Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Rattled By New Weather Forecasts; January Jumps 28 Cents

Physical gas for Thursday delivery gained ground in Wednesday trading as advances in the Northeast, Appalachia, Gulf and Southeast points lifted smaller gains in California and the Rockies. The NGI National Spot Gas Average rose 11 cents to $3.49, but the big move of the day was in the futures ring, where a revised weather forecast suggesting the arrival of arctic cold by early next month caught traders’ attention.

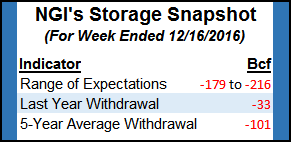

Thursday’s storage figures are expected to show supplies less than the five-year average for the first time in 18 months, and January futures bounded higher by 27.9 cents to $3.542 and February added 27.0 cents to $3.567. February crude oil dropped 81 cents to $52.49/bbl.

Weather models changed overnight and indicated conditions suggestive of colder temperatures around New Year’s. “In the past 24 hours, both the American and European model guidance have shifted back toward more high-pressure ridging around Alaska that sets the stage for a shift back colder again by about the New Year’s weekend with one cold push and then maybe more later in the 11-15 day,” said Matt Rogers, president of Commodity Weather Group, in a morning report. “Today’s changes were a bit cooler in the East and colder West in the short term, slightly less warm for the Midwest to South in the six-10 day, and then warmer South to West in the 11-15 day, while Midwest to East shift colder.”

Rogers expects forecasts to be more challenging going forward, in part due to the presence of a weak La Nina. “[W]e must anticipate a fairly volatile winter situation when both warm and cold periods have shorter lifespans than what is typical. This challenges forecast models and forecasters as the standard deviation is higher, [and] about two-thirds of these types of winters tend to have longer cold than warm periods.”

Not all are on board with the forecast. “What’s now of greatest interest weatherwise is if cold temperatures can become established across the northern US during the first week of January,” said Natgasweather.com in a noon update. “We continue to expect frigid polar air over Canada , although initially bottled up. The cold pool would need to release and advance toward the northern U.S. if frigid cold were to return and intimidate.

“The failure to do so would result in mild conditions over the important eastern U.S. to start January as weather systems would just not be cold enough overall. The weather data is inconclusive for early Jan but continues to show milder solutions maintaining the upper hand over cold ones, Natgasweather.com said.

The recent forecasts of milder weather through the end of the year have not dissuaded analysts from projecting an end to the five-year storage surplus. “We still see enough heating demand to still power a swing from a year-on-five-year storage surplus to a deficit in the weeks ahead,” said Tim Evans of Citi Futures Perspective in closing comments.

Evans is expecting a pull of 198 Bcf in Thursday’s storage report and thinks “the year-on-five-year surplus that was 186 Bcf on Dec. 9 will swing to deficit of 39 Bcf by Dec. 30. “This swing from surplus to deficit still confirms that the market is becoming physically tighter on seasonally adjusted basis, a fundamental support for prices over the near term,” he said.

In the physical market, healthy gains were posted at New England points but mixed pricing was observed in the Mid-Atlantic. Intercontinental Exchange reported higher next-day power in New England, but falling quotes in New York. Next-day power at the ISO New England’s Massachusetts Hub rose $2.90 to $53.73/MWh, but on-peak power at the PJM West terminal eased $2.55 to $30.44. On-peak power at the New York ISO Zone G (eastern New York) terminal tumbled $56.12 to $45.00/MWh on light volume.

Gas at Iroquois, Waddington rose 23 cents to $4.30 and gas on Iroquois Zone 2 gained 27 cents to $4.50. Deliveries to Tenn Zone 6 200L added 44 cents to $7.75.

Gas on Texas Eastern M-3, Delivery gained 17 cents to $3.30 but packages bound for New York City on Transco Zone 6 retreated 29 cents to $3.65.

Major market centers were firm. Gas at the Chicago Citygate rose 15 cents to $3.49 and deliveries to the Henry Hub rose by 12 cents to $3.48. Gas on El Paso Permian changed hands 3 cents higher at $3.23 and deliveries to PG&E Citygate were quoted 13 cents higher at $3.73.

Thursday’s Energy Information Administration storage report is expected to be a doozy, with the inventories possibly dropping below the five-year average. Last year 33 Bcf were withdrawn and the five-year pace is for a 101 Bcf pull. Ritterbusch and Associates calculates a withdrawal of 179 Bcf and ICAP Energy expects a 206 Bcf decline. A Reuters survey of 19 traders and analysts revealed an average 201 Bcf withdrawal with a range from -179 to -216 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |