Markets | NGI All News Access | NGI Data

Broader NatGas Cash Gains Offset Eastern Weakness; Futures Shed Nickel

Physical natural gas for Thursday trading on balance was able to eke out a small gain Wednesday, but futures bulls were not up to the challenge of following through on Tuesday’s 17-cent advance.

Firming prices in the Midwest, Midcontinent, Texas, and Louisiana were able to offset drops in the Northeast and Appalachia. The NGI National Spot Gas Average rose 3 cents to $3.18.

Futures opened unchanged and were unable to hold support at $3.25. February lost 5.4 cents to $3.224, and March came in 5.8 cents lower at $3.217. February crude oil rose $1.43 to $52.25/bbl.

Risk managers acknowledged upside risks, they are positioning from the short side of the market.

“If we continue to see colder than normal temperatures for the balance of the winter, we could see the gas market continue to test the $4 level for the next couple of months,” said DEVO Capital Management President Mike DeVooght in a note to clients. “If temperatures start to trend warmer, we could very well see gas back at $3 by the end of the heating season.

“Looking forward into mid 2017/early 2018, we feel the gas market is going to have a difficult time holding above the mid $3 range as takeaway capacity out of the Marcellus and Utica expands,” he said. “On a trading basis, we will approach the market from the short side as we position for the New Year.”

Trading accounts were advised to hold a short February futures position from $3.70, yet end users are counseled to stand aside.

DeVooght currently is advising producers and physical market longs to buy a $3.00 12-month put strip, along with the sale of $3.75 calls, to offset the cost for a debit of “about 5 cents. It wouldn’t take much of an uptick to make that trade flat. Even if it were a $2.75 [put] and a $4 [call] it all depends on what you are trying to accomplish.

“The highest probability is just like the crude,” he said. “You are looking at an extended trading range. Floors in the $2.75 to $3 range and ceilings in the $3.75 to $4 range should work for producers.”

The Energy Information Administration (EIA) is forecasting that prices are going to advance this year. According to EIA’s monthly outlook issued Tuesday, U.S. gas prices are looking stronger than they did in early December, with Henry Hub now expected to average $3.55/MMBtu in 2017, compared with last month’s forecast of $3.27.

The latest edition of the Short-Term Energy Outlook (STEO) said Henry Hub spot prices, which averaged $2.51/MMBtu in 2016, should climb through 2017 and be more than $1.00 higher year/year. The new forecast, the first to include a call for 2018, sees next year’s prices also higher, averaging $3.73.

Market technicians versed in Elliott Wave and retracement analysis see further market gains dependent upon whether certain key hurdles can be met.

“While $3.099-3.030-3.009 was able to propel natgas higher on Tuesday, bulls were unable to bust through the 0.236 retracement at $3.309 or shift the technical readings back in their favor,” said United ICAP market analyst Brian LaRose. The “best we can label Tuesday’s price action is constructive.” He was planning to see “if the bulls can complete these two tasks Wednesday. If they can, then natgas should have a chance to stage a recovery from here.”

Near-term weather forecasts continued to trend warmer.

“Trends were in the warmer direction once again in this period, with these adjustments focused in parts of the Central U.S. and South,” said MDA Weather Services in its Wednesday morning six- to 10-day report to clients.

“The West, however, is marginally colder” from Tuesday’s forecast, “while the East goes mostly unchanged on the whole. The large-scale pattern remains warmer than normal for most locales across the U.S., including temperatures in the strong above normal category in parts of the Midwest and South.”

In physical market trading, eastern points slumped as temperature forecasts showed above normal readings. Wunderground.com predicted that Boston’s high Wednesday of 55 degrees would ease to 54 Thursday and 42 Friday, still 6 degrees above normal. New York City’s 49 maximum Wednesday was seen reaching 58 Thursday and sliding back to 45 Friday, 7 degrees above normal.

Deliveries to Tetco M-3 fell 8 cents to $2.98 and gas bound for New York City on Transco Zone 6 shed 20 cents to $3.03.

Market points further west firmed. Gas at the Chicago Citygates added 7 cents to $3.25, and packages at the Henry Hub were quoted 7 cents higher also at $3.28. Gas priced at the NGPL Midcontinent Pool rose 13 cents to $3.16, and gas at the SoCal Border Avg. Average gained 6 cents to $3.28.

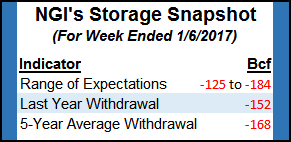

Estimates for Thursday’s EIA storage report are coming in less than last year’s 152 Bcf withdrawal. PIRA Energy predicted a pull of 140 Bcf, but Citi Futures Perspective is calculating a 160 Bcf withdrawal. A Reuters survey of 19 traders and analysts revealed an average 144 Bcf decline with a range of -125 Bcf to -184 Bcf. The five-year average withdrawal is -168 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |