Markets | NGI All News Access | NGI Data

NatGas Cash Languishes While Futures Score New High; Expired January Adds 17 Cents

Physical gas for delivery Thursday moved little in Wednesday’s trading as gains in Texas, the Southeast and Appalachia narrowly offset weakness in the Northeast, Rockies and California. The NGI National Spot Gas Average rose 1 cent to $3.61.

Futures trading was an entirely different ballgame, with traders focusing on longer term weather forecasts expected to bring bone-rattling cold Canadian air to the Midwest as far south and east as the Carolinas by next week.

The expiring January contract made a new high for the advance, which started in March from $1.611, and at the close settled at $3.930 after trading as high as $3.994. February advanced 13.2 cents to $3.898. February crude oil added 16 cents to $54.06/bbl.

Short-term futures traders attributed the advance to a combination of short covering and new length.

“We’ll know if it the short covering has run out by where it settles,” a New York floor trader told NGI shortly before the close. “If the market settles below $3.91 that will indicate short-covering, otherwise new length is more in play.”

Technical traders saw the day’s price action as auguring higher prices to come.

“With natgas busting through the $3.777 high we can confirm the uptrend is intact,” said United ICAP market analyst Brian LaRose. “The question now, just how high can natgas go from here? Bearish case, natgas ends its seasonal run into the $4.301-4.473 neighborhood. Bullish case, natgas marches to $5.234-5.386 before a seasonal top is in place. Bulls will first need to contend with $3.904-3.951-4.003 to start the new year, though.”

The timing of expected cold is under the microscope. Weather models Tuesday overnight continued to be on track for a surge of cold air next week from west to east, but timing and intensity continue to be an issue.

“Trends in [the six- to 10-day] period were in the colder direction from the West to Texas, while changes were mixed and detailed from the Midwest to the East,” said MDA Weather Services in its Wednesday morning report to clients. “This period continues to represent a transitioning in the pattern, when ridging over Alaska and the northern Atlantic enhance a cold air flow into North America.

“The cold will start out focused in the Northwest and northern Rockies before pressing toward the Midwest at mid-period and reaching the East Coast late. Out ahead of this cold push, however, temperatures will be broadly warmer than normal along the East Coast and in the South in the early half. The eastern third carries the highest risk as models struggle in the timing of cold air’s arrival and the intensity of warmth that precedes it; models are generally colder in the West.”

The surge of cold air into the West may not have the impact on demand, one would think, as hydro supplies have taken power generation market share from natural gas.

“Out West, even though temps have been running slightly cooler than normal in both Northern and Southern California, gas has lost share of the power stack as the current weather system has featured decent amounts of precipitation for instant hydro (also building Sierra and Cascade snowpack for spring) and surges of wind,” said industry consultant Genscape Inc. in a Wednesday morning note. “In addition, CAISO power imports have been steadily rising as hydro and wind generation in BPA has also been surging.”

When the cold finally hits eastern markets a multitude of factors will be in play.

“New England demand will actually scale back slightly through the end of the week with moderately warming temperatures relative to earlier this week,” Genscape said. However, the market is forecast to get hit with heavy snow and wind, creating risk that our temperature-driven forecast may come in too high as those conditions may destroy/inhibit demand.

“The departure of this moisture-laden system will be trailed by a block of cold air that will push as far south as the Carolinas, but its impact on demand will be partly offset by the double whammy of the New Year holiday coming during a weekend.”

In physical market trading, Mid-Atlantic prices got some support from firm next-day power pricing. Intercontinental Exchange reported that Thursday on-peak power at the ISO New England’s Massachusetts Hub rose 50 cents to $50.00/MWh, and on-peak next-day power at the PJM West Hub gained $2.94 to $32.76/MWh.

Gas on Texas Eastern M-3, Delivery rose 4 cents to $3.41, and gas headed for New York City on Transco Zone 6 tacked on 16 cents to $3.74.

Deliveries to the Algonquin Citygate shed 25 cents to $5.37, and packages on Iroquois, Waddington rose 12 cents to $4.84. Gas delivered to Tenn Zone 6 200L dropped 55 cents to $5.52.

Major market trading points moved little. Gas at the Chicago Citygate rose a penny to $3.60, and gas at the Henry Hub was quoted a penny lower at $3.66. Deliveries to El Paso Permian shed 2 cents to $3.39, while gas priced at the SoCal Border Avg. also fell 3 cents to $3.58.

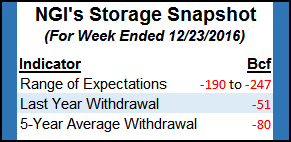

Thursday’s Energy Information Administration storage report is expected to be a doozy, surpassing even last week’s titanic 209 Bcf withdrawal.

Kyle Cooper of IAF Advisors estimated a 227 Bcf withdrawal, and a Reuters survey of 16 traders and analysts revealed a 222 Bcf average with a range from -198 Bcf to -243 Bcf. Last year an adjusted 50 Bcf was withdrawn and the adjusted five-year pace stands at 80 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |