Markets | NGI All News Access | NGI Data

NatGas Bulls Unmoved by Stiff Storage Draw

Natural gas futures traded higher, then lower, but still remained in negative territory Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what traders were expecting.

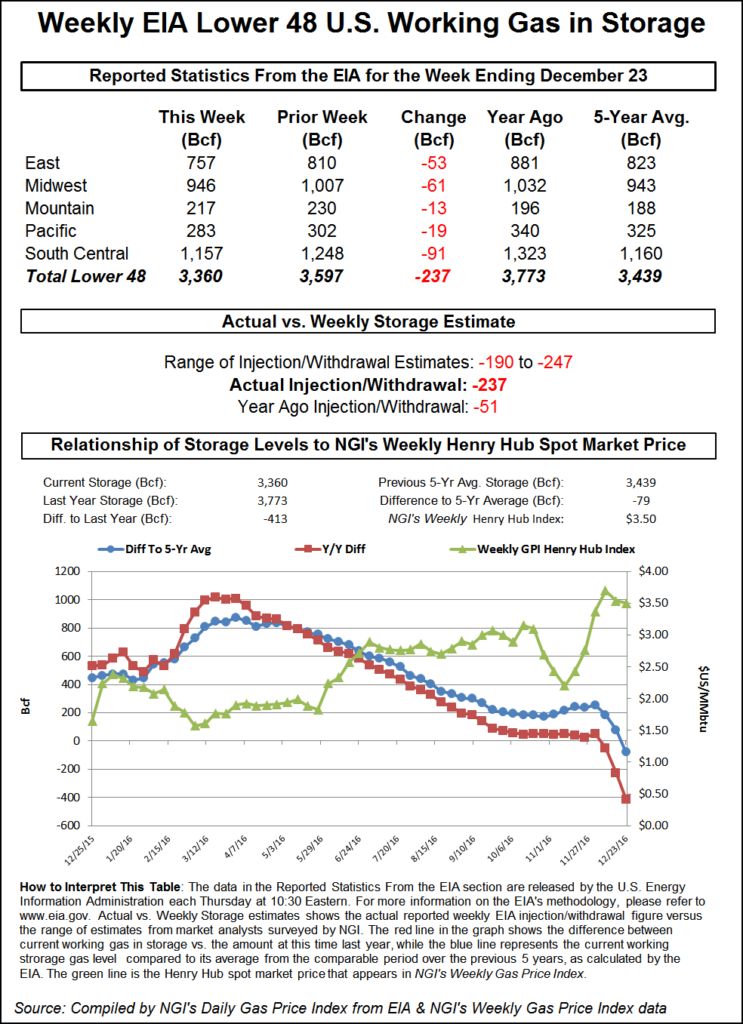

EIA reported a 237 Bcf storage withdrawal in its 10:30 a.m. EST release, whereas traders were expecting a pull about 15 Bcf less. February futures reached a high of $3.884 immediately after the figures were released, and by 10:45 a.m. February was trading at $3.828, down 7.0 cents from Wednesday’s settlement.

“We were looking for between a 220 to 225 Bcf draw,” said a New York floor trader. “Apparently traders thought it would be a lower number, because it rallied after the number came out but came back to where it was before the number came out.”

“$4 is going to be a big, big resistance number. If you look straight across the board, you don’t see any $4 prints.”

The two most recent storage pulls have analysts tweaking their spreadsheets. “The 237 Bcf net withdrawal from storage for last week was in the upper half of the range of expectations, a somewhat bullish surprise,” said Tim Evans of Citi Futures Perspective. “The draw for last week was well above our weather-based model’s 198 Bcf estimate, suggesting some combination of greater demand sensitivity to cold than anticipated and some drop in production or net trade supply. Either way, this will shift our baseline for upcoming reports in a bullish direction.”

Inventories now stand at 3,360 Bcf and are 413 Bcf less than last year and 79 Bcf less than the five-year average. In the East Region 53 Bcf was withdrawn and the Midwest Region saw inventories decrease by 61 Bcf. Stocks in the Mountain Region fell 13 Bcf, and the Pacific Region was down 19 Bcf. The South Central Region declined 91 Bcf.

Salt cavern storage was down 39 Bcf at 324 Bcf, while the non-salt cavern figure was down 51 Bcf at 833 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |