Market Searching For Arctic Air; Weekly NatGas Quotes Add 6 Cents

Physical natural gas bulls and bears went at each other only sparingly for the week ended Jan. 27, and most points advanced but only by a few pennies.

The NGI Weekly Spot Gas Average rose 6 cents to $3.21 and the week’s greatest gainers proved to be Tennessee Zone 6 200 L with an advance of 43 cents to average $4.04 followed closely by its next-door neighbor Algonquin Citygate with a rise of 41 cents to $3.96. Just to the west the week’s greatest loser was Dawn with a modest drop of 3 cents to $3.42.

Numerous regions came away with only 2 to 3 cent moves. The Midcontinent and East Texas both gained 2 cents to $3.09 and $3.15, respectively, and South Texas, the Midwest, and South Louisiana added 3 cents to $3.15, $3.22, and $3.18, respectively.

The Southeast and Appalachia rose by a nickel to average $3.24 and $3.01, respectively and California and the Rockies came in higher by 7 cents to $3.44 and $3.17, respectively.

Regionally the Northeast advanced the most by climbing 19 cents to $3.55.

February futures expired Friday at $3.391, up 18.7 cents on the week.

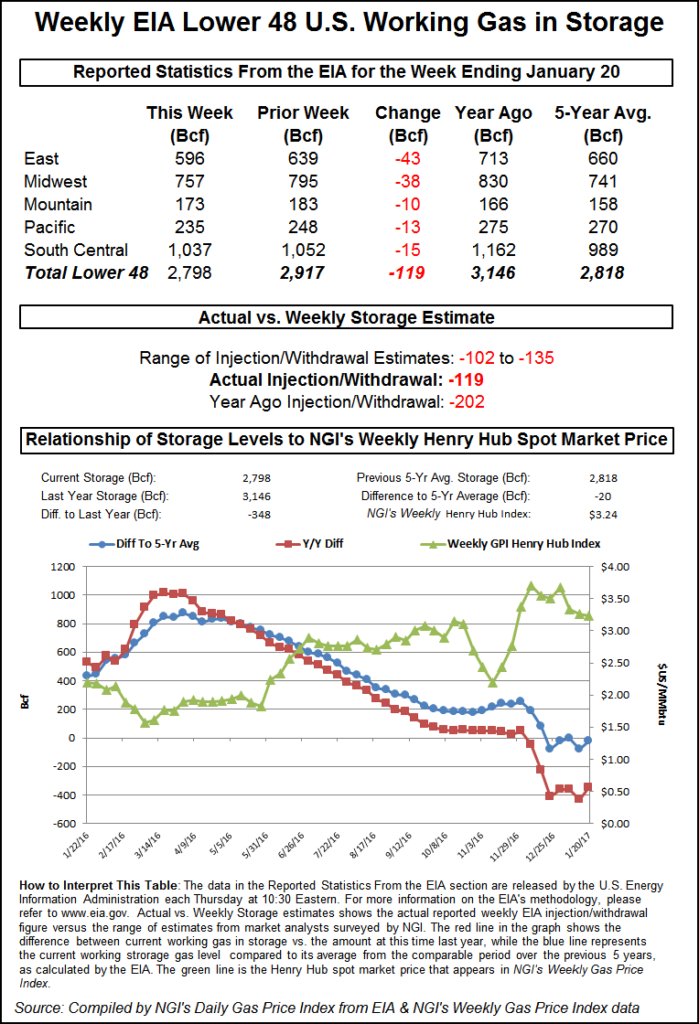

The Energy Information Administration (EIA) Thursday reported a storage withdrawal of 119 Bcf for the week ending Jan. 20, a couple of Bcf greater than expectations, and natural gas futures soared.

After the EIA’s 10:30 a.m. EST release on Thursday, February reached a high of $3.487, and by 10:45 a.m. February was trading at $3.480, up 14.8 cents from Wednesday’s settlement. However, much of those gains were given back as the day played out and the February contract settled the regular session 5 cents higher than Wednesday at $3.382, and March rose by 5.1 cents to $3.397.

“We’ve had pretty mild temperatures here last week so someone took the report as bullish,” said a New York floor trader. “We were looking at $3.44 to $3.45 just before the number came out.”

“The 119 Bcf net withdrawal for last week was nearly in line with the consensus expectation and so neutral on that score,” said Tim Evans of Citi Futures Perspective. “At the same time, however, this was a big step down from the 243 Bcf drop in the prior week and below the 176 Bcf five-year average, and so bearish on a seasonally adjusted basis. Storage remains at a relatively comfortable level, 20 Bcf (0.7%) below the five-year average as we approach the midpoint of the winter on Groundhog Day, Feb. 2.”

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger, an analyst with BMO Capital Markets. “Storage has dropped to five-year average levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 winter withdrawal season, assuming normal weather.”

Inventories now stand at 2,798 Bcf and are 348 Bcf less than last year and 20 Bcf less than the five-year average. In the East Region, 43 Bcf was withdrawn and the Midwest Region saw inventories decrease by 38 Bcf. Stocks in the Mountain Region fell 10 Bcf, and the Pacific Region was down 13 Bcf. The South Central Region dropped 15 Bcf.

In Friday’s physical trading weekend and Monday natural gas prices fell as hefty gains in the Northeast were unable to offset much broader weakness across the country.

Colder eastern temperatures spurred dollar-plus gains Friday in New England, but could not counter stout double-digit declines in producing zones as well as Midwest market zones, and the NGI National Spot Gas Average fell 11 cents to $3.23. Rocky Mountain and California locations were particularly hard hit as weather conditions were forecast to moderate considerably.

February futures, after digging into a 7-cent hole at the open, managed to scramble back and finish just over unchanged on Friday with a gain of nine-tenths of a cent to $3.391. March futures eased 3.9 cents to $3.358.

Next-day gas was pummeled, but the clouds parted, the sun shone, and Southern California was expected to see temperatures above normal. AccuWeather.com forecast that Los Angeles’ Friday high of 64 degrees would jump to 71 Saturday and rise to 76 by Monday, 8 degrees above normal. San Diego’s Friday high of 65 was predicted to climb to 70 Saturday and reach 71 by Monday, 6 degrees above normal.

Weekend and Monday deliveries to Malin fell 25 cents to $3.14, and gas at the PG&E Citygate dropped 14 cents to $3.62. Gas at the SoCal Citygate tumbled 32 cents to $3.37, and packages priced at the SoCal Border Avg. Average shed 24 cents to $3.21.

Power loads were expected to lighten as well. CAISO forecast that Friday’s peak load of 29,598 MW was predicted to drop to 27,467 MW Saturday.

Conversely, on the East Coast weekend and Monday gas jumped as forecasts called for temperatures to work lower. AccuWeather.com predicted that the high Friday in Boston of 44 would ease to 42 by Saturday before dropping to 36 Monday, the seasonal average.

Gas at the Algonquin Citygate jumped $1.17 to $5.14, and deliveries to Iroquois, Waddington added 40 cents to $4.06. Packages on Tenn Zone 6 200L rose $0.91 to $5.01.

Major trading centers declined. Gas at the Chicago Citygate fell 13 cents to $3.21, and deliveries to the Henry Hub lost 13 cents as well to $3.29. Gas on El Paso Permian changed hands 18 cents lower at $3.07, and gas at Opal gave up 28 cents to $3.10. Kern River Deliveries were quoted 25 cents lower at $3.23.

Futures opened lower as forecast cold was expected to be less intense than previously thought.

Trader skepticism of recent market strength was proven correct, at least for the moment, with the overnight price retreat.

“The rally appeared to be discounting another arctic event that has failed to acquire strong consensus within the weather models,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients. “While some colder trends are still expected later next week, deviations from normal don’t appear sizable nor sufficiently broad-based to suggest a major storage decline. [Thursday’s] 119 Bcf drop in supply again exceeded our expectation by a significant margin, and it appears that some structural shifts are developing to drive storage declines beyond those that might be implied by HDDs.

“Power demand remains stout; export activity is still strong, and production continues to show limited response to the recent upswing in the rig counts. While storage is apt to establish a surplus of at least 60-70 Bcf with next week’s EIA report, this overhang could prove short lived, and the aforementioned structural changes strongly suggest a significant deficit situation when supply peaks seasonally in a couple of months.”

Gas buyers for power generation across MISO over the weekend could expect to have to deal with significant cold, but also ample wind generation to offset gas purchases. “A brisk and persistent northwest wind beneath a deep upper-level trough will support seasonably cold and breezy conditions across the power pool through the weekend,” said WSI Corp. in its Friday morning report to clients.

“Max temps will range in the 20s, 30s to low 40s across the Midwest along with minimums in the teens and 20s. The cold flow and a few embedded disturbances will support a chance for a few snow showers and lake-effect snow.

“A persistent northwest wind will lead to elevated wind generation through Sunday morning. Output is forecast to peak today as high as 9-11 GW. After a brief lull, a southwest-to-northwest wind associated with the Clipper will bolster output early next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |