Markets | NGI All News Access | NGI Data

Weekly NatGas Tumbles, But Firming Futures Augur Well For Coming Week

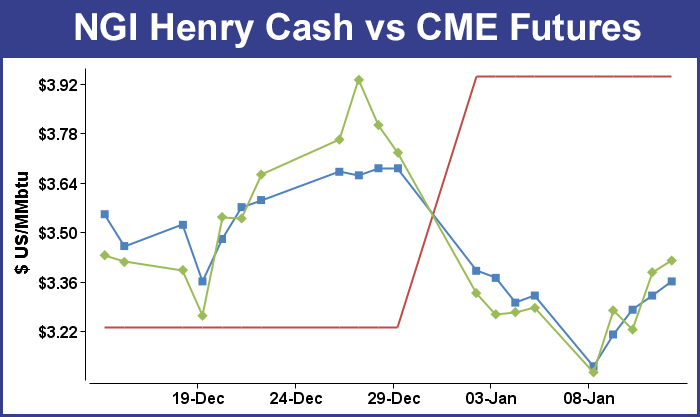

The weekly change in spot futures has a way of correctly forecasting the direction in the NGI Weekly Spot Gas Average for the following week, and this week was no exception. Last week, the February contract fell a stout 43.9 cents and for the week ended January 13 the NGI Weekly Spot Gas Average gave up 33 cents to $3.22.

All points followed by NGI were in the red, and the point showing the greatest loss was Algonquin Citygate, with a drop of $2.75 to $4.44, followed closely by Tennessee Zone 6 200 L with a decline of $2.55 to $5.02. The point proving the most resilient was PG&E Citygate, with a modest setback of just 2 cents to $3.52. With the exception of a few volatile eastern points, most locations were down 10 to 20 cents.

Regionally the Northeast shed $1.68 to $3.81, and the Southeast dropped 52 cents to $3.23.

Appalachia retreated 23 cents to $2.94, the Midcontinent slid 18 cents to $3.16 and the Midwest was off 16 cents to $3.24.

Rocky Mountain weekly quotes changed hands 12 cents lower at $3.16, and South Texas was seen a dime lower at $3.13.

Both South Louisiana and East Texas eased 9 cents, to $3.18 and $3.14 respectively, and California dropped just 6 cents to $3.36.

Next week’s weekly quotes are likely to be positive inasmuch as the February futures rose 13.4 cents to $3.419.

In Thursday’s trading most locations scored advances of a dime or more. The NGI National Spot Gas Average gained 16 cents to $3.34, led by gains in the Northeast off forecasts of falling near-term temperatures as well as supportive power pricing. February natural gas jumped 16.2 cents to $3.386 and March added 15.0 cents to $3.367.

Futures traded sharply higher Thursday morning after the EIA reported a storage withdrawal that was greater than what traders were expecting. It reported a 151 Bcf storage withdrawal in its 10:30 a.m. EST release, whereas traders were expecting a pull of about 7 Bcf less. February futures reached a high of $3.450 immediately after the figures were released and by 10:45 a.m. February was trading at $3.417, up 19.3 cents from Wednesday’s settlement.

“You had all those shorts that panicked out and pushed the market higher,” said a New York floor trader. “We are looking for it to hold $3.41.”

“Following a very bearish print last week [-49 Bcf] prices have quickly spiked this morning, as we expected a number over 150 Bcf to do,” said Harrison NY-based Bespoke Weather Services, “and we see $3.50 as likely to be hit before the week is over as we see significant week-over-week tightening.”

Randy Ollenberger of BMO Capital Markets said he “believes the storage report will be viewed as positive. Storage has dropped to five-year average levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 winter withdrawal season, assuming normal weather.”

Inventories now stand at 3,160 Bcf and are 363 Bcf less than last year and 4 Bcf less than the five-year average. In the East Region 39 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 56 Bcf. Stocks in the Mountain Region fell 10 Bcf, and the Pacific Region was down 12 Bcf. The South Central Region dropped 34 Bcf.

In Friday trading, physical natural gas for weekend through Tuesday delivery no one saw an immediate need to commit to four-day deals and prices oscillated a few pennies on either side of unchanged.

Gains in Texas and Louisiana were overshadowed by losses in the Midwest, Midcontinent, Rockies and California, and even the Northeast failed to exhibit its usual volatility. The NGI National Spot Gas Average fell a penny to $3.33. Futures trading was less volatile as well. Traders see February futures needing to breach the mid $3.50s to maintain upward momentum. At the close February had gained 3.3 cents to $3.419 and March was up 2.9 cents to $3.396.

Short-term traders are partial to the long side. “The storage report came in a little bullish and you’ve got some cold weather coming in, and I like the market short term up to $3.50 to $3.52. It’s got to rally through $3.52 to keep going,” a New York floor trader told NGI.

Market technicians, on the other hand, see market risk to the downside. “The risk to this market is that the market stays far enough from the highs to satisfy the bulls long enough to wear out their patience levels,” said Walter Zimmermann, vice president at United ICAP.

“I’m just a little nervous here. The bulls are all thinking ‘all I need is patience and winter will bail me out.’ My suggestion to them is the market may require more patience of them than they think they are going to need.

“You would think the decline from $3.99 to $3.10 would have been a little traumatizing to the bulls, but they have barely budged at all. The Bloomberg survey shows the natural gas people are still heavily committed to the long side and the sentiment has backed off a little bit but nothing dramatic. The apparent stubbornness of the bulls to recognize that they might be in trouble suggests that their position is more dogmatic than based on reality.

“Dec. 31 is the average seasonal peaking day, and we fell from $3.99 on Dec. 28 to $3.10. You would think experience would ring some bells, but the thing about bulls or bears is that they say ‘history doesn’t matter’ because it will be different this time,” Zimmermann said.

Forecasters see a longer-term pattern developing with cold in the West and warmth in the East. “[Friday’s] 11-15 day period forecast is also warmer than yesterday’s forecast over the eastern two-thirds but a bit colder over the West,” said WSI Corp. in its Friday morning report to clients. CONUS GWHDDs are down 6.3 for days 11-14 and are forecast to be 128.6 for the period. These are 26 below average!”

Near-term gas buyers Friday for power generation across the broad ERCOT footprint will likely see slim pickings from wind generation until the end of the weekend. “A sharp arctic cold front will sag southward and meander across the Panhandle and northern tier during the next couple days,” WSI said. “This will lead to a sharp contrast of temperatures as readings in the 30s, 40s and 50s will bleed into western and the northern tier, including the Dallas metro, but the majority of Texas will remain unseasonably warm and humid with readings in the 60s, 70s to mid 80s.

“A northerly wind will lead to meager wind generation during the next two days, with output between 4 and 8 GW. A quick surge of south-southwest winds may lead to a spike of strong wind generation during Sunday with output as high as 11-13+ GW.”

In spite of a tempered weather outlook, other analysts see most risk to the upside. “Although current stock that approximates average levels might appear conducive toward a neutral trading stance, [Thursday’s] larger than expected supply decline is suggesting subsurface shifts that could remain well entrenched across the balance of the winter,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients.

“Power demand appears stronger than expected while export demand also remains stout. And with gas production has yet to see major response to a seven-month uptrend in drilling rig counts, we feel that the market will be anxious to respond upward to any shifts in the weather views. Speculative shorts have been placed back on the defensive via this month’s price bounce of more than 30 cents off of the Monday lows.”

In physical market trading gas for the four-day weekend fluctuated within narrow ranges at major market centers. Gas at the Chicago Citygate fell 2 cents to $3.30, and deliveries to the Henry Hub were quoted at $3.36, up 4 cents. Gas on Panhandle Eastern shed a nickel to $3.22 and Kern Receipts added a penny to $3.33. Gas priced at the SoCal Citygates changed hands a nickel lower at $3.62.

The typically volatile New England points were relatively subdued. Deliveries to the Algonquin Citygate added 19 cents to $5.02, but packages on Iroquois Zone 2 fell 35 cents to $4.23. Gas on Tenn Zone 6 200L eased 22 cents to $5.51.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |