Bakken Shale | E&P | NGI All News Access

Production, Related Activity Sputters in North Dakota

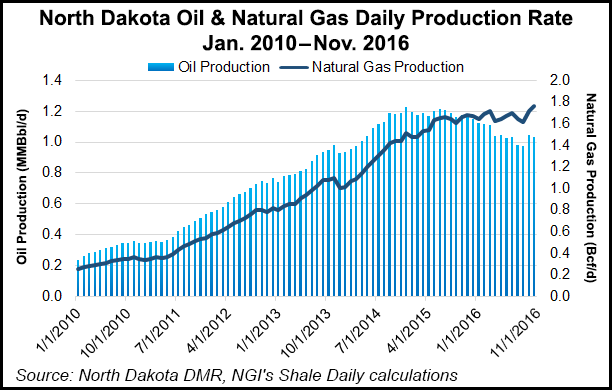

With the exception of average daily natural gas output, North Dakota production and related activities saw declines in November, a downward trend that is likely to continue through the winter, according to Lynn Helms, director of the state’s Department of Mineral Resources.

Oil production in November was 31.03 billion barrels (1.03 million b/d), compared to 32.34 billion barrels (1.04 million b/d) in October, while natural gas reached 52.9 Bcf (1.76 Bcf/d) in November, compared to 53.2 Bcf (1.71 Bcf/d). Permitting activity and the rig count dropped off, too.

Helms predicted that January statistics will show oil production once again below 1 million b/d. “There was some slippage of about 10,000 b/d [in November], and about 80% of that was on the Fort Berthold Reservation [portion of the Bakken].”

Noting that the increased daily gas production came as flaring decreased (gas capture hit 89%), Helms said it is interesting that the latest statistics “reflect just how much more significant natural gas production is becoming — in terms of North Dakota revenues, production and operations.”

Although both conventional and unconventional well numbers are up, Helms said his field inspectors are reporting that a lot of conventional wells among the state’s census of more than 2,000 are being shut in for the winter. “[Operators] plan is to leave them shut until spring, so we’re going to see coming up a significant decline in the number of conventional wells and some serious declines in the production from those conventional wells,” he said, adding that in November conventional well production was 53,000 b/d.

Another area that experienced a major decline was permitting, which dropped by more than half in December compared to the previous month (35 vs. 76, respectively), Helms reported on his monthly webinar, noting he wasn’t sure of the cause of the big decline.

“That’s a very large fall in permitting numbers, and that is a ‘leading-leading indicator;’ it’s the number that feeds drilling rigs,” Helms said, adding that once a company has a permit, typically within six months action is taken on it while the general rule is the permit is good for up to a year. “So when you have a downturn in permits, it is normally a year later that we see an impact, and for rig counts there is another lag of up to six months.”

Helms said the latest drop in permits could be felt in 12 to 18 months, and the real impact on production statistics will be felt. “So this current number could impact production in June of 2018,” he said.

In response to questions from news media on the differences between oil and gas production rates in November, Helms explained that there is a different concentration of gas supplies/barrel of oil in the core part of the Bakken, compared to the outlying production areas, and since the core area is where most of the drilling is now taking place because of relatively low prices, proportionally there is more gas for each barrel produced.

“All of the current drilling is concentrated in a high gas-to-oil ratio area, the core of the Bakken,” Helms said. “Statewide, the ratio is 1,000 cubic feet [1 Mcf] of gas for each barrel of oil, but within the core area it is two-and-a-half to three times that, so as drilling concentrates in that core area, wells produce that much more gas for each barrel of oil.”

At some point in the future when the geology of the developed part of the Bakken changes and “pressure in the Bakken rocks declines,” that trend toward higher ratios of gas/oil bbl will kick in statewide, Helms added.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |