E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Haynesville Did Comstock Proud in 2016; 20 Wells Planned This Year

Comstock Resources Inc. credited its Haynesville Shale drilling program for a 47% increase in proved reserves achieved last year.

The Frisco, TX-based producer said that at year-end, proved oil and natural gas reserves were 7.3 million bbl of crude oil and 872 Bcf of natural gas, or a combined 916 Bcfe. This marks an increase from 365 Bcfe from the end of 2015. In 2016 Comstock replaced production by 667%.

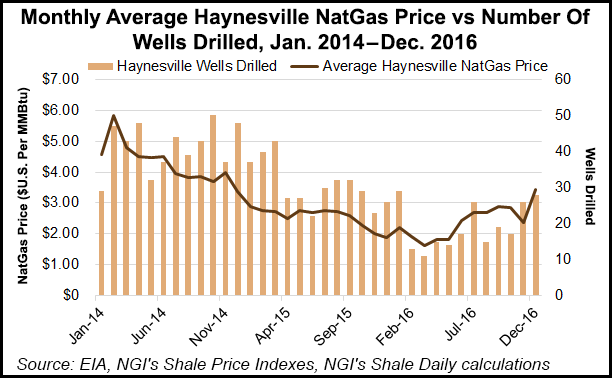

Forty percent of the reserves are classified as proved developed, and 98% are operated by Comstock. The present value, using a 10% discount rate, of the future net cash flows before income taxes of the proved reserves (PV-10 value) was $431 million, using average first-of-month 2016 prices of $2.29/Mcf for natural gas and $37.62/bbl for oil.

Comstock produced 62 Bcfe, or 169 MMcfe/d, during 2016. Natural gas production grew 13% to 53.7 Bcf while oil production decreased by 55% to 1.4 million bbl. Natural gas comprised 87% of 2016 total production compared to 72% in 2015.

Production in the fourth quarter was 14 Bcfe, or 153 MMcfe/d, which was comprised of 3,217 bbl of oil and 133 MMcf of natural gas. The production decline in the fourth quarter was primarily attributable to the suspension of the drilling program in June, which was later restarted in the fourth quarter; the company’s divestiture of certain natural gas properties in the fourth quarter; and the shut-in of certain Haynesville shale production for offset completion activity.

Besides the Haynesville, a debt exchange offer completed in September also helped, Comstock said Thursday.

“Despite a limited drilling budget in 2016, Comstock added 285.5 Bcfe of new reserves, primarily related to its Haynesville Shale properties,” the company said. “In addition, the company experienced 143.6 Bcfe in upward revisions, primarily related to the Haynesville Shale properties included in proved reserves at the end of 2015.”

Comstock said it plans to drill 20 (15.5 net) additional Haynesville wells in 2017 and complete the 2016 wells at an estimated capital outlay of $142.9 million. The company has budgeted an additional $7 million for other non-drilling expenditures. Comstock also has tentatively budgeted an additional $17.6 million for two (1.7 net) Bossier Shale wells that may be drilled in late 2017 depending on natural gas prices.

Comstock and USG Properties earlier this month announced a partnership targeting Haynesville acreage recently acquired by USG. Last November, Comstock said it was essentially writing off its investment in the Tuscaloosa Marine Shale. Executives said the company’s Haynesville acres were “more important than they’ve ever been to us…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |