E&P | NGI All News Access | NGI The Weekly Gas Market Report

Helmerich & Payne Raising High-Spec Rigs, Adding People as U.S. Onshore Gets Back to Work

Exploration and production customers are adding drilling rigs in all of the U.S. basins in which Helmerich & Payne Inc. (H&P) works, leading the contract driller to increase its capital spending and boost its workforce, executives said Thursday.

Since mid-November, when H&P last reported results, 36 of its top-of-the-line FlexRigs, an alternating current (AC), high specification (spec) fleet, have gone back to work, the equivalent of delivering one rig to active status “every 47 hours,” CEO John Lindsay said during a conference call.

“Of those rigs, 21 are in the spot market and 15 on term contract,” he said. “Although spot pricing remains low, we are seeing some pricing improvements for high-quality, high-performing AC-drive rigs.”

The Permian Basin continues to be the go-to basin for activity, with six rigs added in the quarter, but activity is strong elsewhere too, with six rigs each added to the Eagle Ford Shale and Oklahoma’s SCOOP and STACK plays, aka the South Central Oklahoma Oil Province and Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties. Three rigs also were raised in the Haynesville Shale, two each in the Marcellus, Utica shales and Piceance Basin, and one each in the Niobrara and Woodbine formations and on the Texas Gulf Coast.

Of the 36 added rigs, two-thirds are classified as “super-spec,” Lindsay said. “We have also added 11 new customers since the last call, and momentum has been building as a result of the performance our folks are delivering.”

Not surprisingly, the two most active basins remain the Permian and SCOOP/STACK, where most of H&P rigs now are at work.

“The Permian remains our most active operation, and we have 60 rigs contracted, coming off a low of 38 contracted rigs, and at one point last summer, we only had about 23 operating rigs,” the CEO said. “We have 62 idle FlexRigs in the area, 42 of which are 1,500 hp, and we expect to continue to have opportunities to grow our active fleet in the Permian.”

In the liquids-rich reservoirs of the SCOOP/STACK, H&P has 27 rigs contracted coming off a low of 15 contracted rigs.

“We estimate that H&P has about 56% of the available 1,500-hp AC rigs in U.S. land,” Lindsay said. “We currently have 139 1,500-hp AC FlexRigs under contract and 187 idle and available to go to work in the U.S.”

H&P holds an estimated 20% market share in the U.S. land horizontal and directional drilling market, a share that grew over the downturn.

“We believe that our overall market share in U.S. land has expanded to approximately 18% from 16% over the past few months. And we’ve been able to grow our market share from 15% since the peak of activity in 2014.”

Since the trough of the industry downturn in May 2016, H&P has more than doubled the number of active rigs to a current level close to 140 rigs. That means more people have been added to the payroll, but it’s a double-edged sword, he said.

“Putting that many rigs back to work successfully is a complex effort and involves many constituents,” said the CEO. “A significant element in our success is our workforce staffing effort. That team has been responsible for hiring previous employees for our reactivated rigs. We’ve rehired over 1,500 former field employees since May of last year, and it shows in the morale of our people across the board.” H&P also has added 24 first-time FlexRig customers since last May.

“There’s a lot of interviewing going on, a lot of processes that are happening…I think we’ve had a little over 80% of acceptance rate and very little turnover in the previous employees that we’ve brought on. The ability to move people that have been bumped back in position from floor hand to driller, or driller to rig manager, rig manager to superintendent, as you can imagine, has a huge positive impact on morale…

“Obviously, there’s a lot of demand for people…We’ve not had issues hiring in the past. I don’t expect we’ll have issues hiring today…”

With customer demand increasing, the company is expanding its FlexRig capabilities, Lindsay said. Since last November, the company has added 20 rigs to its FlexRig fleet, bringing the number of “super-spec” rigs to 100.

“Should there be additional market demand for super-spec rigs going forward, H&P has the capability of providing approximately 270 super-spec FlexRigs to the market without requiring any newbuilds, solely through upgrades where needed to our current FlexRig 3 and FlexRig 5 fleet,” he said.

The “improving market conditions and customer demand” led H&P to increase to capital expenditures (capex). “A portion of this increase will be dedicated to super-spec upgrades to our FlexRig fleet, which will enable us to continue to be able respond quickly to customers in this tightening market,” Lindsay said. “First, as a result of the high demand for FlexRigs, we have contract commitments for a large portion of our super-spec capability, and we want to make certain future deliveries aren’t constrained…”

Based on customer demand H&P also is adding its first prototype walking system to an existing FlexRig 3, which is expected to be delivered in the next two months.

The clamor for rigs has led to a downside with the high costs associated to take equipment out of the stacks and return them to the fields.

H&P recorded a net loss of $35 million (minus 41 cents/share) in fiscal 1Q2017, versus year-ago profits of $16 million (15 cents). Revenue fell 24% year/year $488 million. U.S. land operating revenue, which accounts for 72% of the total, was down 29% from fiscal 1Q2016. Utilization levels dropped to 31% from 39% a year ago, plunging the segment to an operating loss of $30.9 million. A year ago, income was $55.5 million.

“As reflected in the first quarter results, the rapid pace of the market recovery and our efforts to redeploy additional rigs had an impact on our daily expenses and operating income for the quarter,” Lindsay said. “Although temporary in nature, we expect continued upward pressure on expenses as the ramp-up proceeds and we absorb some upfront costs reactivating more rigs, particularly rigs that were cold stacked during the early stages of the downturn…

“The downturn has been a challenging two-year journey, and H&P has been preparing for the opportunity this upturn presents.”

CFO Juan Pablo Tardio, who shared a microphone during the conference call, said the number of revenue days increased by 23% sequentially, resulting in an average of about 106 rigs generating revenue days during the first fiscal quarter. On average, 73 of the rigs were under term contract and 33 rigs worked in the spot market.

Excluding the impact of early termination revenue, the average rig revenue/day declined by about 2% to $23,891 in the quarter, “as the proportion of rigs working in the spot market increased significantly quarter to quarter,” Tardio said. Not including one-time charges, average rig expense/day increased by around 13% to $15,064. The number of rigs generating revenue days has risen since last November from 102 to 138.

As of Thursday, the company’s 350 available U.S. land rigs included 140 generating revenue and 210 idle rigs, he said.

“Included in the 140 rigs generating revenue are 89 rigs under term contract, 87 of which are generating revenue days. In addition, 51 rigs are currently active in the spot market for a total of 138 rigs generating revenue days in the segment.

“Three of the 138 rigs remain idle and on standby-type day rates. Separately, the two rigs that are not generating revenue days include newbuild rigs that are waiting for the customer to be ready for delivery.”

In the next quarter, H&P is expecting “a sequential increase activity in the range of 30% to 35% in terms of revenue days,” said the CFO. “Excluding the impact of revenues corresponding to early terminated long-term contracts, we expect our average rig revenue per day to the client to approximately $22,400, primarily as a result of a higher proportion of rigs working in the spot market.”

Spot pricing remains low, he said, but “we expect to see average spot pricing for FlexRigs improve over the next few months as we are now seeing leading edge day rates moving from the mid-teens to the high teens.” The average rig expense/day level is expected to decrease to roughly $14,900 in fiscal 2Q2017.

“Although we expect this average expense level to eventually come down to more normalized levels, the upfront rig start-up expenses during this deep phase of the upturn, along with the carrying costs of still over 200 idle and available AC-drive FlexRigs, are temporarily and unfavorably impacting the average,” Tardio said. “If we isolate rigs that remained active during the first fiscal quarter, their average expense level was still close to $13,000 per rig per day, which is similar to overall levels experienced in more stable time periods like 2013 and 2014.”

Term contract commitments are in place for an average of 86 rigs during fiscal 2Q2017, 75 rigs in the last half of fiscal 2017, 44 rigs during fiscal 2018, and 17 rigs during fiscal 2019.

“These commitments include about 20 rigs that have been placed under term contracts since last May with a pricing at slightly higher than spot market levels,” Tardio said. Including these newly contracted rigs, the average daily rig margin for rigs that are under term contracts have been declining from a $15,000 to $16,000 range to an expected range between $13,000 and $14,000/day during the second fiscal quarter.

“I think there’s no doubt that we have some pricing power in the market now,” Lindsay said. “I think everyone’s been pleasantly surprised with how quickly things have moved, and so it’s been kind of hard to keep up with it, quite frankly, but there is pricing power…

“It’s pretty hard to see out past this quarter. We obviously have a lot of calls coming in and customers wanting rigs for February, March, even some April deliveries, and so with that we would expect to see some continued pricing.”

The question remains what producers will do with lower commodity prices than they had in early 2014.

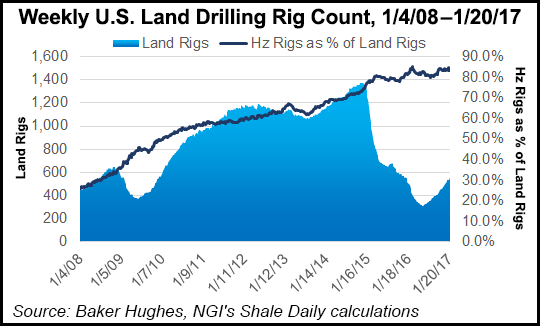

“With these new levels, the question is, is how many rigs does it take? I think right now, it appears that we’re on target as an industry to potentially get to — I mean, we’re almost at 700, so you would think that 800 is within our sights…In that case, it’s going to be tight…

“Clearly, the majority of the focus is going to be on the higher end, higher-spec rigs, based on the types of wells that we see customers drilling today.”

NGI’s Shale Daily is covering many North American-focused oil and gas operator results over the coming weeks. A calendar listing is available on the website.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |