Infrastructure | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

REX Adds Another 250 MMcf/d, Brings Week’s Total to 450 MMcf/d

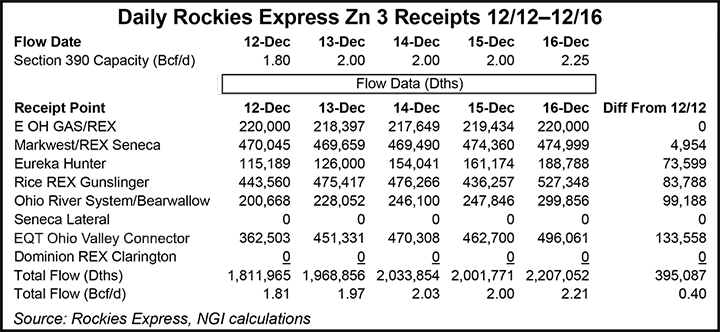

Rockies Express Pipeline LLC (REX) continued to roll out its Zone 3 capacity enhancement project Friday, adding another 250 MMcf/d in east-to-west flows out of eastern Ohio, according to NGI’s Rockies Express Zone 3 Tracker.

Friday’s increase comes after REX added 200 MMcf/d in westbound capacity on Tuesday. Prior to this week, the in-demand Appalachian Basin-to-Midwest Zone 3 segment had been maxed at 1.8 Bcf/d east-to-west. REX’s Zone 3 expansion, approved for start-up late last month, is expected to bring that total up to 2.6 Bcf/d by the end of the year.

REX provides a crucial takeaway route for constrained Appalachian Basin producers consistently faced with large basis differentials. More recently, Appalachian pricing has received a boost from seasonal demand. For now, this makes it “difficult to calculate exactly how much of an improvement in Appalachia prices is the result of the extra 450 MMcf/d through REX vs. a surge in demand from bitter cold temperatures,” according to Patrick Rau, NGIdirector of strategy and research.

“The market has been expecting the additional 800 MMcf/d to come online by the end of the year for quite some time, so that is likely already largely priced in the forwards market,” he said. While this week’s expansion “further solidifies” the likelihood of the project going into service on schedule, “I think the market has been expecting this already…Traders have known it was coming; part of it just came online a little early.”

Pointing to data from the REX Tracker, Rau said the incremental Zone 3 flows are coming from four major receipt points. The EQT Ohio Valley Connector, Rice REX Gunslinger, Ohio River System/Bearwallow and Eureka Hunter receipt points all experienced notable increases in volume from Monday to Friday.

![]()

“This is gas that is being re-routed from other pipelines into REX, and is allowing this gas to be sold at higher Midwest prices, so the main impact right now is anyone who is shipping that extra gas into REX is likely getting a higher realized sales price,” Rau said.

Tallgrass Energy owns a 75% stake in REX through its affiliated entities, with Phillips 66 owning the other 25%. Tallgrass management said during a 3Q2016 conference call that the full 800 MMcf/d on the Zone 3 expansion is spoken for. CEO David Dehaemers hinted during that call that the pipeline might even be able to surpass its design capacity.

“This is gas that is being re-routed from other pipelines into REX, and is allowing this gas to be sold at higher Midwest prices, so the main impact right now is anyone who is shipping that extra gas into REX is likely getting a higher realized sales price,” Rau said.

Tallgrass Energy owns a 75% stake in REX through its affiliated entities, with Phillips 66 owning the other 25%. Tallgrass management said during a 3Q2016 conference call that the full 800 MMcf/d on the Zone 3 expansion is spoken for. CEO David Dehaemers hinted during that call that the pipeline might even be able to surpass its design capacity.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |