Markets | NGI All News Access | NGI The Weekly Gas Market Report

The Winter That Wasn’t — Again: Lower Production, Strong Demand to Keep March Gas Storage Below Record Levels

Analysts’ estimates on where natural gas storage inventories will wind up come March 31 — the end of the traditional withdrawal season — range widely anywhere from around 1.4 Tcf to 2 Tcf as Mother Nature continues to wreak havoc on an otherwise structurally supported market. But all agree that inventories will not reach the record-setting levels of 2016.

This winter, similar to last, has proven to be much warmer than most people in the natural gas industry had expected, or hoped. Data and analytics company Genscape Inc. said gas-weighted heating degree days (HDD) from November to January (per the National Oceanic and Atmospheric Administration) are on track to be about 320 below the 30-year average (in terms of gas demand, more than 500 Bcf/d below normal from November-January) and 280 below the 10-year average.

And while October is not considered a winter month from a gas storage perspective, October HDDs matter as well, said Genscape’s Eric Fell, senior natural gas analyst. “October was the warmest October in more than 30 years with gas-weighted HDDs 113 below the 30-year average, which was only partially offset by October cooling degree days (CDD) being 34 above normal,” Fell said.

The latest weather data do not paint a much different picture for February. While cold shots will sweep across the northern United States heading into February, the most extreme arctic air is expected to stall at the U.S./Canada border, forecasters with NatGasWeather.com said. A milder break is expected between weather systems this weekend (Feb. 4-5) before additional weather systems and associated cold blasts the following week, Feb. 6-11. Thereafter, it’s a safe bet to assume the odds are increasing for mild patterns, the forecaster said.

Bespoke Weather Services’ Jacob Meisel agreed that the latest weather models are easing off any bullishness they once had for February. Recent Global Forecast System (GFS) operational guidance has backed off some of its previous bullish risk, while the GFS ensembles continue to represent the lingering long-range bullish risk.

International guidance shows any cold in the long range quicker to break down, and thus far, those pieces of guidance have been performing well this winter. Climate guidance similarly shows that by mid-February, bearish risks could begin to increase, further making it unlikely that any signiï¬cant bullish weather risks will be added to forecasts, Meisel said.

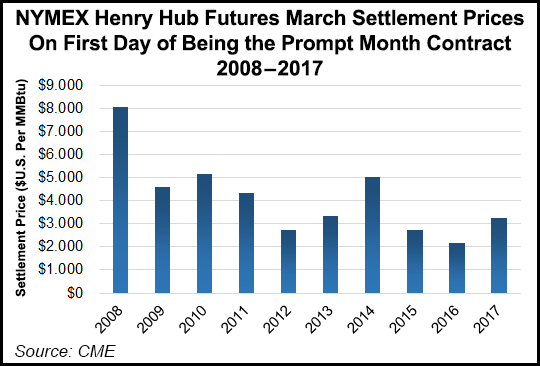

The bearish weather outlook is taking a toll on Nymex futures. On Jan. 30, the Nymex March futures contract lost more than 12 cents to settle at $3.23 on its first day in the prompt-month position. By comparison, the Nymex March futures contract sat at $2.18 on its first day at the front of the curve in 2016, but last winter was the second warmest on record and storage inventories were at record highs.

March’s Jan. 30 settle still ranks as one of the lowest from a historical perspective. In the last 10 years, only three times has March settled lower on its first day as the prompt month. On Jan. 31, the Nymex March futures contract lost another 11.5 cents, settling at $3.12.

Technical indicators may help provide a sense of short-term price direction, but even those are a bit muddled right now, according to Patrick Rau, NGI’s director of strategy and finance. “The prompt month is in no man’s land as far as the Relative Strength Indicator and slow stochastics are concerned, both of which are designed to indicate whether a market is overbought or oversold.”

On the positive side, the March contract is right at the bottom of its 20-day Bollinger band, but it also just settled below its 100-day moving average of $3.15, Rau said. “That average has served as pretty strong support in recent weeks, so a move below that could lead to continued short-term weakness.” Weather, “of course, will be the main driving factor on prices for the rest of winter.”

Analysts said barring unusually warm weather for the remainder of the winter season, several factors indicate that tight market conditions could leave storage inventories at a healthy level that would continue to support prices.

As of Jan. 20, working gas in storage was 2,798 Bcf, according to U.S. Energy Information Administration estimates. Stocks were 348 Bcf below year-ago levels and and 20 Bcf below the five-year average of 2,818 Bcf.

Last March, gas inventories exited the traditional withdrawal season at a record high 2,478 Bcf, 868 Bcf (54%) higher than the five-year (2011-2015) end-of-March average, and higher than the previous end-of-March high set in 2012.

But analysts are confident this year won’t be a repeat of last year. “Even with the temperatures we’re having, demand and withdrawals have been stronger than normal,” said RBN Energy’s Sheetal Nasta, fundamental energy analyst. “That implies that if we get even normal demand, we’ll be tighter.”

In terms of the supply/demand balance, production is running around 2 Bcf/d below last year, while demand (not including exports) is running around 1 Bcf/d below last year, Nasta said. “When you throw in exports, the balance will be even tighter year on year,” she said.

RBN is currently projecting end-of-winter storage inventories to be around 1.6 Tcf, around 900 Bcf/d lower than the same time last year.

Wood Mackenzie’s Gabriel Harris agreed that storage inventories continue to dwindle in spite of this winter’s mild weather and higher prices as power plant demand has been surprisingly strong. For example, power burn amounted to around 16 Bcf/d during periods of mild weather, but shot up to around 30 Bcf/d when temperatures plummeted.

This occurred even as coal generation increased in regions covered by the Midwest Independent System Operator, New England ISO and Southwest Power Pool, Harris said. In those footprints, demand from coal was more than double what it was in December 2015. Henry Hub spot prices averaged $3.58 in December 2016, compared to $1.92 in December 2015, NGI historical data shows.

“We’ve had high stockpiles of coal the past year, but inventories are declining, and this should help coal and natural gas prices support each other more this injection season,” Harris said.

But even if power burn disappoints the market during the shoulder season, Harris said other structural factors should keep the pressure on storage and gas prices in 2017. For one, liquefied natural gas (LNG) exports at Cheniere’s Sabine Pass Terminal have ramped up quickly, with Trains 1 and 2 in operation and Trains 3 and 4 under construction and expected to be in service in the first half of 2017 and second half of 2017, respectively.

The Sabine Pass site can readily accommodate up to six liquefaction trains capable of processing more than 3.5 Bcf/d of natural gas. The production capacity of each LNG train is being designed for about 4.5 mtpa, according to Cheniere’s website.

Meanwhile, all regulatory approvals have been received to construct and operate Train 6, and a final investment decision is expected to be reached upon obtaining commercial contracts and financing sufficient to support construction, the company said.

In addition to increasing LNG exports, Mexican exports are also growing. U.S. pipeline exports of natural gas have doubled since 2009, with almost all of this growth attributable to increasing exports to Mexico, which have accounted for more than half of all U.S. natural gas exports since April 2015, according to the EIA.

In August 2016, when gas demand was high south of the border, the United States exported 4.2 Bcf/d o Mexico via pipelines, the EIA said. At the time, U.S. daily pipeline exports to Mexico tracked at a yearly average of 3.6 Bcf/d, 25% above the year-ago level and 85% above the five-year (2011–2015) average level. Interestingly, the amount of gas exported in August 2016 matched the level originally forecast in 2013 to be reached in 2018.

And Mexican exports are set to continue growing. On Jan. 27, the Federal Energy Regulatory Commission granted in-service authorization to the Comanche Trail San Elizario Crossing export-to-Mexico project.

Comanche Trail, an Energy Transfer project, would be a 42-inch diameter line with capacity to export 1,135 MMcf/d. It originates at the Waha Hub and moves to a border crossing into northern Chihuahua state. Once in Mexico, gas would move along the San Isidro-Samalayuca line, where it will serve gas-fired generation and interconnect to a handful of other pipes capable of moving the gas westward and southward deeper into Mexico.

Both Kinder Morgan and Enterprise Products have indicated that the portions of their respective Texas intrastate systems that can accept Permian Basin production are “getting to be pretty full,” Rau said. “If Mexican export demand on the new intrastates out of Waha is slow to develop, there could be some takeaway problems in the area that emerge pretty quickly, especially out of the hypergrowth Delaware sub-basin.”

On the other hand, drilling continues to rise in the Eagle Ford Shale, where there is likely “plenty of takeaway capacity” available, according to Rau, which would help offset any transportation issues out of the Permian.

Canadian storage levels are also providing some bullish risk to the market. “Canadian storage was at record highs this past fall, which resulted in strong imports into the U.S. But now, inventories are below year-ago levels, which could limit U.S. imports from Canada by the end of 2017,” Harris said.

Wood Mackenzie expects U.S. storage inventories to end March at 1.7 Tcf — if the remainder of the winter season is “normal” and a significant storage deficit developing in the spring.

Perhaps the biggest unknown, however, is production. Production is currently running about 2 Bcf/d below year-ago levels, and with several factors pointing to stronger demand this year, there is little reason to believe storage inventories will flip to a meaningful surplus and cause prices to crash, according to PA Consulting’s Michael Bennett.

PA Consulting is currently projecting end-of-winter inventories to reach 1.8-2 Tcf. “However, never discount Mother Nature’s ability to throw a curveball at U.S. gas markets,” Bennett said.

Indeed, after gaining 60% in 2016, Nymex prompt-month futures lost about 10% of their value on warm weather forecasts. “The 10% decline on Jan. 3 proves that one forecast can change a lot. That being said, there do not seem to be a lot of unknowns from a supply and demand perspective in 2017, so hopefully the rebalancing continues without major price disruption,” Bennett said.

Societe Generale (Soc Gen) analyst Breanne Dougherty agreed there is nothing that looks particularly threatening relative to history, and the investment bank expects to finish this winter at a storage levels that looks very healthy from the surface, between 1.45 and 1.6 Tcf.

“But, end of March is the start point for 2017; how much can be expected to be injected through summer 2017? Our bearish/bullish bias for the year comes down to where end-of-March storage ends up and how production evolves in the seven months that follow,” she said. “Growth needs to come in 2017 to meet rising demand. We have not seen any solid signals around that happening…yet.”

Bennett agreed that a reasonably balanced market depends on growth. The Northeast, which has accounted for the lion’s share of production growth in recent years, will continue to grow in 2017, albeit to a lesser extent as takeaway capacity in the region is essentially tapped out and additional pipeline projects await in-service or federal approval.

“Delays in pipeline infrastructure and the ongoing depletion of drilled but uncompleted wells (DUC) in the Northeast have made it clear to the market that we need some other basins to help out on the supply side of things,” Bennett said.

It appears that the Haynesville Shale is ready to help fill the void. “Breakevens are higher in the Haynesville, in the low to mid-$3 range, and the forward curve reflects that, which, in turn, is allowing producers to hedge future production and get back to work,” Bennett said.

The rig count in the Haynesville has more than doubled from its 2016 minimum of eight rigs, driven largely by the basin’s most active drillers. Vine, Chesapeake, Indigo, GEP and Comstock currently account for 15 rigs in the basin, and have added 11 rigs from the 2016 lows.

Wood Mackenzie’s Ryan Duman agreed that prices and fundamentals point to the Haynesville once again becoming an active play. “We’re seeing a lot of acreage in the money at $2.75-3.00 pricing, and it’s been long enough that we’ve seen prices hold above $2.50 that operators are willing to add back rigs,” Duman said.

Duman said prices and fundamentals point to Haynesville production increasing 1.3 Bcf/d in 2017. “It’s starting to be meaningful growth play to look at in the near term.”

Meanwhile, Soc Gen is awaiting the first sign of volumes from the rigs that were added across several plays through the end of 2016. “Based on traditional drill-to-volume timing, we expect that volume growth to start showing up in the next couple of months. If volumes in March, however, do not show evidence of a re-orientation to growth, even a very comfortable end-of-March storage exit could be met with increased bullish market sentiment,” Dougherty said.

Rau said such volumes already are showing up in production numbers. “Marketed production for November came in at 77.0 Bcf/d, down 1.7 Bcf/d from last year, but up 1.5% from October. That month-over-month gain is the largest since February,” he said.

Meanwhile, fourth-quarter 2016 earnings season is well underway, and producers will give more clues as to their capital expenditure plans for 2017, although several early indications are that U.S. spend could be up by as much as 30% year/year.

Looking ahead, how storage injections trend over the summer will help define how things shape up for 2018. Soc Gen’s base-case view assumes a 2.2 Tcf net injection during the April to October period, a level similar to the five-year average, which would put inventories at around 3.65 Tcf at the end of October.

But again, production remains the wild card and could be the key to whether the investment bank remains bullish on prices through 2018. “In order for production to exit 2017 in line with our view, it has to grow over 4 Bcf/d between now and December,” Dougherty said.

As reference, the only years production has grown by more than what Soc Gen has currently built into its base-case between January and December were 2010, 2011 and 2014. “All of those years benefitted from strong upstream investment periods in the 12-24 months preceding,” she said.

Dougherty noted that there is material uncertainty surrounding the speed and strength to which the domestic production base can recover from what has been 24 months of investment retrenchment. “Producers can’t carry that risk. Growing production too aggressively into this near-term market of unknowns holds too much risk for producers to shoulder given the financial stress that they have been under the last couple of years,” she said.

Wood Mackenzie’s Duman agreed that it is only recently that operator mentality has shifted to a more optimistic outlook. “Operators have been looking to DUCs as a good answer to higher prices without having to commit to rigs. But within the last quarter, the mindset of a number of operators I have talked to has shifted to a more optimistic mindset. Prices will be strong enough to incentivize drilling in a lot of plays,” Duman said.

Wood Mackenzie sees production exiting 2017 at 72.5 Bcf/d and exiting 2018 at 80.4 Bcf/d, if the various pipeline projects aimed at debottlenecking the Northeast come to fruition.

Already, many in the industry are banking on a delay of one year for Energy Transfer’s Rover Pipeline, which is still awaiting FERC approval after originally being slated to go into service this summer. The 3.25 Bcf/d Rover Pipeline would connect Marcellus and Utica shale gas to the Midwest Hub in Defiance, OH, and to an interconnection with the Vector Pipeline in Michigan, giving Appalachian producers access to points that include the Dawn Hub in Ontario.

Meanwhile, an additional 4.8 Bcf/d of takeaway capacity is scheduled to start up in the Northeast at the end of 2017 and another 7.3 Bcf/d in 2018. As Rau noted, though, “the resignation of FERC Chairman (Norman) Bay means projects like Nexus Transmission perhaps get delayed as well.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |