Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

New ISO-NE Algonquin Tariff Fails to Reflect Scarcity Market, Dominion Says

A tariff change that was approved by FERC on Jan. 9 and went into effect on Jan. 10 granting ISO-New England (ISO-NE) permission to base certain price thresholds on Intercontinental Exchange’s (ICE) Algonquin Gas Transmission (AGT) Citygates Non-G pricing hub, rather than on the ICE AGT Citygates pricing hub, brought to light the issue of non-liquidity and its impact on daily business.

While ISO-NE uses various sources of natural gas prices for some purposes, the electric grid operator relies primarily on the daily ICE AGT-CG gas price index as an element of three tariff mechanisms: the import capacity resources, the peak energy rent (PER) strike price and the forward reserve threshold price.

In its filing to the Federal Energy Regulatory Commission, ISO-NE said that, historically, the price formed at the AGT-CG hub has been a good representation of the cost to acquire natural gas in New England, as the index has been highly liquid, with many trades and high volumes of transactions each day.

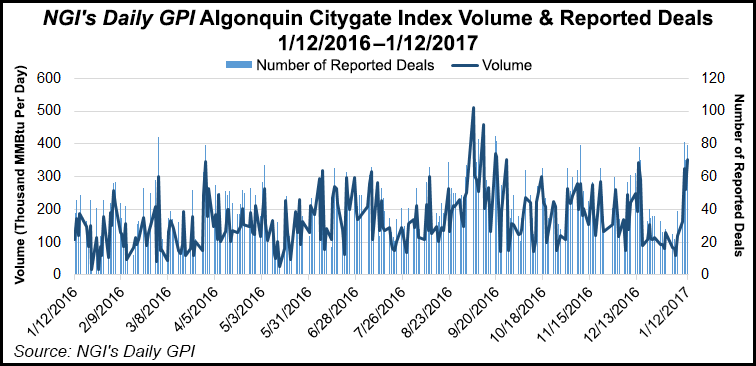

After ICE introduced the AGT Citygates Non-G pricing location in January 2016, however, liquidity at the AGT Citygates dropped substantially, failing to form an index on 55% of days from April through September 2016, making the index unsuitable to calculate ISO-NE’s three tariff mechanisms because of a lack of liquidity.

Most of the trading on the Algonquin pipeline is now done at the AGT Non-G pricing hub, and the new index complies with the Commission’s availability and liquidity thresholds for indices used in jurisdictional tariffs, ISO-NE said.

So on Nov. 10, 2016, ISO-NE, together with the New England Power Pool and the New England Power Pool Participants Committee, jointly filed with FERC the proposed tariff revisions to change the source of natural gas prices used in calculating the thresholds in ISO-NE’s Transmission, Markets and Services Tariff.

“Like all proposed tariff revisions, this proposal went through the complete stakeholder process, including the NEPOOL Market Committee and the NEPOOL Participants Committee,” ISO-NE spokeswoman Marcia Bromberg said.

ISO-NE noted that ICE is an approved price index developer and a review of a recent 90-day period (Aug. 3, 2016-Oct. 31, 2016) shows that a daily price index was calculated at the AGT-CG (Non-G) hub every day.

ISO-NE also noted that the average daily trade volume for non-holiday weekdays during this period was approximately 71,000 MMBtus and that the AGT-CG (Non-G) index has a consistently sufficient trade volume to ensure that natural gas prices used in calculating the tariff thresholds will be representative of the cost to acquire natural gas in New England.

NGI, meanwhile, began publishing its Algonquin Citygate index on Sept. 1, 1999. Since that time, there have been only a handful of occasions during the early history of that point in which NGI did not publish an index for that location. In fact, NGI has published a daily index for Algonquin Citygate every single day since Oct. 17, 2002. For more information on NGI’s data, visit: www.naturalgasintel.com/NGI_Data.

NGI’s Algonquin Citygate index includes transactions to delivery points within the Algonquin system, including transactions on the G lateral and non-G transactions. It excludes gas deliveries into Algonquin from connecting pipelines as that is a separate index.

“NGI continues to survey and analyze the market to determine whether there is a need for a separate Algonquin Citygate Non-G index. We welcome any comments and input on this and other market matters,” said NGI’s Pat Rau, director of strategy and research.

ICE’s AGT Citygates Non-G price index, meanwhile, excludes transactions requiring delivery of natural gas on the “G” lateral of the Algonquin pipeline, an often constrained part of the pipeline system during peak demand days that results in higher prices.

And because ICE’s Non-G price index does not include transactions requiring delivery on the G lateral, Dominion had argued that it did not conform to existing PER requirements in ISO-NE’s tariff.

ISO-NE utilizes the PER strike price, derived in part by the AGT Citygates price index, in the PER Adjustment, which is intended to act as a hedge for load against price spikes in the energy market. The PER Adjustment is designed to approximate the additional revenues that a hypothetical proxy peaking unit would earn in the real-time energy market during the highest-priced hours reflecting scarcity, and to return those revenues to load.

To develop the PER adjustment, each day, ISO-NE calculates a PER strike price that is slightly higher than the marginal operating cost of the most expensive resource in New England, i.e., the hypothetical proxy peaking unit.

The Richmond, VA-based company asserted that a PER strike price that fails to approximate the cost of the marginal resource as the system approaches a scarcity condition would subject capacity resources to unwarranted PER penalties.

Dominion said ISO-NE provided no analysis or evidence that the price at the AGT Citygates Non-G hub would lead to a PER strike price that approximates the fuel costs of the marginal resource.

Failure to do so could have a discriminatory effect on generators that must purchase higher-priced natural gas, i.e., if the real-time price exceeds the PER Strike Price but remains below the price of the higher priced generators, the company said. Dominion suggested that these higher-priced generators would be penalized more because they would not be dispatched for energy, but still would be subject to PER penalties.

As an alternative, Dominion proposed FERC should require ISO-NE to revise the proposed tariff language to use the higher of the AGT-CG and AGT-CG Non-G indices to calculate the PER Strike Price. Dominion argued this alternative would ensure that when natural gas prices exceed oil prices, the natural gas price used in the PER strike price calculation would approximate the cost of the PER proxy unit in accordance with the tariff.

It should be noted that Dominion generally supported ISO-NE’s proposed change. Its only issue was in relation to the PER strike price.

But FERC said because it deemed ISO-NE’s proposal to be just and reasonable, there was no need to entertain Dominion’s alternative proposal. Furthermore, FERC said in order for an index location to be used in the jurisdictional tariff, it must meet at least one of the Commission’s conditions for minimum levels of activity at a particular trading location.

Specifically, those conditions are: (1) average daily volume traded of at least 25,000 MMBtu/d for gas or 2,000 MWh/d for power; (2) average daily number of transactions of five, eight, 10 or more (depending on whether it is a daily, weekly, or monthly index); and (3) average daily number of counterparties of five, eight, 10 or more (depending on whether it is a daily, weekly, or monthly index).

Dominion has failed to explain how the continued use of the AGT-CG price index meets at least one of these criteria, FERC said.

NEPOOL said it would support an ISO-NE evaluation of the effectiveness of the natural gas index change, based on actual experience with use of the AGT-CG Non-G index, to be presented to stakeholders in the NEPOOL stakeholder process.

In an emailed response to several questions related to the tariff change, Dominion spokesman Frank Mack said, “The Federal Energy Regulatory Commission Order was made, and it is unlikely that we will appeal the decision.”

No other stakeholders protested ISO-NE’s change to the AGT Citygates Non-G price index, FERC spokesman Craig Cano said.

Once the grid operator submitted its proposed tariff change in November 2016, a 21-day period for filing comments and responses began, as is customary under the Federal Power Act, Cano said. In this case, comments were due Dec. 21.

Cano noted that FERC has a 60-day statutory deadline by which it must act on Section 205 filings (with very limited ability to grant extensions), so the Jan. 9 order met that deadline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |