Regulatory | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

Mexico NatGas Market Growth Comes With Familiar Names, New Uncertainties

On the journey to reform Mexico’s natural gas markets, participants can’t always see where they’re going. While optimism for robust transparency and trading prevails, there are devils in the details, said speakers at a recent industry conference in Monterrey, the capital of Nuevo Leon, MX.

As much of Mexico’s gas market growth is predicated on expanding use of gas-fired power plants, it shouldn’t surprise that Mexico’s Comision Federal de Electricidad (CFE) will be a large player.

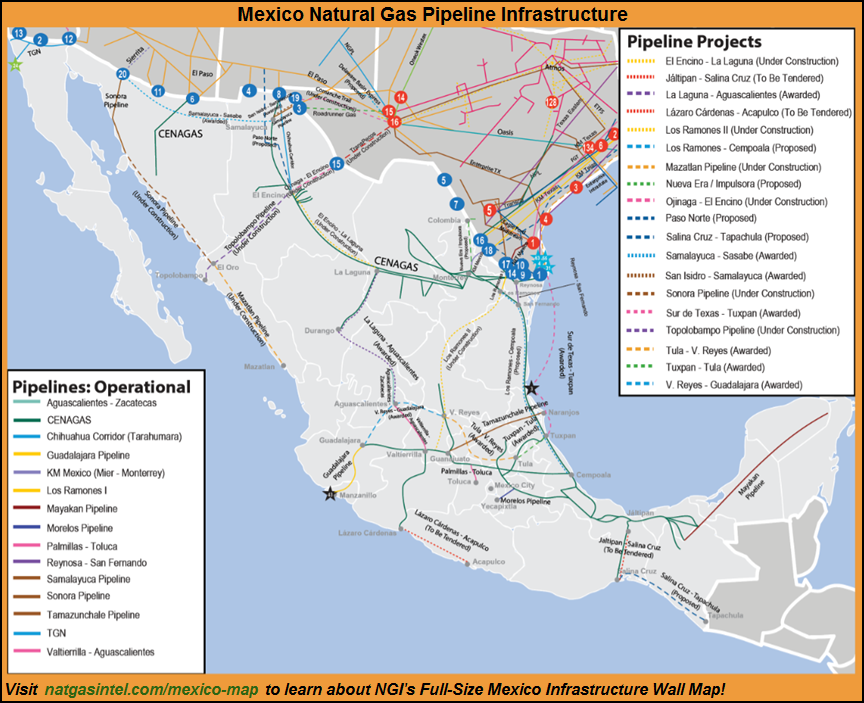

CFE’s Javier Gutiérrez, deputy director of modernization, said much of CFE’s future lies in trading natural gas. “The new game in town is filling up those ducts [with gas],” he said, in reference to the 5,000-plus kilometers of new transportation infrastructure that CFE tendered in the last three years and which is expected to fully come online by the end of 2018.

In June 2015, CFE marketing affiliates CFEnergÃa and CFE International were incorporated as private firms to participate in energy reforms. CFEnergÃa was awarded a permit in November 2015 to start marketing natural gas, fuel oil and diesel fuel.

“If you need gas or gas transportation, or both, CFEnergÃa is your partner,” Gutiérrez told attendees at the recent Mexico Infrastructure Projects Forum.

CFEnergÃa’s market share is expected to benefit considerably from the Petroleos Mexicanos (Pemex) natural gas supply contract release program over the next few years.

Mexican authorities launched the country’s first open season to reserve capacity in the Integrated National Pipeline System, last December. According to the Comision Reguladora de Energia (CRE), just under half the capacity will be available; Centro Nacional de Control del Gas Natural (Cenagas), the network system operator, is expected to announce results in April.

As the market unfolds, private-sector players are as hungry for information as they are for pipeline capacity and the energy commodity.

“The opening of the electricity and hydrocarbons market has been very orderly,” said Roberto Blanco, vice president of energy at Mexican industrial conglomerate Grupo Alfa. However, he said, “the transition schedule [for the natural gas market] has been tight, and the private sector faces a lack of information about the availability of transportation capacity and prices at importation points, among other things.”

Private-sector market participants are challenged by information asymmetries in their relationships with Pemex, which until recently was the owner and operator of the pipeline network, said Patricio Gamboa, energy director at steel company Deacero.

“Pemex has always had all the information and can now compete for capacity in other pipelines,” he said. “We are very far from the optimal level of information.”

But there’s only one game in town if one wants to buy, sell or transport gas. Open season? “You have to do it; there are no other options,” Blanco said.

Another area of uncertainty for market participants is the First Hand Sales rule, Gamboa said. Companies whose facilities are near the U.S. border — and U.S. gas supply — might not see the rule as daunting as those farther south, where the market will be less well supplied and less liquid. The government will be setting prices in the south, and supply will come from Pemex until the market develops more fully.

Natural gas price formation is anticipated, as are multiple liquid hubs where trading will emerge. Gutiérrez said the new transportation network is designed to develop hubs like those in Waha and Agua Dulce in Texas.

“I believe hubs will very likely develop at Samalayuca, El Encino, La Laguna and here in Monterrey, among other sites,” he said.

That Gutiérrez should mention these locations is not gratuitous, since they are points where CFE’s newly tendered infrastructure will interconnect. Yet, these hubs will likely take more than a year to consolidate, as the market has not yet begun operations, domestic production is declining and the country still lacks any significant gas storage infrastructure.

Blanco said that, given declining production at Pemex and growing imports, attempts to increase private-sector production in Mexico were likely to disappoint because “although the Burgos Basin has plentiful resources, the fields auctioned off in the third round of bidding are too small to make a difference.”

Looking further ahead on the market’s development, Blanco urged regulators to step up the pace for the secondary natural gas market to take off. “[CRE] just approved the use of swaps,” he said, “but many rules are still missing.”

Price indexes, and the price transparency they provide, will take time to develop, said BP Energy Co.’s Darrel Thorson, vice president of business development. In the interim the best option for market participants is to use Houston Ship Channel prices, plus 30 or 50 cents for transportation, he said.

Gutiérrez disagreed, saying “Mexican consumers should not have their prices fixed to a U.S. index.” Industry participants, he said, should embrace the market and let go of the “paternalistic attitudes of yore.”

Yet, Thorson countered, “it depends on who is doing the importing and exporting.” In the end, Thorson said, “The transition phase still must play out.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |