. 27, leaving the market with an additional cushion to help cover the balance of the winter heating season.”

“The market seems to have priced in this number, though it could add a little support coming on the more bullish range of expectations,” said Harrison NY-based Bespoke Weather Services. “While maybe not enough to rally significantly, it has added support at the $3.10 level with prices unchanged in the five minutes following the print.”

Inventories now stand at 2,711 Bcf and are 266 Bcf less than last year and 59 Bcf greater than the five-year average. In the East Region, 27 Bcf was withdrawn and the Midwest Region also saw inventories fall by 27 Bcf. Stocks in the Mountain Region fell 9 Bcf, and the Pacific Region was down 14 Bcf. The South Central Region dropped 10 Bcf.

Salt cavern storage was up 15 Bcf at 340 Bcf, and nonsalt storage was lower by 25 Bcf to 687 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |