Infrastructure | NGI All News Access

Canadian Services Companies Predict ‘Modest Recovery’ in 2017

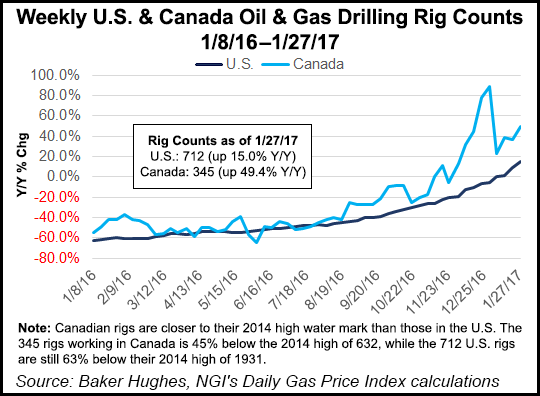

Canadian drilling will stage a modest recovery this year, about one-sixth of the long way back toward the extended activity peak before oil and natural gas prices plunged in mid-2014, according to field service and supply contractors.

The national 2017 well count will hit 5,150, which is up 30% from a hard-times 2016 low of 3,950 but still less than half of the pre-slump annual average for five fat years of 11,670, according to a forecast by the Petroleum Services Association of Canada (PSAC).

The anticipated activity increase would regain 1,200 of the 7,720 Canadian wells per year lost since 2014. PSAC President Mark Salkeld described the improving outlook as just “some uptick. It took us many years to recover from a similar, but less impactful, downturn in the early 1980s and it will be the same again now.”

For starting the recovery, the association credits Alberta provincial royalty reform as well as firming commodity prices. PSAC expects 2017 averages of US$52.50/bbl for oil and C$3.00/Mcf (US$2.25/Mcf) for natural gas. The revised royalty regime holds rates down to token levels until drilling costs are recovered.

Traditional gas and oil supply mainstay Alberta is forecast to dominate 2017 drilling with 2,706 wells. But activity is also expected to grow in liquids-rich shale gas formations in northern British Columbia and shallow heavy oil regions of Saskatchewan.

Production results of the partial drilling revival were not forecast. But Statistics Canada, in a monthly gross domestic product update, confirmed that output continues to rise in the northern Alberta oilsands, the biggest and fastest-growing natural gas consumer.

The federal government agency reported total Canadian oil and gas extraction rose 1.3% last November from October. Oilsands production grew by 3.7%, while effects of the 2014-2016 drilling slump continued to be felt in a 0.9% contraction of conventional oil and gas output.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |