Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bakken to Get ‘First Call’ on Increased Capital, Says Hess CEO

Hess Corp. plans to increase its drilling this year in the Bakken Shale, moving to six rigs from two by year’s end, and if oil prices are closer to $60/bbl, the North Dakota play could see more capital, CEO John Hess said Wednesday during a 4Q2016 earnings conference call.

Global production will lag demand leading to further increases in oil prices, which would be good for the Bakken and elsewhere this year and next, the CEO said.

The exploration production (E&P) company earlier this month signaled that it planned to spend close to $700 million this year in the Bakken as part of overall plans to spend $2.25 billion in capital expenditures in 2017 overall, including $1.35 billion in the United States.

COO Greg Hill said production by the end of this year should be about 105,000-110,000 boe/d in the Bakken. Total production including in the Gulf of Mexico, Norway and Guyana, is forecast to be close to 300,000-310,000 boe/d.

“As we have said in the past, during the downturn, we have tried to preserve a lot of capability, especially on the contracting side, so we can enable a smoother transition when we ramp back up” in the Bakken, Hill said. “We’re reasonably confident that this year we can manage that pretty efficiently.”

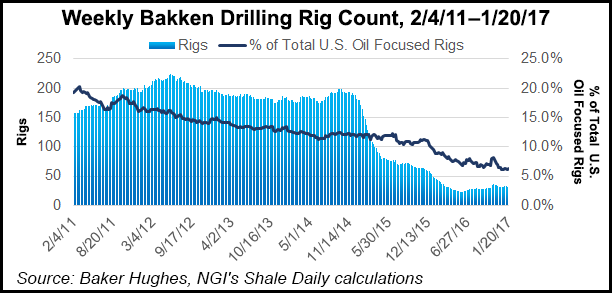

Net production in the Bakken during 4Q2016 was down 13% year/year to 95,000 boe/d. The New York City-based E&P averaged two rigs and brought 21 gross operated wells on production in the final quarter.

Drilling costs should remain flat in the Bakken this year, averaging about $4.8 million/well using 50-stage hydraulic fractures (frack). Up to 10 pilot wells also are planned using 60-stage fracks.

“In the fourth quarter all of the wells we drilled were 50-stage fracks in the core-of-the-core in the Bakken, so the best ones we were drilling were all in the fourth quarter,” Hill said. “We will stay in the core in 2017; it will be the bulk of where our drilling is, and with the 50-stage fracks the IP [initial production] rates will be higher this year than they were in 2016.”

The CEO said “the first call on cash” this year will be the Bakken. “With oil prices and what we’re doing to ramp up rigs in the Bakken, we have said that first call will be in the Bakken, so we would look to how we could accelerate that rig count there.”

Hess predicted that the recent agreement by the Organization of the Petroleum Exporting Countries (OPEC) to reduce global output through May would be a boon for U.S. shale oil production growth, writing a “new chapter” for oil prices globally.

“We see that continued strong demand, coupled with the continued reduced supply from OPEC and non-OPEC supply cuts and natural field declines, will more than offset any increases in U.S. shale production, leading to higher oil prices this year and into 2018,” he said.

Hess plans to spend $660 million in the Bakken this year, including $50 million for nonoperating participation activities and $465 million for drilling/completions, with the remainder directed to drilled-but-uncompleted wells ($95 million) and maintenance/field upgrades ($50 million).

On the technology front, Hill said the company may be nearing the technical limits for adding frack stages, and it now is testing the limits on additional proppant.

“We now want to push the technical limits on the amounts of proppant in each stage,” he said. “We are going to pilot test higher loadings to find out what the optimum point might be to further increase value while not causing significant well development interference. So far, we haven’t seen any significant interference.”

For 4Q2016, Hess reported a net loss of $4.89 billion (minus $15.65/share), compared with a net loss in the year-ago period of $1.82 billion (minus $6.43). The 4Q2016 losses included a one-time accounting charges of $3.7 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |