Natural Gas Traders Looking Past Bullish EIA Storage Data

Natural gas futures tried to work higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what traders were expecting.

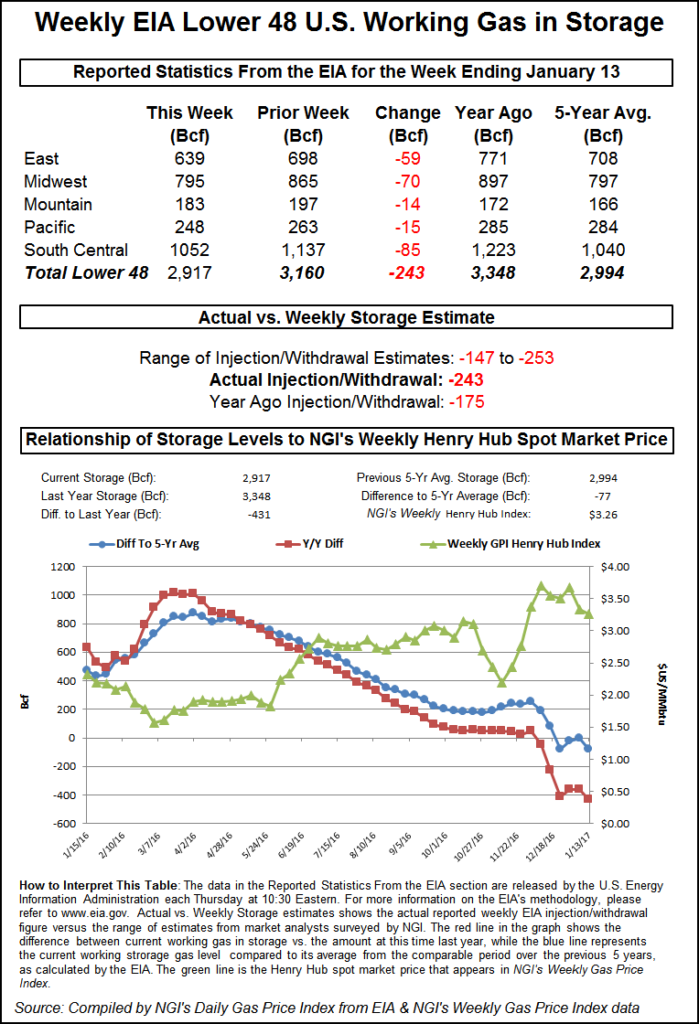

The EIA reported a 243 Bcf storage withdrawal for the week ending Jan. 13 in its 10:30 a.m. EST release, whereas traders were expecting a pull of about 12 Bcf less. February futures reached a high of $3.336 immediately after the figures were released and by 10:45 a.m., February was trading at $3.314, up 1.2 cents from Wednesday’s settlement.

“The market really didn’t do much and struggled to get above resistance at $3.31,” said a New York floor trader. He added that additional market buying could take the market to the “next level” at $3.35 to $3.37.

“The 243 Bcf net withdrawal for last week was more than the final survey expectations, but not out of the range of estimates,” said Tim Evans of Citi Futures Perspective. “This was the largest draw of the season to date, exceeding the 237 Bcf decline in the week ended Dec. 23. It was also supportive relative to the 170 Bcf five-year average for the date, and so supportive on a seasonally adjusted basis.

“While this report was more supportive than anticipated and does go some way toward showing a somewhat tighter supply-demand balance, smaller and somewhat bearish storage withdrawals are still likely over the next two reports, limiting the upward price potential,” he added.

Inventories now stand at 2,917 Bcf and are 431 Bcf less than last year and 77 Bcf less than the five-year average. In the East Region 59 Bcf was withdrawn and the Midwest Region saw inventories decrease by 70 Bcf. Stocks in the Mountain Region fell 14 Bcf, and the Pacific Region was down 15 Bcf. The South Central Region dropped 85 Bcf.

Salt Cavern storage was down 31 Bcf at 312 Bcf, and non-salt storage was lower by 54 Bcf to 740 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |