Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Part Company; February Sheds Another 6 Cents

The physical natural gas and futures markets decided to take opposite paths in trading Wednesday as physical prices in eastern markets were buoyed by a near 20-degree drop in temperatures and supportive power pricing. TheNGI National Spot Gas Average gained 5 cents to $3.49.

Gains in the Midcontinent and Northeast were able to offset broader weakness in Texas, Louisiana, Appalachia, the Rockies and California. Futures traders were more concerned with a break in the recent string of 200 Bcf-plus storage withdrawals as estimates of Thursday’s Energy Information Administration report are coming in well below historical averages.

February continued to slide, losing 6.0 cents to $3.267, and March dropped 6.8 cents to $3.249. February crude oil added 93 cents to $53.26/bbl.

Traders are gearing up for a influx of cold air now hitting the Rockies and then moving through eastern markets in coming days. In the meantime, though, eastern points had to deal with cold of their own as forecasts called for a double-digit temperature drop in key eastern markets. Forecaster Wunderground.com predicted that New York City’s Wednesday high of 52 degrees would drop to 33 Thursday before recovering ever so slightly to 34 by Friday. The normal high in the Big Apple this time of year is 39. Philadelphia’s 55 maximum Wednesday was anticipated to drop by 19 degrees to 36 Thursday and hold Friday, 5 degrees below normal.

Gas at the Algonquin Citygate jumped $1.53 to $6.67, and gas at Iroquois, Waddington rose 47 cents to $4.70. Deliveries to Tennessee Zone 6 200 L rose $1.19 to $6.96.

Packages on Texas Eastern M-3, Delivery added 20 cents to $3.54, and gas bound for New York City on Transco Zone 6 gained 96 cents to $4.50.

Next-day power prices were also supportive. Intercontinental Exchange reported on-peak Thursday power at the ISO New England’s Massachusetts Hub jumped $14.82 to $59.83/MWh, and peak power at the PJM West Hub gained $4.20 to $38.59/MWh.

Other trading hubs were mostly lower. Gas at the Chicago Citygate shed 6 cents to $3.49, and deliveries to the Henry Hub fell 2 cents to $3.37. Gas on Panhandle Eastern was flat at $3.36 and gas at the SoCal Citygate fell 15 cents to $3.61.

Tuesday overnight weather models showed little overall change with a slightly colder one- to seven-day outlook balanced by a warmer eight- to 14-day period.

“After the weekend’s major changes, the models appear to be settling for now on this new narrative,” said Commodity Weather Group President Matt Rogers in a Tuesday morning report to clients.

“The short-lived colder period in the front half of the forecast period gets a little bit stronger” with Wednesday’s update, adding “some demand to the balance of this week into the start of next, but then the return to warmer weather later next week gets just a bit warmer…with some demand losses in that window.”

Most of the demand gains Wednesday were “found in the Midwest to East, but at times in the South and West, too,” Rogers said. “The late six-10 day into 11-15 day losses are strongest into the East and South, but also into the Southwest and Midwest at times.”

The phalanx of cold marching into the Midwest has pipeline operators scrambling to balance flows with high demand.

“The cold weather system is migrating south and eastward into the Midwest market and causing several Midwest pipelines to begin issuing warnings and system limitations,” said industry consultant Genscape Inc. in a Wednesday morning report to clients. “We are showing Lower 48 demand is up to a 15-day high at 92.4 Bcf/d, with Midwest demand up to 17.5 Bcf/d, a 3.65 Bcf/d day-over-day increase.

“Midwest pipelines are putting out notices warning of potentially strained operating conditions. Guardian, Midwest Gas, Missouri River Transmission, NGPL and Viking have all issued warnings of high demand sharply limiting system flexibility.” NNG implemented a system overrun limitation “for all market zones, and Carlton Resolution rules are in effect.”

Genscape estimated Midwest population-weighted heating degree days (HDD) to be up to 51 Wednesday compared to a normal at 41, and they are forecast to reach 56.2 by Friday.

The forecast cold had yet to manifest itself in elevated heating loads, according to National Weather Service (NWS) figures. For the week ending Jan. 7, NWS predicted that New England would see 242 HDDs, or 35 fewer than normal. The Mid-Atlantic is projected to experience 235 HDDs, or 22 fewer than its seasonal norm, and the greater Midwest should have 272 HDDs, or 19 fewer than its seasonal tally.

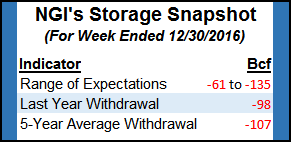

Thursday’s storage report is expected to break the recent trend of above normal storage withdrawals. Last year 98 Bcf was withdrawn and the five-year pace is for a 107 Bcf pull. Estimates this time around are wide-ranging as analysts grapple with the effect of the holiday, but they are generally less than 100 Bcf.

A Reuters survey of 17 traders and analysts showed an average 82 Bcf withdrawal with a range of -61 Bcf to -135 Bcf. Citi Futures Perspective calculated a 106 Bcf pull and PIRA Energy is looking for a 65 Bcf decline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |