Markets | NGI All News Access | NGI Data

Firm NatGas Cash Outdoes Lackadaisical Futures; January Essentially Flat

Physical natural gas traders who made sure they got their deals done before the weekly Energy Information Administration (EIA) storage report saw more activity than their futures brethren as gas traded for Friday delivery made healthy moves in many venues, while futures struggled to move much at all.

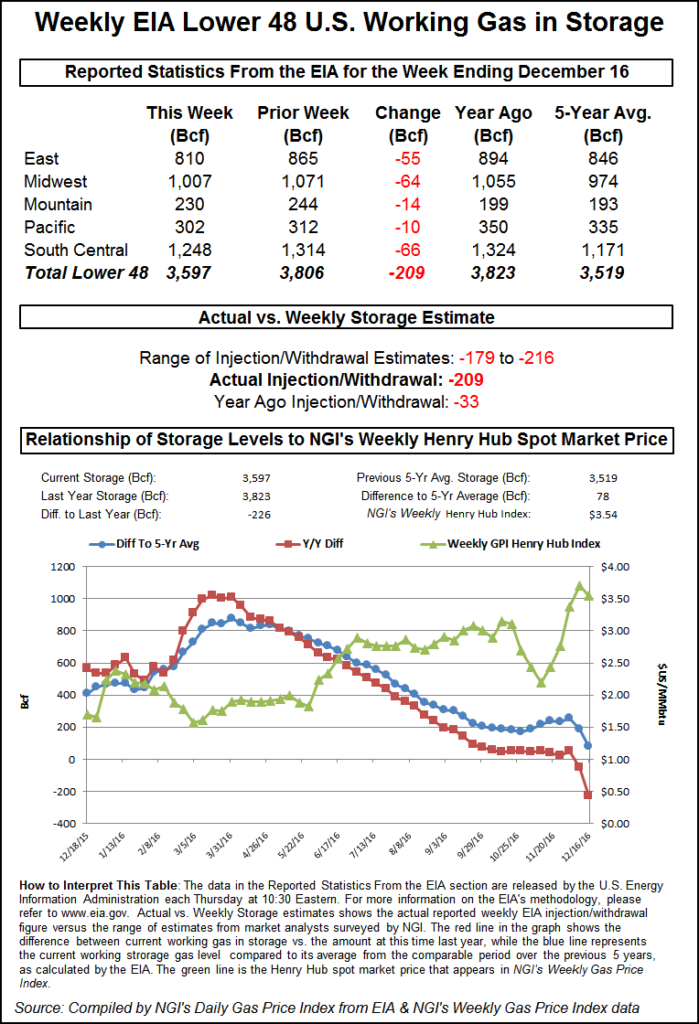

Strength in Texas, Louisiana, and the Northeast was able to advance the NGI National Spot Gas Average by 6 cents to $3.55, but futures struggled despite a monster withdrawal from inventories that put the year-on-year storage surplus into a deficit. EIA reported a withdrawal of 209 Bcf, about 8 Bcf more than what the market was expecting. Prices traded modestly higher initially, but at the end of the day January had slipped four-tenths of a cent to $3.538, and February had eased four-tenths as well to $3.563. February crude oil gained 46 cents to $52.95/bbl.

January futures reached a high of $3.626 immediately after the figures were released, and by 10:45 a.m. January was trading at $3.560, up 1.8 cents from Wednesday’s settlement.

“It looked like the market moved high enough to give some traders a chance to take money off the table ahead of the long weekend,” said a New York floor trader

“This drawdown was 9 Bcf below our estimate of -200 Bcf and on the lower side of most analyst estimates as well,” said Harrison, NY-based Bespoke Weather Services. “However, the recent market rally has seemed to have priced in an even more bullish miss in today’s number, and the number falling generally within expectations has helped prices fall back a bit today as weather remains neutral. Still, this market remains tight with some upside risk left.”

“The 209 Bcf versus 203 Bcf is pretty neutral, and the market should slip on it,” said Mike DeVooght, president of DEVO Capital, a Colorado trading and risk management firm.

“If we were at $3, it could have been bullish, but we’re at $3.60 and this is the third time we have been up here, and the reality is that there has been a tremendous amount of optimism built into the natural gas market. The funds have pretty much liquidated all their short positions, and that along with all the optimism about re-inflation has given the market a nice boost.”

DeVooght said these were times for producers to initiate short hedges to manage price risk. “It’s not that we are negative on natural gas, but I look at $3, $4 collars [selling $4 call options against the purchase of $3 put options to hedge downside price exposure] as making a lot of sense. We have had clients that have had stuff shut in and are now turning it back on. They have put hedges in place so that gas will show up later.

“The $3, $4 collar traded today at 1.2 cents [credit], so you could have executed that trade this morning. I like those. Just a few weeks ago prices were at $2.65.

“We are not terribly bearish, but it makes sense to do some forward sales in the form of collars with a $3 floor.”

Citi Futures Perspective analyst Tim Evans called the report “bullish,” adding that it was likely the result of stronger-than-anticipated heating demand. “The data implies a somewhat tighter balance in the market for the reports to follow as well,” he said.

The 209 Bcf draw dwarfed last year’s 33 Bcf pull for the week, as well as the 101 Bcf five-year average draw for the week.

Inventories now stand at 3,597 Bcf and are 226 Bcf less than last year but still 78 Bcf more than the five-year average. In the East Region 55 Bcf was withdrawn and the Midwest Region saw inventories decrease by 64 Bcf. Stocks in the Mountain Region fell 14 Bcf, and the Pacific Region was down 10 Bcf. The South Central Region declined 66 Bcf.

Overnight weather models turned cooler near-term. WSI Corp. in its morning six- to 10-day outlook said “[Thursday’s] six-10 day forecast period is colder than yesterday’s forecast over the East and a bit warmer on average over portions of the West and Midcontinent. CONUS GWHDDs are up 5 to 138.6 for the period, which are still 10.9 below average.”

WSI said confidence in the forecast was only close to average, and “The colder risks outweigh the warmer risks, mainly late in the forecast period based on the operational models and a potential -EPO [Eastern Pacific Oscillation].”

Analysts point out that current supply conditions emulate a period of much higher prices. “[T]his added up to the rescom demand within the Lower 48 shifting up to the 63 BCF level on the 19th,” said EnergyGPS in a Thursday morning note to clients. “On the same day, the power burns ramped up to top the 30 BCF level. On the supply side, there were some disruptions due to freeze-offs in the Midcon/Rockies as well as an unplanned outage at a processing plant in West Virginia.

“Ultimately, the production numbers shifted down from a high of 71.4 Bcf last Friday to 69.8 Bcf. The 1.6 Bcf drop added a little fuel to the fire as the net daily surplus/(deficit) shifted down to a negative 51 Bcf daily withdrawal. This level has not been seen since February 2015, when the entire northern portion of the Lower 48 remained extremely cold for a few weeks straight.”

Spot futures traded as high as $6.493 on Feb. 24, 2015.

In physical market trading next-day power pricing proved to be a stronger price driver than next-day temperatures. AccuWeather.com predicted that last-minute Christmas shoppers in Boston and New York would enjoy temperatures above seasonal norms. Boston’s high Thursday of 41 degrees was predicted to rise to 43 Friday and Saturday, 4 degrees above normal. New York City’s Friday high of 50 was seen sliding to 47 Friday and Saturday, 6 degrees above normal.

Gas at the Algonquin Citygate, however, rose $1.52 to $8.29, and deliveries to Iroquois, Waddington added 11 cents to $4.41. Packages on Tenn Zone 6 200L jumped $1.54 to $9.29.

Mid-Atlantic prices slumped. Gas delivered on Tetco M-3 fell 15 cents to $3.15, and gas bound for New York City on Transco Zone 6 shed 30 cents to $3.35.

Next-day power prices were in stronger alignment with gas prices than temperature forecasts. Intercontinental Exchange reported that on-peak power Friday at ISO New England’s Massachusetts Hub jumped $10.30 to $64.03/MWh, and Friday power at the PJM West terminal slipped $2.29 to $28.15/MWh.

Other market centers rose. Gas at the Chicago Citygate increased by 3 cents to $3.52, and deliveries to the Henry Hub were quoted 9 cents higher at $3.57. Packages on Panhandle Eastern were flat at $3.31, and Kern Delivery changed hands 8 cents higher at $3.49.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |